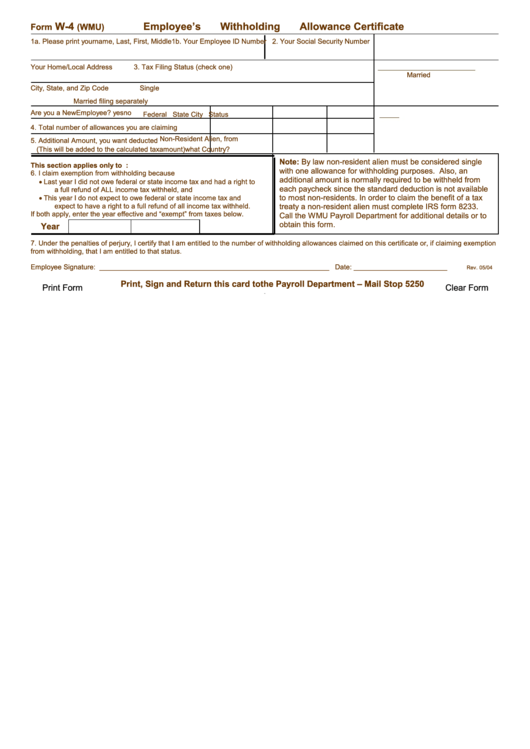

W-4

Employee’s Withholding Allowance Certificate

Form

(WMU)

1a. Please print your name, Last, First, Middle

1b. Your Employee ID Number

2. Your Social Security Number

Your Home/Local Address

3. Tax Filing Status (check one)

Married

City, State, and Zip Code

Single

Married filing separately

Are you a New Employee?

yes

no

Federal

State

City

Status

4. Total number of allowances you are claiming

U.S. Citizen or Resident Alien

Non-Resident Alien, from

5. Additional Amount, you want deducted

(This will be added to the calculated tax amount)

what Country?

Note: By law non-resident alien must be considered single

This section applies only to U.S. citizens or residents:

with one allowance for withholding purposes. Also, an

6. I claim exemption from withholding because

additional amount is normally required to be withheld from

•

Last year I did not owe federal or state income tax and had a right to

each paycheck since the standard deduction is not available

a full refund of ALL income tax withheld, and

•

to most non-residents. In order to claim the benefit of a tax

This year I do not expect to owe federal or state income tax and

expect to have a right to a full refund of all income tax withheld.

treaty a non-resident alien must complete IRS form 8233.

If both apply, enter the year effective and “exempt” from taxes below.

Call the WMU Payroll Department for additional details or to

obtain this form.

Year

7. Under the penalties of perjury, I certify that I am entitled to the number of withholding allowances claimed on this certificate or, if claiming exemption

from withholding, that I am entitled to that status.

Employee Signature: ___________________________________________________________ Date: ________________________

Rev. 05/04

Print, Sign and Return this card to the Payroll Department – Mail Stop 5250

Print Form

Clear Form

1

1