Tax Deduction Form 2008

ADVERTISEMENT

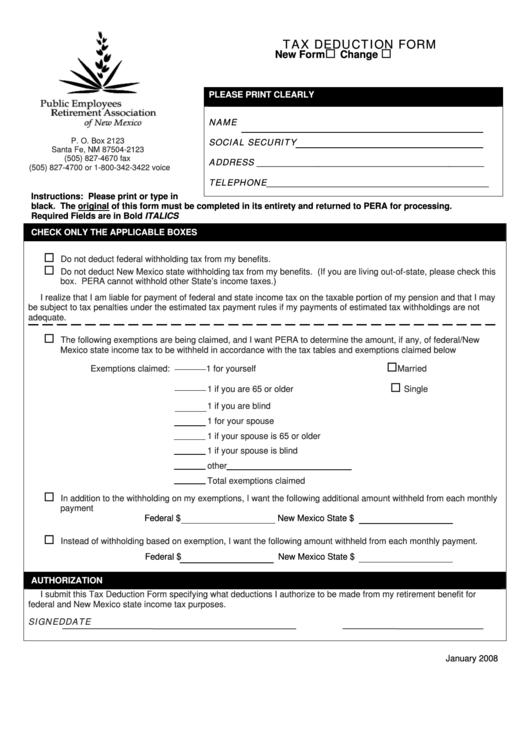

TAX DEDUCTION FORM

New Form

Change

PLEASE PRINT CLEARLY

NAME

SOCIAL SECURITY

P. O. Box 2123

Santa Fe, NM 87504-2123

(505) 827-4670 fax

ADDRESS ____________________________________________________

(505) 827-4700 or 1-800-342-3422 voice

TELEPHONE___________________________________________________

Instructions: Please print or type in

black. The original of this form must be completed in its entirety and returned to PERA for processing.

Required Fields are in Bold ITALICS

CHECK ONLY THE APPLICABLE BOXES

Do not deduct federal withholding tax from my benefits.

Do not deduct New Mexico state withholding tax from my benefits. (If you are living out-of-state, please check this

box. PERA cannot withhold other State’s income taxes.)

I realize that I am liable for payment of federal and state income tax on the taxable portion of my pension and that I may

be subject to tax penalties under the estimated tax payment rules if my payments of estimated tax withholdings are not

adequate.

The following exemptions are being claimed, and I want PERA to determine the amount, if any, of federal/New

Mexico state income tax to be withheld in accordance with the tax tables and exemptions claimed below

Exemptions claimed:

1 for yourself

Married

1 if you are 65 or older

Single

1 if you are blind

1 for your spouse

1 if your spouse is 65 or older

1 if your spouse is blind

other

Total exemptions claimed

In addition to the withholding on my exemptions, I want the following additional amount withheld from each monthly

payment

Federal $

New Mexico State $

Instead of withholding based on exemption, I want the following amount withheld from each monthly payment.

Federal $

New Mexico State $

AUTHORIZATION

I submit this Tax Deduction Form specifying what deductions I authorize to be made from my retirement benefit for

federal and New Mexico state income tax purposes.

SIGNED

DATE

January 2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1