In The United States District Court For The District Of Arizona - Phoenix Criminal Minutes Trial

ADVERTISEMENT

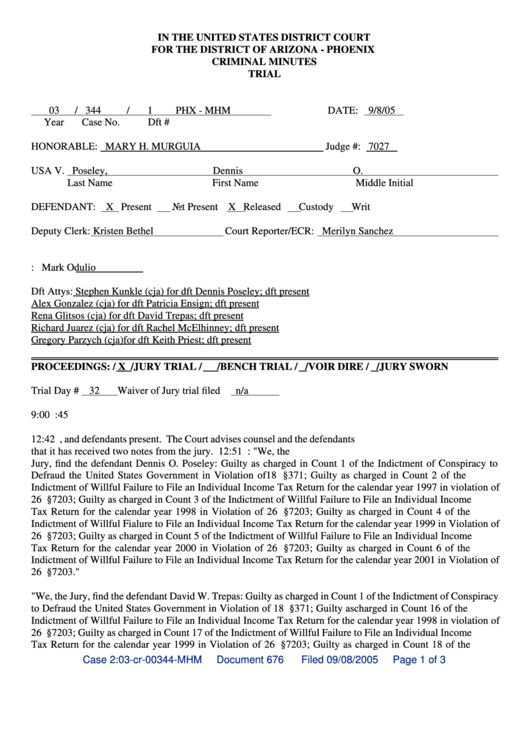

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF ARIZONA - PHOENIX

CRIMINAL MINUTES

TRIAL

03

/ 344

/

1

PHX - MHM

DATE: 9/8/05

Year

Case No.

Dft #

HONORABLE: MARY H. MURGUIA

Judge #: 7027

USA V. Poseley,

Dennis

O.

Last Name

First Name

Middle Initial

DEFENDANT: X Present

Not Present X Released

Custody

Writ

Deputy Clerk: Kristen Bethel

Court Reporter/ECR: Merilyn Sanchez

U.S. Atty: Mark Odulio

Dft Attys: Stephen Kunkle (cja) for dft Dennis Poseley; dft present

Alex Gonzalez (cja) for dft Patricia Ensign; dft present

Rena Glitsos (cja) for dft David Trepas; dft present

Richard Juarez (cja) for dft Rachel McElhinney; dft present

Gregory Parzych (cja)for dft Keith Priest; dft present

PROCEEDINGS: / X /JURY TRIAL /

/BENCH TRIAL / /VOIR DIRE / /JURY SWORN

Trial Day # 32

Waiver of Jury trial filed

n/a

9:00 a.m. Jury in jury room to continue deliberations. 11:45 a.m. Jury taking lunch break.

12:42 a.m. Court reconvenes with counsel, and defendants present. The Court advises counsel and the defendants

that it has received two notes from the jury. 12:51 p.m. Jury is now present. Verdicts read as follows: "We, the

Jury, find the defendant Dennis O. Poseley: Guilty as charged in Count 1 of the Indictment of Conspiracy to

Defraud the United States Government in Violation of 18 U.S.C. §371; Guilty as charged in Count 2 of the

Indictment of Willful Failure to File an Individual Income Tax Return for the calendar year 1997 in violation of

26 U.S.C. §7203; Guilty as charged in Count 3 of the Indictment of Willful Failure to File an Individual Income

Tax Return for the calendar year 1998 in Violation of 26 U.S.C. §7203; Guilty as charged in Count 4 of the

Indictment of Willful Fialure to File an Individual Income Tax Return for the calendar year 1999 in Violation of

26 U.S.C. §7203; Guilty as charged in Count 5 of the Indictment of Willful Failure to File an Individual Income

Tax Return for the calendar year 2000 in Violation of 26 U.S.C. §7203; Guilty as charged in Count 6 of the

Indictment of Willful Failure to File an Individual Income Tax Return for the calendar year 2001 in Violation of

26 U.S.C. §7203."

"We, the Jury, find the defendant David W. Trepas: Guilty as charged in Count 1 of the Indictment of Conspiracy

to Defraud the United States Government in Violation of 18 U.S.C. §371; Guilty as charged in Count 16 of the

Indictment of Willful Failure to File an Individual Income Tax Return for the calendar year 1998 in violation of

26 U.S.C. §7203; Guilty as charged in Count 17 of the Indictment of Willful Failure to File an Individual Income

Tax Return for the calendar year 1999 in Violation of 26 U.S.C. §7203; Guilty as charged in Count 18 of the

Case 2:03-cr-00344-MHM

Document 676

Filed 09/08/2005

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3