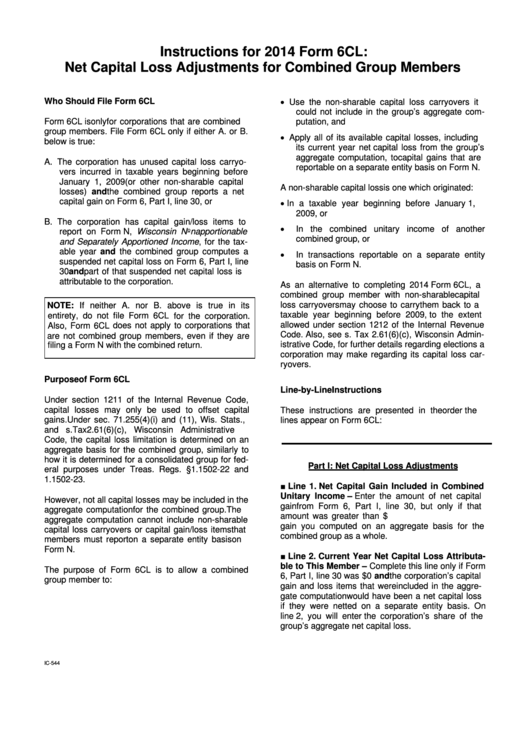

Instructions For 2014 Form 6cl: Net Capital Loss Adjustments For Combined Group Members

ADVERTISEMENT

Instructions for 2014 Form 6CL:

Net Capital Loss Adjustments for Combined Group Members

•

Who Should File Form 6CL

Use the non-sharable capital loss carryovers it

could not include in the group’s aggregate com-

Form 6CL is only for corporations that are combined

putation, and

group members. File Form 6CL only if either A. or B.

•

Apply all of its available capital losses, including

below is true:

its current year net capital loss from the group’s

aggregate computation, to capital gains that are

A. The corporation has unused capital loss carryo-

reportable on a separate entity basis on Form N.

vers incurred in taxable years beginning before

January 1, 2009 (or other non-sharable capital

A non-sharable capital loss is one which originated:

losses) and the combined group reports a net

•

capital gain on Form 6, Part I, line 30, or

In a taxable year beginning before January 1,

2009, or

B. The corporation has capital gain/loss items to

•

In the combined unitary income of another

report on Form N, Wisconsin Nonapportionable

combined group, or

and Separately Apportioned Income, for the tax-

able year and the combined group computes a

•

In transactions reportable on a separate entity

suspended net capital loss on Form 6, Part I, line

basis on Form N.

30 and part of that suspended net capital loss is

attributable to the corporation.

As an alternative to completing 2014 Form 6CL, a

combined group member with non-sharable capital

loss carryovers may choose to carry them back to a

NOTE: If neither A. nor B. above is true in its

taxable year beginning before 2009, to the extent

entirety, do not file Form 6CL for the corporation.

allowed under section 1212 of the Internal Revenue

Also, Form 6CL does not apply to corporations that

Code. Also, see s. Tax 2.61(6)(c), Wisconsin Admin-

are not combined group members, even if they are

istrative Code, for further details regarding elections a

filing a Form N with the combined return.

corporation may make regarding its capital loss car-

ryovers.

Purpose of Form 6CL

Line-by-Line Instructions

Under section 1211 of the Internal Revenue Code,

capital losses may only be used to offset capital

These instructions are presented in the order the

gains. Under sec. 71.255(4)(i) and (11), Wis. Stats.,

lines appear on Form 6CL:

and s. Tax 2.61(6)(c), Wisconsin Administrative

Code, the capital loss limitation is determined on an

aggregate basis for the combined group, similarly to

how it is determined for a consolidated group for fed-

Part I: Net Capital Loss Adjustments

eral purposes under Treas. Regs. §1.1502-22 and

1.1502-23.

■ Line 1. Net Capital Gain Included in Combined

Unitary Income – Enter the amount of net capital

However, not all capital losses may be included in the

gain from Form 6, Part I, line 30, but only if that

aggregate computation for the combined group. The

amount was greater than $0. This is the net capital

aggregate computation cannot include non-sharable

gain you computed on an aggregate basis for the

capital loss carryovers or capital gain/loss items that

combined group as a whole.

members must report on a separate entity basis on

Form N.

■ Line 2. Current Year Net Capital Loss Attributa-

ble to This Member – Complete this line only if Form

The purpose of Form 6CL is to allow a combined

6, Part I, line 30 was $0 and the corporation’s capital

group member to:

gain and loss items that were included in the aggre-

gate computation would have been a net capital loss

if they were netted on a separate entity basis. On

line 2, you will enter the corporation’s share of the

group’s aggregate net capital loss.

IC-544

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4