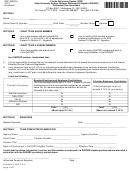

Enrollment Form - Fsa Dca Lpf Page 2

ADVERTISEMENT

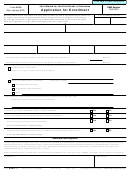

Health Care Expense Planning Worksheet

*Not required, for employee use in estimating expenses

Common Medical Expenses

Estimated Plan Year Total

Medical Expenses:

Co pays

___________________________

Deductible

___________________________

Chiropractor

___________________________

Prescriptions

___________________________

Other___________________

___________________________

Dental Expenses

Cleanings

___________________________

Fillings

___________________________

Crowns

___________________________

Other____________________

___________________________

Vision Expenses

Glasses

___________________________

Contacts

___________________________

Exams

___________________________

Lasik

___________________________

Other____________________

___________________________

Over-The-Counter Expenses

Band Aids

___________________________

Contact lens solution

___________________________

Pain Reliever (only with Rx)

___________________________

Other____________________

___________________________

(Medicines, Vitamins and Supplements only with Rx)

TOTAL:

_______________________

*All eligible out-of-pocket medical expenses for you, your spouse and your dependents can be reimbursed regardless of

insurance coverage. A listing of eligible expenses can be found in the accompanying enrollment guide or

Dependent Care Account

*A dependent receiving care must be a child under the age of 13, or a tax dependent unable to provide for

their own care, who resides with you.

*The care must be necessary for you or your spouse to be gainfully employed or to go to school.

*Care may be provided by anyone other than your spouse or your children under the age of 19.

*Expenses for schooling, kindergarten and above, overnight camp and nursing homes are not reimbursable.

*The maximum you can elect, in a calendar year, is equal to the smallest of the following:

-$5,000 – Married and filing federal taxes jointly or a single parent

-$2,500 – Married and filing separate federal tax return

*The amount contributed year-to-date, is available for reimbursement.

All elected “Pre-Tax” amounts are exempt from Federal, State, FICA, and Medicare taxes.

Services must be incurred within the plan year in order to be eligible for reimbursement.

Be conservative in your election! Any amount that is not used during the plan year and/or applicable grace

period will revert back to your employer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2