Dependent V1 Worksheet - Elizabethtown College

ADVERTISEMENT

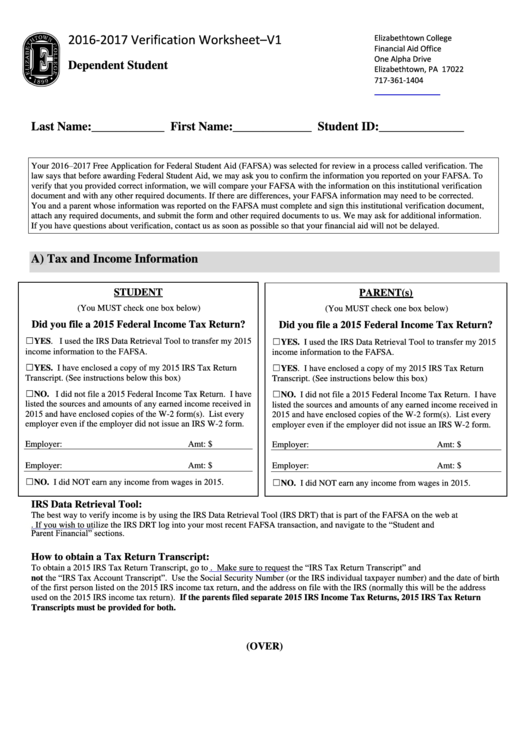

2016-2017 Verification Worksheet–V1

Elizabethtown College

Financial Aid Office

One Alpha Drive

Dependent Student

Elizabethtown, PA 17022

717-361-1404

finaid@etown.edu

Last Name:____________ First Name:_____________

Student ID:______________

Your 2016–2017 Free Application for Federal Student Aid (FAFSA) was selected for review in a process called verification. The

law says that before awarding Federal Student Aid, we may ask you to confirm the information you reported on your FAFSA. To

verify that you provided correct information, we will compare your FAFSA with the information on this institutional verification

document and with any other required documents. If there are differences, your FAFSA information may need to be corrected.

You and a parent whose information was reported on the FAFSA must complete and sign this institutional verification document,

attach any required documents, and submit the form and other required documents to us. We may ask for additional information.

If you have questions about verification, contact us as soon as possible so that your financial aid will not be delayed.

A) Tax and Income Information

STUDENT

PARENT(s)

(You MUST check one box below)

(You MUST check one box below)

Did you file a 2015 Federal Income Tax Return?

Did you file a 2015 Federal Income Tax Return?

☐YES. I used the IRS Data Retrieval Tool to transfer my 2015

☐YES. I used the IRS Data Retrieval Tool to transfer my 2015

income information to the FAFSA.

income information to the FAFSA.

☐YES. I have enclosed a copy of my 2015 IRS Tax Return

☐YES. I have enclosed a copy of my 2015 IRS Tax Return

Transcript. (See instructions below this box)

Transcript. (See instructions below this box)

☐NO. I did not file a 2015 Federal Income Tax Return. I have

☐NO. I did not file a 2015 Federal Income Tax Return. I have

listed the sources and amounts of any earned income received in

listed the sources and amounts of any earned income received in

2015 and have enclosed copies of the W-2 form(s). List every

2015 and have enclosed copies of the W-2 form(s). List every

employer even if the employer did not issue an IRS W-2 form.

employer even if the employer did not issue an IRS W-2 form.

Employer:

Amt: $

Employer:

Amt: $

Employer:

Amt: $

Employer:

Amt: $

☐NO. I did NOT earn any income from wages in 2015.

☐NO. I did NOT earn any income from wages in 2015.

IRS Data Retrieval Tool:

The best way to verify income is by using the IRS Data Retrieval Tool (IRS DRT) that is part of the FAFSA on the web at

If you wish to utilize the IRS DRT log into your most recent FAFSA transaction, and navigate to the “Student and

Parent Financial” sections.

How to obtain a Tax Return Transcript:

To obtain a 2015 IRS Tax Return Transcript, go to Make sure to request the “IRS Tax Return Transcript” and

not the “IRS Tax Account Transcript”. Use the Social Security Number (or the IRS individual taxpayer number) and the date of birth

of the first person listed on the 2015 IRS income tax return, and the address on file with the IRS (normally this will be the address

used on the 2015 IRS income tax return). If the parents filed separate 2015 IRS Income Tax Returns, 2015 IRS Tax Return

Transcripts must be provided for both.

(OVER)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2