Form Fsa 001 - 2010 Election Form/compensation Reduction Agreement (Paychex)

ADVERTISEMENT

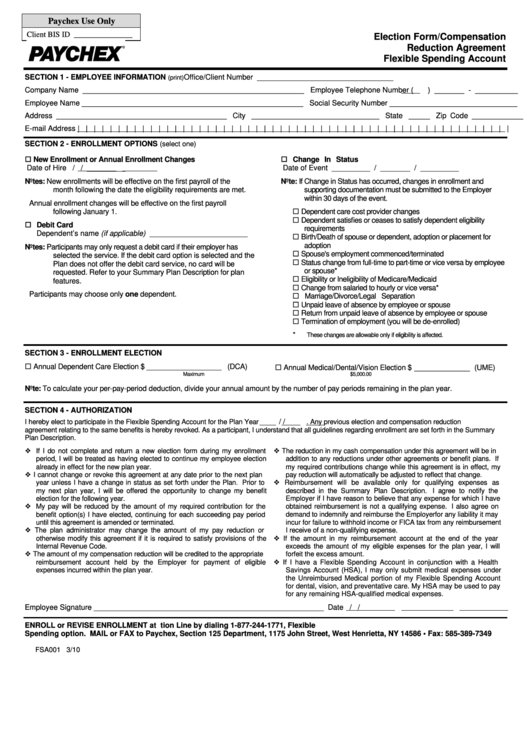

Paychex Use Only

Client BIS ID _______________

Election Form/Compensation

Reduction Agreement

Flexible Spending Account

SECTION 1 - EMPLOYEE INFORMATION

Office/Client Number ________________________________

(print)

Company Name ____________________________________________________ Employee Telephone Number (

) _______ - __________

Employee Name ____________________________________________________ Social Security Number ______________________________

Address ________________________________________ City ______________________________ State _____

Zip Code ____________

E-mail Address | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

SECTION 2 - ENROLLMENT OPTIONS

(select one)

New Enrollment or Annual Enrollment Changes

Change In Status

Date of Hire

/

/ _________

Date of Event _________ / _______ / _________

Notes: New enrollments will be effective on the first payroll of the

Note: If Change in Status has occurred, changes in enrollment and

month following the date the eligibility requirements are met.

supporting documentation must be submitted to the Employer

within 30 days of the event.

Annual enrollment changes will be effective on the first payroll

Dependent care cost provider changes

following January 1.

Dependent satisfies or ceases to satisfy dependent eligibility

Debit Card

requirements

Dependent’s name (if applicable) _______________________

Birth/Death of spouse or dependent, adoption or placement for

adoption

Notes: Participants may only request a debit card if their employer has

Spouse's employment commenced/terminated

selected the service. If the debit card option is selected and the

Status change from full-time to part-time or vice versa by employee

Plan does not offer the debit card service, no card will be

or spouse*

requested. Refer to your Summary Plan Description for plan

Eligibility or Ineligibility of Medicare/Medicaid

features.

Change from salaried to hourly or vice versa*

Participants may choose only one dependent.

Marriage/Divorce/Legal Separation

Unpaid leave of absence by employee or spouse

Return from unpaid leave of absence by employee or spouse

Termination of employment (you will be de-enrolled)

*

These changes are allowable only if eligibility is affected.

SECTION 3 - ENROLLMENT ELECTION

Annual Dependent Care Election

Annual Medical/Dental/Vision Election

$ __________________ (DCA)

_____________

$

(UME)

Maximum $5,000.00

Note:

To calculate your per-pay-period deduction, divide your annual amount by the number of pay periods remaining in the plan year.

SECTION 4 - AUTHORIZATION

/

/

I hereby elect to participate in the Flexible Spending Account for the Plan Year

. Any previous election and compensation reduction

agreement relating to the same benefits is hereby revoked. As a participant, I understand that all guidelines regarding enrollment are set forth in the Summary

Plan Description.

If I do not complete and return a new election form during my enrollment

The reduction in my cash compensation under this agreement will be in

period, I will be treated as having elected to continue my employee election

addition to any reductions under other agreements or benefit plans. If

already in effect for the new plan year.

my required contributions change while this agreement is in effect, my

I cannot change or revoke this agreement at any date prior to the next plan

pay reduction will automatically be adjusted to reflect that change.

Reimbursement will be available only for qualifying expenses as

year unless I have a change in status as set forth under the Plan. Prior to

my next plan year, I will be offered the opportunity to change my benefit

described in the Summary Plan Description.

I agree to notify the

election for the following year.

Employer if I have reason to believe that any expense for which I have

My pay will be reduced by the amount of my required contribution for the

obtained reimbursement is not a qualifying expense. I also agree on

benefit option(s) I have elected, continuing for each succeeding pay period

demand to indemnify and reimburse the Employer for any liability it may

until this agreement is amended or terminated.

incur for failure to withhold income or FICA tax from any reimbursement

The plan administrator may change the amount of my pay reduction or

I receive of a non-qualifying expense.

If the amount in my reimbursement account at the end of the year

otherwise modify this agreement if it is required to satisfy provisions of the

Internal Revenue Code.

exceeds the amount of my eligible expenses for the plan year, I will

The amount of my compensation reduction will be credited to the appropriate

forfeit the excess amount.

If I have a Flexible Spending Account in conjunction with a Health

reimbursement account held by the Employer for payment of eligible

expenses incurred within the plan year.

Savings Account (HSA), I may only submit medical expenses under

the Unreimbursed Medical portion of my Flexible Spending Account

for dental, vision, and preventative care. My HSA may be used to pay

for any remaining HSA-qualified medical expenses.

Employee Signature ______________________________________________________

Date

/

/

ENROLL or REVISE ENROLLMENT at or on the FSA Information Line by dialing 1-877-244-1771, Flexible

Spending option. MAIL or FAX to Paychex, Section 125 Department, 1175 John Street, West Henrietta, NY 14586 • Fax: 585-389-7349

FSA001 3/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1