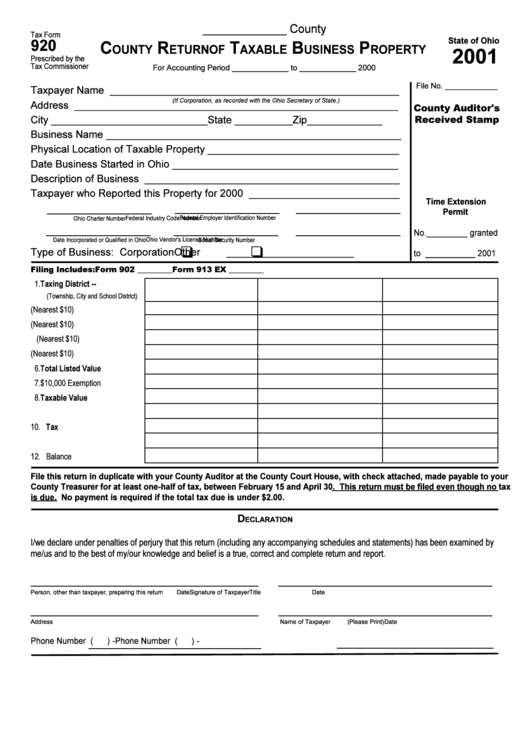

Tax Form 920 - County Return Of Taxable Business Property - 2001

ADVERTISEMENT

_____________ County

Tax Form

920

C

R

T

B

P

OUNTY

ETURN OF

AXABLE

USINESS

ROPERTY

2001

Prescribed by the

Tax Commissioner

For Accounting Period _____________ to _____________ 2000

File No. ____________

Taxpayer Name __________________________________________________

(If Corporation, as recorded with the Ohio Secretary of State.)

Address ________________________________________________________

County Auditor's

City ___________________________ State __________ Zip_____________

Received Stamp

Business Name ___________________________________________________

Physical Location of Taxable Property _________________________________

Date Business Started in Ohio _______________________________________

Description of Business ____________________________________________

Taxpayer who Reported this Property for 2000 __________________________

Federal Employer Identification Number

Federal Industry Code Number

Ohio Charter Number

Ohio Vendor's License Number

Date Incorporated or Qualified in Ohio

Social Security Number

q

q

Type of Business: Corporation

Other

______________________

Filing Includes:

Form 902 _________

Form 913 EX _________

1. Taxing District --

(Township, City and School District)

2. Schedule 2

(Nearest $10)

3. Schedule 3

(Nearest $10)

4. Schedule 3-A (Nearest $10)

5. Schedule 4

(Nearest $10)

6. Total Listed Value

7. $10,000 Exemption

8. Taxable Value

9. Tax Rate

10. Tax

11. Amount Paid with Return

12. Balance

ECLARATION

I/we declare under penalties of perjury that this return (including any accompanying schedules and statements) has been examined by

me/us and to the best of my/our knowledge and belief is a true, correct and complete return and report.

Person, other than taxpayer, preparing this return

Date

Signature of Taxpayer

Title

Date

Address

Name of Taxpayer

(Please Print)

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2