Tax Certification - Alleghany County

ADVERTISEMENT

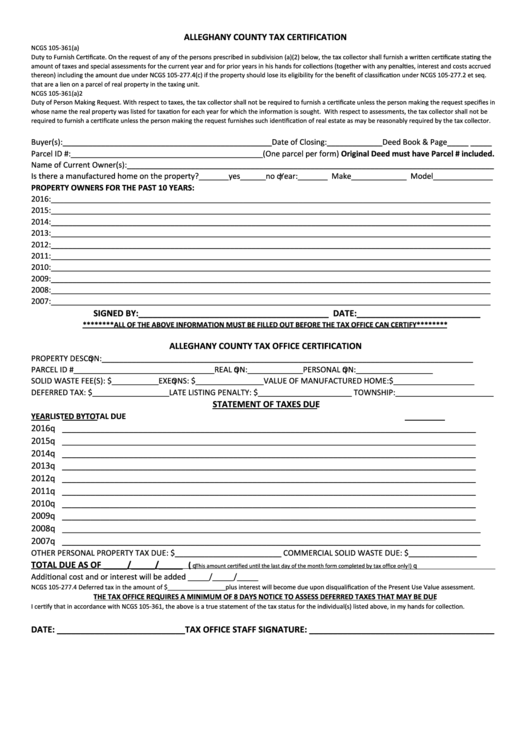

ALLEGHANY COUNTY TAX CERTIFICATION

NCGS 105-361(a)

Duty to Furnish Certificate. On the request of any of the persons prescribed in subdivision (a)(2) below, the tax collector shall furnish a written certificate stating the

amount of taxes and special assessments for the current year and for prior years in his hands for collections (together with any penalties, interest and costs accrued

thereon) including the amount due under NCGS 105-277.4(c) if the property should lose its eligibility for the benefit of classification under NCGS 105-277.2 et seq.

that are a lien on a parcel of real property in the taxing unit.

NCGS 105-361(a)2

Duty of Person Making Request. With respect to taxes, the tax collector shall not be required to furnish a certificate unless the person making the request specifies in

whose name the real property was listed for taxation for each year for which the information is sought. With respect to assessments, the tax collector shall not be

required to furnish a certificate unless the person making the request furnishes such identification of real estate as may be reasonably required by the tax collector.

Buyer(s):_________________________________________________Date of Closing:_____________Deed Book & Page_____ _____

Parcel ID #:_____________________________________________(One parcel per form) Original Deed must have Parcel # included.

Name of Current Owner(s):______________________________________________________________________________________

Is there a manufactured home on the property?_______yes______no Year:_______ Make_____________ Model______________

PROPERTY OWNERS FOR THE PAST 10 YEARS:

2016:_______________________________________________________________________________________________________

2015:_______________________________________________________________________________________________________

2014:_______________________________________________________________________________________________________

2013:_______________________________________________________________________________________________________

2012:_______________________________________________________________________________________________________

2011:_______________________________________________________________________________________________________

2010:_______________________________________________________________________________________________________

2009:_______________________________________________________________________________________________________

2008:_______________________________________________________________________________________________________

2007:_______________________________________________________________________________________________________

SIGNED BY:________________________________________ DATE:__________________________

********ALL OF THE ABOVE INFORMATION MUST BE FILLED OUT BEFORE THE TAX OFFICE CAN CERTIFY********

ALLEGHANY COUNTY TAX OFFICE CERTIFICATION

PROPERTY DESCRIPTION:_______________________________________________________________________________________

PARCEL ID #_________________________________REAL VALUATION:_____________PERSONAL VALUATION:__________________

SOLID WASTE FEE(S): $___________EXEMPTIONS: $________________VALUE OF MANUFACTURED HOME:$___________________

DEFERRED TAX: $__________________LATE LISTING PENALTY: $______________________ TOWNSHIP:_______________________

STATEMENT OF TAXES DUE

YEAR

LISTED BY

TOTAL DUE

2016

____________________________________________________________________

___________________

2015

____________________________________________________________________

___________________

2014

____________________________________________________________________

___________________

2013

____________________________________________________________________

___________________

2012

____________________________________________________________________

___________________

2011

____________________________________________________________________

___________________

2010

____________________________________________________________________

___________________

2009

____________________________________________________________________

___________________

2008

_____________________________________________________________________

___________________

2007

_____________________________________________________________________

___________________

OTHER PERSONAL PROPERTY TAX DUE: $_________________________ COMMERCIAL SOLID WASTE DUE: $________________

TOTAL DUE AS OF _____/_____/_____

$__________________

(

This amount certified until the last day of the month form completed by tax office only!)

Additional cost and or interest will be added _____/_____/_____

NCGS 105-277.4 Deferred tax in the amount of $_________________plus interest will become due upon disqualification of the Present Use Value assessment.

THE TAX OFFICE REQUIRES A MINIMUM OF 8 DAYS NOTICE TO ASSESS DEFERRED TAXES THAT MAY BE DUE

I certify that in accordance with NCGS 105-361, the above is a true statement of the tax status for the individual(s) listed above, in my hands for collection.

DATE: ___________________________ TAX OFFICE STAFF SIGNATURE: _______________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2