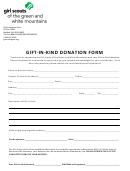

Chad Gift In Kind Donation Form Page 2

ADVERTISEMENT

GIFT INFORMATION

Description of donated item or service:

Gift Restrictions (check one)

□ Donor Stipulations or limitations

(Attach donor statement on detail of stipulation or limitation)

□ Gift to be retained or used for designated purposes

□ *Gift may be sold, proceeds to be used for designated purpose

□ *Gift will be sold and proceeds used for: ______________________________________________

*SS# or TIN __________________________________ must be provided for individuals who have

contributed gifts-in-kind valued at more than $5,000 that may or will be sold.

GIFT VALUE

Estimated Fair Market Value: $________________________

(to be provided by the Donor)

VALUATION METHODS (CHECK ONE)

Please attach at least one of the following (check all that apply)

□ Donor/Vendor documentation (invoice, receipt, letter)

□ Itemized Inventory List

□ Published Value (catalog, etc)

□ Qualified Appraisal (for Items valued $5,000+)

DONORS SIGNATURE & DATE

Signature

Date

FOR INTERNAL PURPOSES ONLY

Received By

Signature

Date Received

CHAD is a nonprofit organization under 501 (C)(3) of the Internal Revenue code; therefore your donation may be

tax deductible as allowable by law. However, please note that IRS guidelines established by the IRS do not

permit us to provide you with an estimated value of your contribution. PLEASE RETAIN A COPY OF THIS

COMPLETED FORM FOR YOUR RECORDS. CHAD’s Federal TAX ID Number is 36-3246645.

CHAD GIFT-IN-KIND FORM

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2