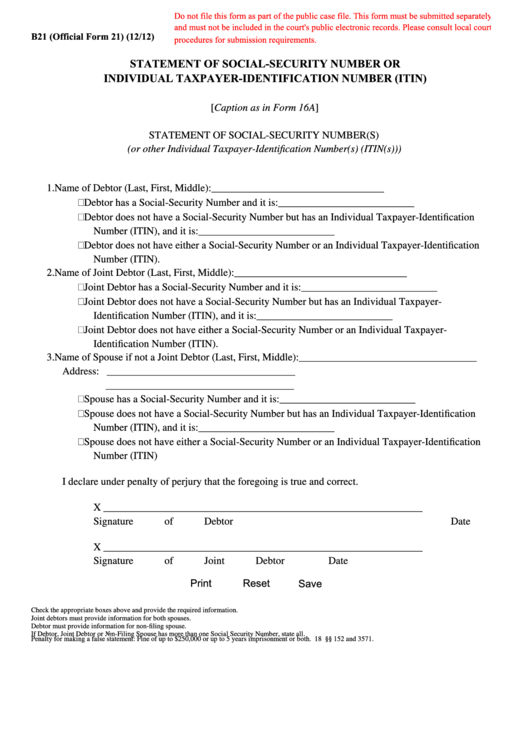

Do not file this form as part of the public case file. This form must be submitted separately

and must not be included in the court's public electronic records. Please consult local court

B21 (Official Form 21) (12/12)

procedures for submission requirements.

STATEMENT OF SOCIAL-SECURITY NUMBER OR

INDIVIDUAL TAXPAYER-IDENTIFICATION NUMBER (ITIN)

[Caption as in Form 16A]

STATEMENT OF SOCIAL-SECURITY NUMBER(S)

(or other Individual Taxpayer-Identification Number(s) (ITIN(s)))

1. Name of Debtor (Last, First, Middle):_________________________________

Debtor has a Social-Security Number and it is:__________________________

Debtor does not have a Social-Security Number but has an Individual Taxpayer-Identification

Number (ITIN), and it is:__________________________

Debtor does not have either a Social-Security Number or an Individual Taxpayer-Identification

Number (ITIN).

2. Name of Joint Debtor (Last, First, Middle):_________________________________

Joint Debtor has a Social-Security Number and it is:__________________________

Joint Debtor does not have a Social-Security Number but has an Individual Taxpayer-

Identification Number (ITIN), and it is:__________________________

Joint Debtor does not have either a Social-Security Number or an Individual Taxpayer-

Identification Number (ITIN).

3. Name of Spouse if not a Joint Debtor (Last, First, Middle):__________________________________

Address: ____________________________________

____________________________________

Spouse has a Social-Security Number and it is:__________________________

Spouse does not have a Social-Security Number but has an Individual Taxpayer-Identification

Number (ITIN), and it is:__________________________

Spouse does not have either a Social-Security Number or an Individual Taxpayer-Identification

Number (ITIN)

I declare under penalty of perjury that the foregoing is true and correct.

X _____________________________________________________________

Signature of Debtor

Date

X _____________________________________________________________

Signature of Joint Debtor

Date

Reset

Print

Save

Check the appropriate boxes above and provide the required information.

Joint debtors must provide information for both spouses.

Debtor must provide information for non-filing spouse.

If Debtor, Joint Debtor or Non-Filing Spouse has more than one Social Security Number, state all.

Penalty for making a false statement: Fine of up to $250,000 or up to 5 years imprisonment or both. 18 U.S.C. §§ 152 and 3571.

1

1