Financial History And Budget Ratios Template

ADVERTISEMENT

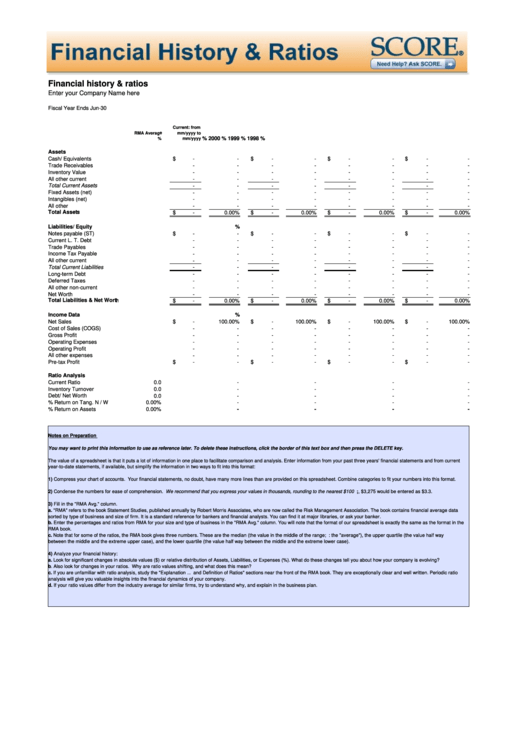

Financial history & ratios

Enter your Company Name here

Fiscal Year Ends

Jun-30

Current: from

RMA Average

mm/yyyy to

%

2000

%

1999

%

1998

%

%

mm/yyyy

Assets

Cash/ Equivalents

$

-

-

$

-

-

$

-

-

$

-

-

Trade Receivables

-

-

-

-

-

-

-

-

Inventory Value

-

-

-

-

-

-

-

-

All other current

-

-

-

-

-

-

-

-

Total Current Assets

-

-

-

-

-

-

-

-

Fixed Assets (net)

-

-

-

-

-

-

-

-

Intangibles (net)

-

-

-

-

-

-

-

-

All other

-

-

-

-

-

-

-

-

Total Assets

-

0.00%

$

-

0.00%

$

-

0.00%

$

-

0.00%

$

Liabilities/ Equity

%

Notes payable (ST)

-

$

-

-

$

-

-

$

-

-

$

-

Current L. T. Debt

-

-

-

-

-

-

-

-

Trade Payables

-

-

-

-

-

-

-

-

Income Tax Payable

-

-

-

-

-

-

-

-

All other current

-

-

-

-

-

-

-

-

-

Total Current Liabilities

-

-

-

-

-

-

-

Long-term Debt

-

-

-

-

-

-

-

-

Deferred Taxes

-

-

-

-

-

-

-

-

All other non-current

-

-

-

-

-

-

-

-

Net Worth

-

-

-

-

-

-

-

-

Total Liabilities & Net Worth

0.00%

$

-

0.00%

$

-

0.00%

$

-

0.00%

$

-

Income Data

%

Net Sales

$

-

100.00%

$

-

100.00%

$

-

100.00%

$

-

100.00%

Cost of Sales (COGS)

-

-

-

-

-

-

-

-

Gross Profit

-

-

-

-

-

-

-

-

Operating Expenses

-

-

-

-

-

-

-

-

Operating Profit

-

-

-

-

-

-

-

-

All other expenses

-

-

-

-

-

-

-

-

Pre-tax Profit

$

-

-

$

-

-

$

-

-

$

-

-

Ratio Analysis

Current Ratio

0.0

-

-

-

-

Inventory Turnover

0.0

-

-

-

-

Debt/ Net Worth

0.0

-

-

-

-

% Return on Tang. N / W

-

-

0.00%

-

-

% Return on Assets

0.00%

-

-

-

-

Notes on Preparation

You may want to print this information to use as reference later. To delete these instructions, click the border of this text box and then press the DELETE key.

The value of a spreadsheet is that it puts a lot of information in one place to facilitate comparison and analysis. Enter information from your past three years' financial statements and from current

year-to-date statements, if available, but simplify the information in two ways to fit into this format:

1) Compress your chart of accounts. Your financial statements, no doubt, have many more lines than are provided on this spreadsheet. Combine categories to fit your numbers into this format.

2) Condense the numbers for ease of comprehension. We recommend that you express your values in thousands, rounding to the nearest $100 ; i.e., $3,275 would be entered as $3.3.

3) Fill in the "RMA Avg." column.

a. "RMA" refers to the book Statement Studies, published annually by Robert Morris Associates, who are now called the Risk Management Association. The book contains financial average data

sorted by type of business and size of firm. It is a standard reference for bankers and financial analysts. You can find it at major libraries, or ask your banker.

b. Enter the percentages and ratios from RMA for your size and type of business in the "RMA Avg." column. You will note that the format of our spreadsheet is exactly the same as the format in the

RMA book.

c. Note that for some of the ratios, the RMA book gives three numbers. These are the median (the value in the middle of the range; i.e.: the "average"), the upper quartile (the value half way

between the middle and the extreme upper case), and the lower quartile (the value half way between the middle and the extreme lower case).

4) Analyze your financial history:

a. Look for significant changes in absolute values ($) or relative distribution of Assets, Liabilities, or Expenses (%). What do these changes tell you about how your company is evolving?

b. Also look for changes in your ratios. Why are ratio values shifting, and what does this mean?

c. If you are unfamiliar with ratio analysis, study the "Explanation ... and Definition of Ratios" sections near the front of the RMA book. They are exceptionally clear and well written. Periodic ratio

analysis will give you valuable insights into the financial dynamics of your company.

d. If your ratio values differ from the industry average for similar firms, try to understand why, and explain in the business plan.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1