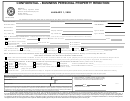

New Mexico Business Personal Property Report Form - 2014 Page 3

ADVERTISEMENT

INSTRUCTIONS

For Assistance or Questions, contact the personal property department for Rio Arriba County.

1. Assets having a deduction for depreciation and/or a Section 179 expense which was reported to the IRS for

the previous tax year must be reported on this form. Sec. 7-36-8 NMSA 1993 Amended.

An itemized list of assets must accompany this form.

2. Depreciation used in a straight line method of calculating the depreciation allowance over the useful life of an

asset. The MACRTS or ACRS recovery periods cannot be used New Mexico property tax valuation purposes.

3. 100% acquisition cost must include freight, installation, and any fees included in the purchase of an asset.. Use

rounded whole numbers.

4. Owner of rentals or leased housing must report appliances, drapes, furnishings, equipment for office, club

homes, maintenance etc. if a deduction for depreciation was reported to the IRS.

5. If leasing equipment, a separate sheet listing the equipment type and the lessor's names mailing address and

phone number must be attached.

6. Do not report vehicles or trailers licensed in the State of New Mexico.

7. A copy of the Federal depreciation schedule/detail worksheet must be attached.

8. A separate from must be used in reporting assets in several districts.

9. On line reporting is available in this county.

10. Corrections submitted after the 30 day protest period as indicted on the notice of Value; will be applied to the

next year. If you are not on the tax roll then you will be added to this year under the omitted property guidelines

and will be subject to the non rendition penalty.

Note

This form must be completed in accordance with the above listed instructions and returned by the last day

of February. (Sec7.38.8)

All business assets and farm equipment subject to valuation for property tax purposes shall be valued as of

January 1 (Sec.7-38-7) of every year (Sec. 7.38-8; 7-36-33).

A personal property report must be made annually even if no changes have been made. Failure to report,

will result in a 5% non-rendition penalty.

Falsification of a report may result in penalties up to 2%% (Sec. 7-38-8).

All returns are subject to audit.

All fields followed by an asterisk must be completed.

Affirmation Mandatory

I do solemnly affirm to the best of my knowledge that the statements on this form completed and signed by me and the

preceding list and descriptions are full and correct statements of all business personal property required to be reported

pursuant to Section 7-38-8 of the Property tax code, in the County on January 1st, and all statements required to be made

under the Property tax code and I so affirm under pains and penalties of perjury.

_________________________________________

_______________________________

Signature of Owner/Authorized Agent

Date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4