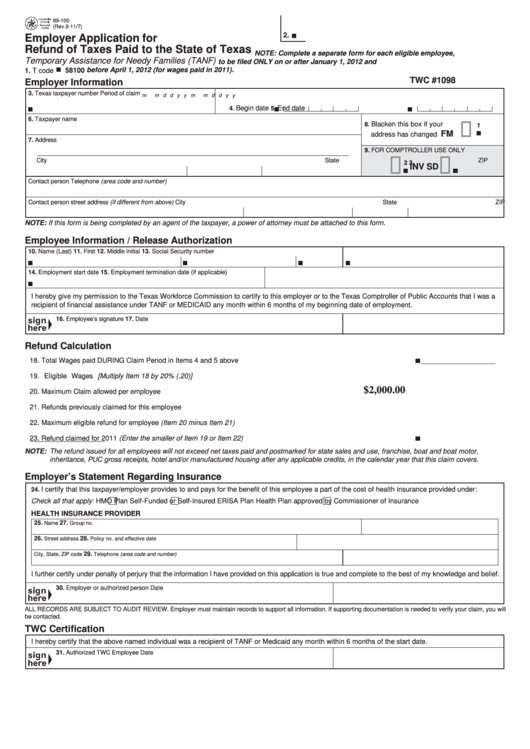

89-100

CLEAR FORM

PRINT FORM

(Rev.9-11/7)

2.

Employer Application for

Refund of Taxes Paid to the State of Texas

NOTE: Complete a separate form for each eligible employee,

Temporary Assistance for Needy Families (TANF)

to be filed ONLY on or after January 1, 2012 and

before April 1, 2012 (for wages paid in 2011).

1. T code

58100

TWC #1098

Employer Information

3. Texas taxpayer number

Period of claim

m

m d

d

y

y

m

m

d

d

y

y

Begin date

End date

4.

5.

6. Taxpayer name

Blacken this box if your

8.

1

FM

address has changed ..........

7. Address

9. FOR COMPTROLLER USE ONLY

City

S tate

ZIP code

2

3

INV

SD

Contact person

Telephone (area code and number)

Contact person street address (if different from above)

City

S tate

ZIP code

NOTE: If this form is being completed by an agent of the taxpayer, a power of attorney must be attached to this form.

Employee Information / Release Authorization

10. Name (Last)

11. First

12. Middle initial

13. Social Security number

14. Employment start date

15. Employment termination date (if applicable)

I hereby give my permission to the Texas Workforce Commission to certify to this employer or to the Texas Comptroller of Public Accounts that I was a

recipient of financial assistance under TANF or MEDICAID any month within 6 months of my beginning date of employment.

16. Employee’s signature

17. Date

Refund Calculation

18. Total Wages paid DURING Claim Period in Items 4 and 5 above .................................................................................... 18.

___________________

19. Eligible Wages [Multiply Item 18 by 20% (.20)] ................................................................................................................ 19.

___________________

$2,000.00

20. Maximum Claim allowed per employee ....................................................................................20. ___________________

21. Refunds previously claimed for this employee .......................................................................21. ___________________

22. Maximum eligible refund for employee (Item 20 minus Item 21) .............................................22. ___________________

23. Refund claimed for 2011 (Enter the smaller of Item 19 or Item 22) ................................................................................. 23.

___________________

NOTE: The refund issued for all employees will not exceed net taxes paid and postmarked for state sales and use, franchise, boat and boat motor,

inheritance, PUC gross receipts, hotel and/or manufactured housing after any applicable credits, in the calendar year that this claim covers.

Employer’s Statement Regarding Insurance

I certify that this taxpayer/employer provides to and pays for the benefit of this employee a part of the cost of health insurance provided under:

24.

Check all that apply:

HMO Plan

Self-Funded or Self-Insured ERISA Plan

Health Plan approved by Commissioner of Insurance

HEALTH INSURANCE PROVIDER

25.

27.

Name

Group no.

26.

28.

Street address

Policy no. and effective date

29.

City, State, ZIP code

Telephone (area code and number)

I further certify under penalty of perjury that the information I have provided on this application is true and complete to the best of my knowledge and belief.

30. Employer or authorized person

Date

ALL RECORDS ARE SUBJECT TO AUDIT REVIEW. Employer must maintain records to support all information. If supporting documentation is needed to verify your claim, you will

be contacted.

TWC Certification

I hereby certify that the above named individual was a recipient of TANF or Medicaid any month within 6 months of the start date.

31. Authorized TWC Employee

Date

1

1 2

2