Instructions For 2014 Form U: Underpayment Of Estimated Tax By Corporations

ADVERTISEMENT

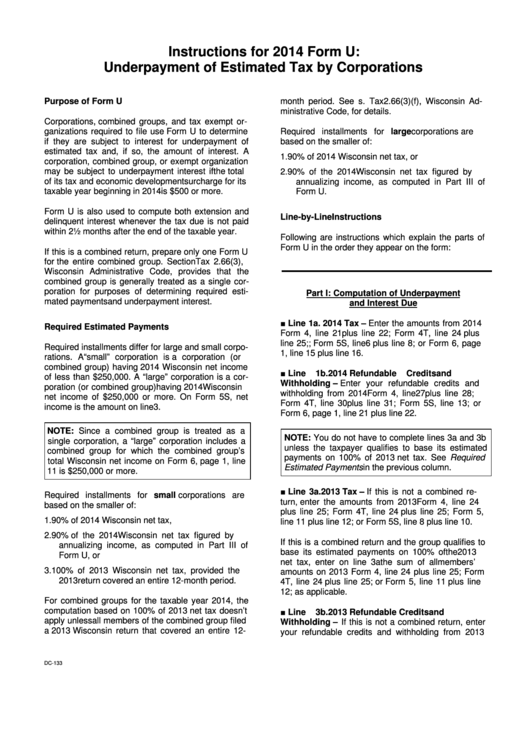

Instructions for 2014 Form U:

Underpayment of Estimated Tax by Corporations

Purpose of Form U

month period. See s. Tax 2.66(3)(f), Wisconsin Ad-

ministrative Code, for details.

Corporations, combined groups, and tax exempt or-

ganizations required to file use Form U to determine

Required installments for large corporations are

if they are subject to interest for underpayment of

based on the smaller of:

estimated tax and, if so, the amount of interest. A

1. 90% of 2014 Wisconsin net tax, or

corporation, combined group, or exempt organization

may be subject to underpayment interest if the total

2. 90% of the 2014 Wisconsin net tax figured by

of its tax and economic development surcharge for its

annualizing income, as computed in Part III of

taxable year beginning in 2014 is $500 or more.

Form U.

Form U is also used to compute both extension and

Line-by-Line Instructions

delinquent interest whenever the tax due is not paid

within 2½ months after the end of the taxable year.

Following are instructions which explain the parts of

Form U in the order they appear on the form:

If this is a combined return, prepare only one Form U

for the entire combined group. Section Tax 2.66(3),

Wisconsin Administrative Code, provides that the

combined group is generally treated as a single cor-

poration for purposes of determining required esti-

Part I: Computation of Underpayment

mated payments and underpayment interest.

and Interest Due

■ Line 1a. 2014 Tax – Enter the amounts from 2014

Required Estimated Payments

Form 4, line 21 plus line 22; Form 4T, line 24 plus

line 25;; Form 5S, line 6 plus line 8; or Form 6, page

Required installments differ for large and small corpo-

1, line 15 plus line 16.

rations. A “small” corporation is a corporation (or

combined group) having 2014 Wisconsin net income

■

Line

1b.

2014

Refundable

Credits

and

of less than $250,000. A “large” corporation is a cor-

Withholding – Enter your refundable credits and

poration (or combined group) having 2014 Wisconsin

withholding from 2014 Form 4, line 27 plus line 28;

net income of $250,000 or more. On Form 5S, net

Form 4T, line 30 plus line 31; Form 5S, line 13; or

income is the amount on line 3.

Form 6, page 1, line 21 plus line 22.

NOTE: Since a combined group is treated as a

NOTE: You do not have to complete lines 3a and 3b

single corporation, a “large” corporation includes a

unless the taxpayer qualifies to base its estimated

combined group for which the combined group’s

payments on 100% of 2013 net tax. See Required

total Wisconsin net income on Form 6, page 1, line

Estimated Payments in the previous column.

11 is $250,000 or more.

■ Line 3a. 2013 Tax – If this is not a combined re-

Required installments for small corporations are

turn, enter the amounts from 2013 Form 4, line 24

based on the smaller of:

plus line 25; Form 4T, line 24 plus line 25; Form 5,

1. 90% of 2014 Wisconsin net tax,

line 11 plus line 12; or Form 5S, line 8 plus line 10.

2. 90% of the 2014 Wisconsin net tax figured by

If this is a combined return and the group qualifies to

annualizing income, as computed in Part III of

base its estimated payments on 100% of the 2013

Form U, or

net tax, enter on line 3a the sum of all members’

3. 100% of 2013 Wisconsin net tax, provided the

amounts on 2013 Form 4, line 24 plus line 25; Form

2013 return covered an entire 12-month period.

4T, line 24 plus line 25; or Form 5, line 11 plus line

12; as applicable.

For combined groups for the taxable year 2014, the

■

computation based on 100% of 2013 net tax doesn’t

Line

3b.

2013

Refundable

Credits

and

apply unless all members of the combined group filed

Withholding – If this is not a combined return, enter

a 2013 Wisconsin return that covered an entire 12-

your refundable credits and withholding from 2013

DC-133

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4