Instructions For Arizona Form 221 - Underpayment Of Estimated Tax By Individuals - 2001

ADVERTISEMENT

2001 Underpayment of

Arizona Form

Estimated Tax by Individuals

221

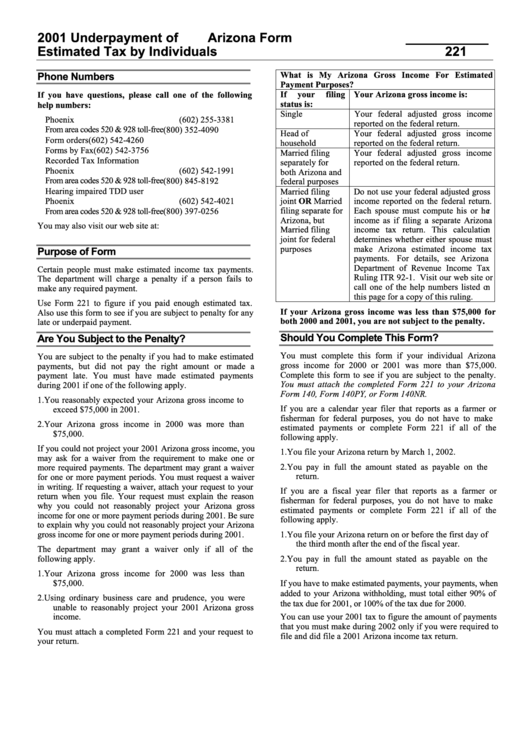

What is My Arizona Gross Income For Estimated

Phone Numbers

Payment Purposes?

If

your

filing

Your Arizona gross income is:

If you have questions, please call one of the following

status is:

help numbers:

Single

Your federal adjusted gross income

Phoenix

(602) 255-3381

reported on the federal return.

From area codes 520 & 928 toll-free

(800) 352-4090

Head of

Your federal adjusted gross income

Form orders

(602) 542-4260

household

reported on the federal return.

Forms by Fax

(602) 542-3756

Married filing

Your federal adjusted gross income

Recorded Tax Information

separately for

reported on the federal return.

Phoenix

(602) 542-1991

both Arizona and

From area codes 520 & 928 toll-free

(800) 845-8192

federal purposes

Hearing impaired TDD user

Married filing

Do not use your federal adjusted gross

Phoenix

(602) 542-4021

joint OR Married

income reported on the federal return.

filing separate for

Each spouse must compute his or her

From area codes 520 & 928 toll-free

(800) 397-0256

Arizona, but

income as if filing a separate Arizona

You may also visit our web site at:

Married filing

income tax return. This calculation

joint for federal

determines whether either spouse must

purposes

make Arizona estimated income tax

Purpose of Form

payments.

For details, see Arizona

Department of Revenue Income Tax

Certain people must make estimated income tax payments.

Ruling ITR 92-1. Visit our web site or

The department will charge a penalty if a person fails to

call one of the help numbers listed on

make any required payment.

this page for a copy of this ruling.

Use Form 221 to figure if you paid enough estimated tax.

If your Arizona gross income was less than $75,000 for

Also use this form to see if you are subject to penalty for any

both 2000 and 2001, you are not subject to the penalty.

late or underpaid payment.

Should You Complete This Form?

Are You Subject to the Penalty?

You must complete this form if your individual Arizona

You are subject to the penalty if you had to make estimated

gross income for 2000 or 2001 was more than $75,000.

payments, but did not pay the right amount or made a

Complete this form to see if you are subject to the penalty.

payment late. You must have made estimated payments

You must attach the completed Form 221 to your Arizona

during 2001 if one of the following apply.

Form 140, Form 140PY, or Form 140NR.

1.

You reasonably expected your Arizona gross income to

If you are a calendar year filer that reports as a farmer or

exceed $75,000 in 2001.

fisherman for federal purposes, you do not have to make

2.

Your Arizona gross income in 2000 was more than

estimated payments or complete Form 221 if all of the

$75,000.

following apply.

If you could not project your 2001 Arizona gross income, you

1.

You file your Arizona return by March 1, 2002.

may ask for a waiver from the requirement to make one or

2.

You pay in full the amount stated as payable on the

more required payments. The department may grant a waiver

return.

for one or more payment periods. You must request a waiver

in writing. If requesting a waiver, attach your request to your

If you are a fiscal year filer that reports as a farmer or

return when you file. Your request must explain the reason

fisherman for federal purposes, you do not have to make

why you could not reasonably project your Arizona gross

estimated payments or complete Form 221 if all of the

income for one or more payment periods during 2001. Be sure

following apply.

to explain why you could not reasonably project your Arizona

gross income for one or more payment periods during 2001.

1.

You file your Arizona return on or before the first day of

the third month after the end of the fiscal year.

The department may grant a waiver only if all of the

2.

You pay in full the amount stated as payable on the

following apply.

return.

1.

Your Arizona gross income for 2000 was less than

$75,000.

If you have to make estimated payments, your payments, when

added to your Arizona withholding, must total either 90% of

2.

Using ordinary business care and prudence, you were

the tax due for 2001, or 100% of the tax due for 2000.

unable to reasonably project your 2001 Arizona gross

income.

You can use your 2001 tax to figure the amount of payments

that you must make during 2002 only if you were required to

You must attach a completed Form 221 and your request to

file and did file a 2001 Arizona income tax return.

your return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4