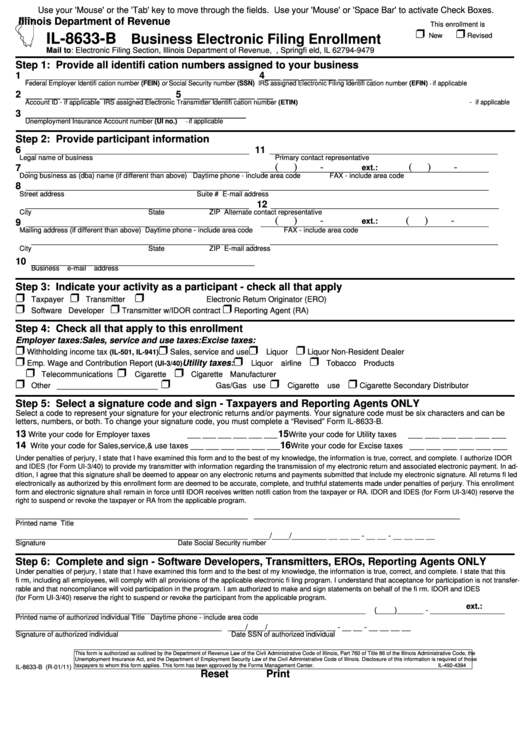

Use your 'Mouse' or the 'Tab' key to move through the fields. Use your 'Mouse' or 'Space Bar' to activate Check Boxes.

Illinois Department of Revenue

This enrollment is

IL-8633-B

New

Revised

Business Electronic Filing Enrollment

Mail to: Electronic Filing Section, Illinois Department of Revenue, P.O. Box 19479, Springfi eld, IL 62794-9479

Step 1: Provide all identifi cation numbers assigned to your business

1

4 ___ ___ ___ ___ ___ ___

____________________________________________________

Federal Employer Identifi cation number (FEIN) or Social Security number (SSN)

IRS assigned Electronic Filing Identifi cation number (EFIN)

if applicable

-

2

___ ___ ___ ___ ___ ___ ___ ___

5 ___ ___ ___ ___ ___

Account ID - if applicable

IRS assigned Electronic Transmitter Identifi cation number (ETIN) - if applicable

3

__________________________________________

Unemployment Insurance Account number (UI no.)

if applicable

-

Step 2: Provide participant information

6

11

___________________________________________________

____________________________________________________

Legal name of business

Primary contact representative

(

)

-

(

)

-

7

ext.:

___________________________________________________

____________________________________________________

Doing business as (dba) name (if different than above)

Daytime phone - include area code

FAX - include area code

8

___________________________________________________

____________________________________________________

Street address

Suite #

E-mail address

12

___________________________________________________

____________________________________________________

City

State

ZIP

Alternate contact representative

(

)

-

(

)

-

9

ext.:

___________________________________________________

____________________________________________________

Mailing address (if different than above)

Daytime phone - include area code

FAX - include area code

___________________________________________________

____________________________________________________

City

State

ZIP

E-mail address

10

___________________________________________________

Business e-mail address

Step 3: Indicate your activity as a participant - check all that apply

Taxpayer

Transmitter

Electronic Return Originator (ERO)

Software Developer

Transmitter w/IDOR contract

Reporting Agent (RA)

Step 4: Check all that apply to this enrollment

Employer taxes:

Sales, service and use taxes:

Excise taxes:

Withholding income tax

Sales, service and use

Liquor

Liquor Non-Resident Dealer

(IL-501, IL-941)

Utility taxes:

Emp. Wage and Contribution Report

Liquor airline

Tobacco Products

(UI-3/40)

Telecommunications

Cigarette

Cigarette Manufacturer

Other _______________________

Gas/Gas use

Cigarette use

Cigarette Secondary Distributor

Step 5: Select a signature code and sign - Taxpayers and Reporting Agents ONLY

Select a code to represent your signature for your electronic returns and/or payments. Your signature code must be six characters and can be

letters, numbers, or both. To change your signature code, you must complete a “Revised” Form IL-8633-B.

13

15

___ ___ ___ ___ ___ ___

Write your code for Employer taxes

___ ___ ___ ___ ___ ___

Write your code for Utility taxes

14

16

___ ___ ___ ___ ___ ___

Write your code for Sales,service,& use taxes ___ ___ ___ ___ ___ ___

Write your code for Excise taxes

Under penalties of perjury, I state that I have examined this form and to the best of my knowledge, the information is true, correct, and complete. I authorize IDOR

and IDES (for Form UI-3/40) to provide my transmitter with information regarding the transmission of my electronic return and associated electronic payment. In ad-

dition, I agree that this signature shall be deemed to appear on any electronic returns and payments submitted that include my electronic signature. All returns fi led

electronically as authorized by this enrollment form are deemed to be accurate, complete, and truthful statements made under penalties of perjury. This enrollment

form and electronic signature shall remain in force until IDOR receives written notifi cation from the taxpayer or RA. IDOR and IDES (for Form UI-3/40) reserve the

right to suspend or revoke the taxpayer or RA from the applicable program.

_____________________________________________________ _______________________________________________

Printed name

Title

_____________________________________________________ ____/____/________

__ __ __ - __ __ - __ __ __ __

Signature

Date

Social Security number

Step 6: Complete and sign - Software Developers, Transmitters, EROs, Reporting Agents ONLY

Under penalties of perjury, I state that I have examined this form and to the best of my knowledge, the information is true, correct, and complete. I state that this

fi rm, including all employees, will comply with all provisions of the applicable electronic fi ling program. I understand that acceptance for participation is not transfer-

rable and that noncompliance will void participation in the program. I am authorized to make and sign statements on behalf of the fi rm. IDOR and IDES

(for Form UI-3/40) reserve the right to suspend or revoke the participant from the applicable program.

ext.:

_______________________________________________

____________________________

(____)______ - _________________

Printed name of authorized individual

Title

Daytime phone - include area code

_______________________________________________

____/____/________

__ __ __ - __ __ - __ __ __ __

Signature of authorized individual

Date

SSN of authorized individual

This form is authorized as outlined by the Department of Revenue Law of the Civil Administrative Code of Illinois, Part 760 of Title 86 of the Illinois Administrative Code, the

Unemployment Insurance Act, and the Department of Employment Security Law of the Civil Administrative Code of Illinois. Disclosure of this information is required of those

taxpayers to whom this form applies. This form has been approved by the Forms Management Center.

IL-492-4394

IL-8633-B (R-01/11)

Reset

Print

1

1 2

2