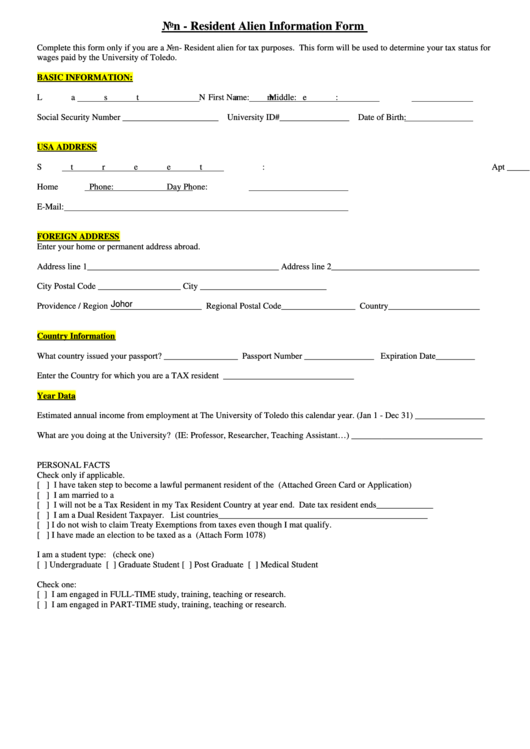

Non - Resident Alien Information Form

Complete this form only if you are a Non- Resident alien for tax purposes. This form will be used to determine your tax status for

wages paid by the University of Toledo.

BASIC INFORMATION:

Last Name:

First Name:

Middle:

Social Security Number ______________________ University ID#________________ Date of Birth:

USA ADDRESS

Street :

Apt _________

Toledo, Ohio

Zip Code:_____________

Home Phone:

Day Phone:

E-Mail:

FOREIGN ADDRESS

Enter your home or permanent address abroad.

Address line 1____________________________________________ Address line 2__________________________________

City Postal Code ___________________

City _____________________________

Johor

Providence / Region _____________________ Regional Postal Code_________________ Country_____________________

Country Information

What country issued your passport? _________________ Passport Number ________________ Expiration Date_________

Enter the Country for which you are a TAX resident ______________________________

Year Data

Estimated annual income from employment at The University of Toledo this calendar year. (Jan 1 - Dec 31) ________________

What are you doing at the University? (IE: Professor, Researcher, Teaching Assistant…) ______________________________

PERSONAL FACTS

Check only if applicable.

[ ] I have taken step to become a lawful permanent resident of the U.S. (Attached Green Card or Application)

[ ] I am married to a U.S. citizen

[ ] I will not be a Tax Resident in my Tax Resident Country at year end. Date tax resident ends_____________

[ ] I am a Dual Resident Taxpayer. List countries________________________________________________

[ ] I do not wish to claim Treaty Exemptions from taxes even though I mat qualify.

[ ] I have made an election to be taxed as a U.S. resident (Attach Form 1078)

I am a student type: (check one)

[ ] Undergraduate

[ ] Graduate Student

[ ] Post Graduate

[ ] Medical Student

Check one:

[ ] I am engaged in FULL-TIME study, training, teaching or research.

[ ] I am engaged in PART-TIME study, training, teaching or research.

1

1 2

2