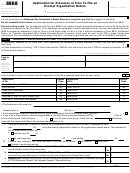

Form 5558 - Application For Extension Of Time To File Certain Employee Plan Returns

ADVERTISEMENT

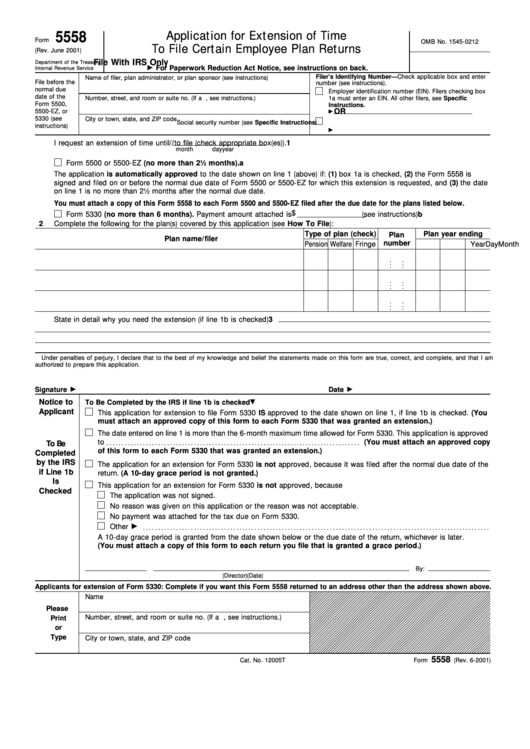

5558

Application for Extension of Time

Form

OMB No. 1545-0212

To File Certain Employee Plan Returns

(Rev. June 2001)

File With IRS Only

Department of the Treasury

For Paperwork Reduction Act Notice, see instructions on back.

Internal Revenue Service

Filer’s Identifying Number—Check applicable box and enter

Name of filer, plan administrator, or plan sponsor (see instructions)

File before the

number (see instructions).

normal due

Employer identification number (EIN). Filers checking box

date of the

Number, street, and room or suite no. (If a P.O. box, see instructions.)

1a must enter an EIN. All other filers, see Specific

Form 5500,

Instructions.

OR

5500-EZ, or

5330 (see

City or town, state, and ZIP code

Social security number (see Specific Instructions)

instructions)

1

I request an extension of time until

/

/

to file (check appropriate box(es)).

month

day

year

a

Form 5500 or 5500-EZ (no more than 2

1

⁄

months).

2

The application is automatically approved to the date shown on line 1 (above) if: (1) box 1a is checked, (2) the Form 5558 is

signed and filed on or before the normal due date of Form 5500 or 5500-EZ for which this extension is requested, and (3) the date

on line 1 is no more than 2

⁄

months after the normal due date.

1

2

You must attach a copy of this Form 5558 to each Form 5500 and 5500-EZ filed after the due date for the plans listed below.

Form 5330 (no more than 6 months). Payment amount attached is $

b

(see instructions)

2

Complete the following for the plan(s) covered by this application (see How To File):

Type of plan (check)

Plan year ending

Plan

Plan name/filer

number

Pension Welfare Fringe

Month

Day

Year

3

State in detail why you need the extension (if line 1b is checked)

Under penalties of perjury, I declare that to the best of my knowledge and belief the statements made on this form are true, correct, and complete, and that I am

authorized to prepare this application.

Signature

Date

Notice to

To Be Completed by the IRS if line 1b is checked

Applicant

This application for extension to file Form 5330 IS approved to the date shown on line 1, if line 1b is checked. (You

must attach an approved copy of this form to each Form 5330 that was granted an extension.)

The date entered on line 1 is more than the 6-month maximum time allowed for Form 5330. This application is approved

to

(You must attach an approved copy

To Be

of this form to each Form 5330 that was granted an extension.)

Completed

by the IRS

The application for an extension for Form 5330 is not approved, because it was filed after the normal due date of the

if Line 1b

return. (A 10-day grace period is not granted.)

Is

This application for an extension for Form 5330 is not approved, because

Checked

The application was not signed.

No reason was given on this application or the reason was not acceptable.

No payment was attached for the tax due on Form 5330.

Other

A 10-day grace period is granted from the date shown below or the due date of the return, whichever is later.

(You must attach a copy of this form to each return you file that is granted a grace period.)

By:

(Date)

(Director)

Applicants for extension of Form 5330: Complete if you want this Form 5558 returned to an address other than the address shown above.

Name

Please

Number, street, and room or suite no. (If a P.O. box, see instructions.)

Print

or

Type

City or town, state, and ZIP code

5558

Cat. No. 12005T

Form

(Rev. 6-2001)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2