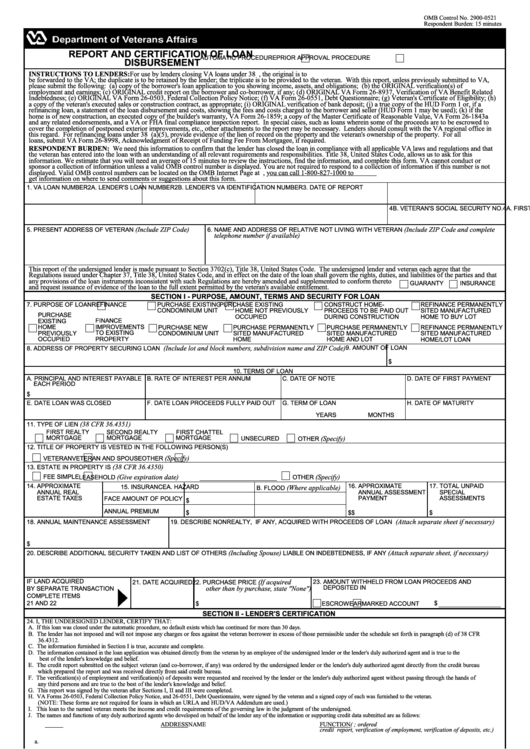

OMB Control No. 2900-0521

Respondent Burden: 15 minutes

REPORT AND CERTIFICATION OF LOAN

AUTOMATIC PROCEDURE

PRIOR APPROVAL PROCEDURE

DISBURSEMENT

INSTRUCTIONS TO LENDERS: For use by lenders closing VA loans under 38 U.S.C. 3710. After closing of the loan and completion of the form, the original is to

be forwarded to the VA; the duplicate is to be retained by the lender; the triplicate is to be provided to the veteran. With this report, unless previously submitted to VA,

please submit the following: (a) copy of the borrower's loan application to you showing income, assets, and obligations; (b) the ORIGINAL verification(s) of

employment and earnings; (c) ORIGINAL credit report on the borrower and co-borrower, if any; (d) ORIGINAL VA Form 26-8937, Verification of VA Benefit Related

Indebtedness; (e) ORIGINAL VA Form 26-0503, Federal Collection Policy Notice; (f) VA Form 26-0551, Debt Questionnaire; (g) Veteran's Certificate of Eligibility; (h)

a copy of the veteran's executed sales or construction contract, as appropriate; (i) ORIGINAL verification of bank deposit; (j) a true copy of the HUD Form 1 or, if a

refinancing loan, a statement of the loan disbursement and costs, showing the fees and costs charged to the borrower and seller (HUD Form 1 may be used); (k) if the

home is of new construction, an executed copy of the builder's warranty, VA Form 26-1859; a copy of the Master Certificate of Reasonable Value, VA Form 26-1843a

and any related endorsements, and a VA or FHA final compliance inspection report. In special cases, such as loans wherein some of the proceeds are to be escrowed to

cover the completion of postponed exterior improvements, etc., other attachments to the report may be necessary. Lenders should consult with the VA regional office in

this regard. For refinancing loans under 38 U.S.C. 3710 (a)(5), provide evidence of the lien of record on the property and the veteran's ownership of the property. For all

loans, submit VA Form 26-8998, Acknowledgment of Receipt of Funding Fee From Mortgagee, if required.

RESPONDENT BURDEN: We need this information to confirm that the lender has closed the loan in compliance with all applicable VA laws and regulations and that

the veteran has entered into the loan with an understanding of all relevant requirements and responsibilities. Title 38, United States Code, allows us to ask for this

information. We estimate that you will need an average of 15 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or

sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not

displayed. Valid OMB control numbers can be located on the OMB Internet Page at If desired, you can call 1-800-827-1000 to

get information on where to send comments or suggestions about this form.

1. VA LOAN NUMBER

2A. LENDER'S LOAN NUMBER

2B. LENDER'S VA IDENTIFICATION NUMBER 3. DATE OF REPORT

4A. FIRST NAME - MIDDLE NAME - LAST NAME OF VETERAN

4B. VETERAN'S SOCIAL SECURITY NO.

(Include ZIP Code)

(Include ZIP Code and complete

5. PRESENT ADDRESS OF VETERAN

6. NAME AND ADDRESS OF RELATIVE NOT LIVING WITH VETERAN

telephone number if available)

This report of the undersigned lender is made pursuant to Section 3702(c), Title 38, United States Code. The undersigned lender and veteran each agree that the

Regulations issued under Chapter 37, Title 38, United States Code, and in effect on the date of the loan shall govern the rights, duties, and liabilities of the parties and that

any provisions of the loan instruments inconsistent with such Regulations are hereby amended and supplemented to conform thereto

GUARANTY

INSURANCE

and request issuance of evidence of the loan to the full extent permitted by the veteran's available entitlement.

