Purchase And Sale Agreement Form Page 12

ADVERTISEMENT

SCHEDULE B

At the date hereof exceptions to coverage in addition to the printed Exceptions and Exclusions in the said policy

form would be as follows:

1.

The lien of supplemental taxes, if any, assessed pursuant to the provisions of Section 75, et seq. of the

Revenue and Taxation Code of the State of California.

2.

Release and relinquishment of abutter’s or access rights to and from the Highway/Freeway, upon which

premises abuts in the document recorded: March 27, 1964 in Book 654, Page 538 of Official Records.

3.

Redevelopment Plan, as follows:

Entitled: Statement of Institution of Redevelopment Plan

Recorded: July 10, 2003 as 2003-17702 of Official Records

Revised Statement of Institution of Redevelopment Proceedings recorded August 30, 2007 as

2007-16152 of Official Records.

4.

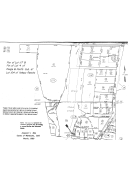

Easement(s) for the purposes stated herein and incidental purposes as provided in the document:

Recorded: July 9, 2008 as 2008-09771 of Official Records

For: public utilities

END OF SCHEDULE B

INFORMATIONAL NOTES:

1.

Taxes and assessments, general and special, for the fiscal year 2012 - 2013, as follows

Assessor’s Parcel No.: 169-113-27

Code No.: 154-065

1st Installment: $0.00, Not Billed

2nd Installment: $0.00, Not Billed

2.

NOTE: According to the public records, there have been no deeds conveying the property described in

this report recorded within a period of 24 months prior to the date hereof except as follows:

A Grant Deed executed by The Redevelopment Agency of the County of Mendocino to The Successor

Agency of the Redevelopment Agency of the County of Mendocino, recorded June 11, 2012 as

2012-08691 of Official Records.

Preliminary Report

Page 3

20121566DN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23