II.

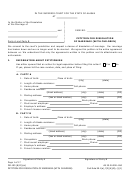

FINANCIAL INFORMATION

Each party must attach a copy of his or her most recent federal tax return, W2, and at least two of

his or her most recent paystubs to verify income and deductions. If work is seasonal, show yearly

income. If income or deductions will change after the dissolution, file documents showing expected

income and deductions. The following income and deductions are

monthly

yearly.

A. Gross Income (Do not list ATAP or SSI.)

Party A

Party B

Gross wages

$

$

Value of employer-provided

housing/food/BAH/BAS/COLA/etc.

$

$

Unemployment compensation

$

$

Permanent Fund Dividend

$

$

Other:

$

$

$

$

$

$

$

$

TOTAL INCOME

$

$

B. Deductions

Federal, state, and local income tax

$

$

Social security (FICA) or self-employ. tax

$

$

Medicare tax

$

$

Employment security tax (SUI)

$

$

Mandatory retirement deductions

$

$

Mandatory union dues

$

$

Voluntary retirement contributions if plan

earnings are tax-free or deferred, up to

7.5% of gross wages & self-employ. income

when combined with mandatory contrib.

$

$

Other mandatory deductions (specify):

$

$

Spousal support (alimony) ordered in other

cases and currently paid

$

$

Child support ordered for prior children of a

1

different relationship and currently paid

$

$

In-kind support for prior children of a

different relationship calculated under

2

90.3(a)(1)(D)

$

$

Work-related child care for children in this

case

$

$

TOTAL DEDUCTIONS

$

$

C. Net Income

TOTAL INCOME from section A

$

$

TOTAL DEDUCTIONS from section B

$

$

Subtract deductions from income to get

NET INCOME

$

$

Signature of Party A

Signature of Party B

1

Not to exceed support amount calculated under 90.3(a)(2). “Prior children” includes children from a different

relationship who were born or adopted before the children in this case.

2

For more information, see

Prior Child Deduction Chart

and Civil Rule 90.3.

Page 3 of 8

DR-100 (8/15)(cs)

AS 25.24.200-.260

PETITION FOR DISSOLUTION OF MARRIAGE (NO MINOR CHILDREN)

Civil Rule 90.1(a), f(2)(A)(B), (i)(1)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8