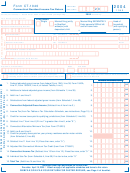

Form Ct 1040 - Connecticut Resident Income Tax Return - 2007 Page 2

ADVERTISEMENT

Form CT-1040 - Page 2 of 4

Your Social

-

-

Security Number

00

.

17. Enter amount from Line 16.

17.

,

,

Column A

Column B

Column C

3

Connecticut Wages, Tips, etc.

Connecticut Income Tax Withheld

Employer’s federal ID No. from Box b of W-2,

or Payer’s federal ID No. from Form 1099

.

–

00

00

.

18a.

18a.

,

,

W-2 and 1099

Information

.

–

00

00

.

18b.

18b.

,

,

Only enter

information

.

–

00

00

18c.

.

18c.

from your W-2

,

,

and 1099 forms

.

–

00

00

.

18d.

if Connecticut

18d.

,

,

income tax

.

–

00

00

.

was withheld.

18e.

18e.

,

,

.

–

00

00

.

18f.

18f.

,

,

.

–

00

00

.

18g.

,

,

18g.

00

.

18h. Enter amount from Supplemental Schedule CT-1040WH, Line 3.

18h.

,

,

00

.

,

,

18. Total Connecticut Income Tax Withheld: Add amounts in Column C and enter here.

18.

You must complete Columns A, B, and C or your withholding will be disallowed.

00

.

,

,

19. All 2007 estimated tax payments and any overpayments applied from a prior year 19.

00

.

,

,

20. Payments made with Form CT-1040 EXT (Request for extension of time to file)

20.

00

.

,

,

21. Total Payments: Add Lines 18, 19, and 20.

21.

00

.

,

,

4

22. Overpayment: If Line 21 is more than Line 17, subtract Line 17 from Line 21.

22.

.

00

,

,

23. Amount of Line 22 you want applied to your 2008 estimated tax

23.

00

.

,

,

24. Total Contributions of Refund to Designated Charities from Schedule 5, Line 70

24.

25. Refund: Subtract Lines 23 and 24 from Line 22.

00

.

,

,

For faster refund, use Direct Deposit by completing Lines 25a, 25b, and 25c.

25.

25a.Type:

25b. Routing

25c. Account

checking

Number

Number

savings

00

.

5

,

,

26. Tax Due: If Line 17 is more than Line 21, subtract Line 21 from Line 17.

26.

00

.

,

,

27. If Late: Enter penalty. Multiply Line 26 by 10% (.10).

27.

28. If Late: Enter interest. Multiply Line 26 by number of months or fraction of a month

00

.

,

,

late, then by 1% (.01).

28.

00

.

29. Interest on underpayment of estimated tax from Form CT-2210:

,

,

29.

See instructions, Page 17.

00

.

,

,

30.

30. Total Amount Due: Add Lines 26 through 29.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying

6

schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct.

I understand the penalty for willfully delivering a false return or document to DRS is a fine of not more

than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer

other than the taxpayer is based on all information of which the preparer has any knowledge.

Your Signature

Date

Daytime Telephone Number

(

)

Spouse’s Signature (if joint return)

Date

Daytime Telephone Number

(

)

Paid Preparer’s Signature

Date

Telephone Number

Preparer’s SSN or PTIN

(

)

Firm’s Name, Address, and ZIP Code

FEIN

Third Party Designee - Complete the following to authorize DRS to contact another person about this return.

Designee’s Name

Telephone Number

Personal Identification Number (PIN)

Complete applicable schedules on Pages 3 and 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4