SECTION I - PURPOSE, AMOUNT, TERMS AND SECURITY FOR LOAN

7. PURPOSE OF LOAN

REFINANCE

PURCHASE EXISTING

PURCHASE EXISTING

CONSTRUCT HOME-

REFINANCE PERMANENTLY

CONDOMINIUM UNIT

HOME NOT PREVIOUSLY

PROCEEDS TO BE PAID OUT

SITED MANUFACTURED

PURCHASE

OCCUPIED

DURING CONSTRUCTION

HOME TO BUY LOT

FINANCE

EXISTING

HOME

IMPROVEMENTS

PURCHASE NEW

PURCHASE PERMANENTLY

PURCHASE PERMANENTLY

REFINANCE PERMANENTLY

PREVIOUSLY

TO EXISTING

CONDOMINIUM UNIT

SITED MANUFACTURED

SITED MANUFACTURED

SITED MANUFACTURED

PROPERTY

OCCUPIED

HOME

HOME AND LOT

HOME/LOT LOAN

(Include lot and block numbers, subdivision name and ZIP Code)

9. AMOUNT OF LOAN

8. ADDRESS OF PROPERTY SECURING LOAN

$

10. TERMS OF LOAN

A. PRINCIPAL AND INTEREST PAYABLE

B. RATE OF INTEREST PER ANNUM

C. DATE OF NOTE

D. DATE OF FIRST PAYMENT

EACH PERIOD

$

E. DATE LOAN WAS CLOSED

F. DATE LOAN PROCEEDS FULLY PAID OUT

G. TERM OF LOAN

H. DATE OF MATURITY

YEARS

MONTHS

(38 CFR 36.4351)

11. TYPE OF LIEN

FIRST REALTY

SECOND REALTY

FIRST CHATTEL

MORTGAGE

MORTGAGE

MORTGAGE

(Specify)

UNSECURED

OTHER

12. TITLE OF PROPERTY IS VESTED IN THE FOLLOWING PERSON(S)

(Specify)

VETERAN

VETERAN AND SPOUSE

OTHER

(38 CFR 36.4350)

13. ESTATE IN PROPERTY IS

(Give expiration date)

(Specify)

FEE SIMPLE

LEASEHOLD

OTHER

14. APPROXIMATE

16. APPROXIMATE

17. TOTAL UNPAID

15. INSURANCE

A. HAZARD

(Where applicable)

B. FLOOD

ANNUAL REAL

ANNUAL ASSESSMENT

SPECIAL

ESTATE TAXES

PAYMENT

ASSESSMENTS

FACE AMOUNT OF POLICY

$

ANNUAL PREMIUM

$

$

$

$

(Attach separate sheet if necessary)

18. ANNUAL MAINTENANCE ASSESSMENT

19. DESCRIBE NONREALTY, IF ANY, ACQUIRED WITH PROCEEDS OF LOAN

$

(Including Spouse)

(Attach separate sheet, if necessary)

20. DESCRIBE ADDITIONAL SECURITY TAKEN AND LIST OF OTHERS

LIABLE ON INDEBTEDNESS, IF ANY

If acquired

IF LAND ACQUIRED

23. AMOUNT WITHHELD FROM LOAN PROCEEDS AND

21. DATE ACQUIRED 22. PURCHASE PRICE (

DEPOSITED IN

other than by purchase, state "None")

BY SEPARATE TRANSACTION

COMPLETE ITEMS

$

21 AND 22

$

ESCROW

EARMARKED ACCOUNT

SECTION II - LENDER'S CERTIFICATION

24. I, THE UNDERSIGNED LENDER, CERTIFY THAT:

A. If this loan was closed under the automatic procedure, no default exists which has continued for more than 30 days.

B. The lender has not imposed and will not impose any charges or fees against the veteran borrower in excess of those permissible under the schedule set forth in paragraph (d) of 38 CFR

36.4312.

C. The information furnished in Section I is true, accurate and complete.

D. The information contained in the loan application was obtained directly from the veteran by an employee of the undersigned lender or the lender's duly authorized agent and is true to the

best of the lender's knowledge and belief.

E. The credit report submitted on the subject veteran (and co-borrower, if any) was ordered by the undersigned lender or the lender's duly authorized agent directly from the credit bureau

which prepared the report and was received directly from said credit bureau.

F. The verification(s) of employment and verification(s) of deposits were requested and received by the lender or the lender's duly authorized agent without passing through the hands of

any third persons and are true to the best of the lender's knowledge and belief.

G. This report was signed by the veteran after Sections I, II and III were completed.

H. VA Forms 26-0503, Federal Collection Policy Notice, and 26-0551, Debt Questionnaire, were signed by the veteran and a signed copy of each was furnished to the veteran.

(NOTE: These forms are not required for loans in which an URLA and HUD/VA Addendum are used.)

I. This loan to the named veteran meets the income and credit requirements of the governing law in the judgment of the undersigned.

J. The names and functions of any duly authorized agents who developed on behalf of the lender any of the information or supporting credit data submitted are as follows:

NAME

ADDRESS

FUNCTION (e.g. obtained information for loan application; ordered

credit report, verification of employment, verification of deposits, etc.)

a.

b.

c.

d.

e.

If no agent is shown above, the undersigned lender affirmatively charges that all information and supporting credit data were obtained directly by the lender.

K. The undersigned lender understands and agrees that the lender is responsible for the acts of agents identified in Item 24J as to the functions with which they are identified.

L. The loan conforms with the applicable provisions of Title 38, U.S. Code and the Regulations concerning guaranty or insurance of loans to veterans.

M. COMPLETE WHERE AUTHORIZED BY CERTIFICATE OF REASONABLE VALUE.

Any construction, repairs, alterations, or improvements upon which the reasonable value of the property is predicated and which were not inspected and approved subsequent

to completion by a compliance inspector designated by the Secretary have been completed properly.

N. If the loan application has been submitted for the prior approval of the VA, the proceeds of the loan were expended for the purposes described in the loan application or refinancing proposal

originally submitted for the prior approval of the VA and in the amounts shown in the statement of loan disbursement and costs or HUD Form 1 that is attached to and incorporated in this report.

VA FORM

Continued on Reverse

SUPERSEDES VA FORM 26-1820, DEC 2007,

26-1820

SEP 2012

WHICH WILL NOT BE USED.

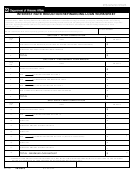

1

1 2

2