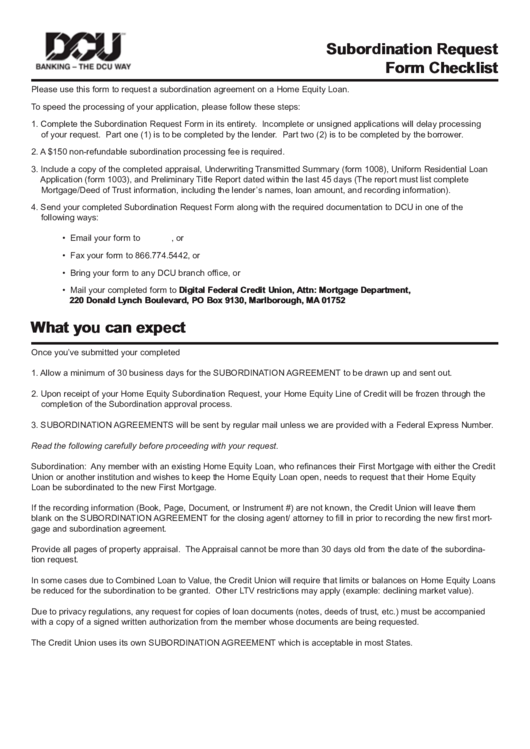

Subordination Request

ADVERTISEMENT

Subordination Request

Form Checklist

Please use this form to request a subordination agreement on a Home Equity Loan.

To speed the processing of your application, please follow these steps:

1. Complete the Subordination Request Form in its entirety. Incomplete or unsigned applications will delay processing

of your request. Part one (1) is to be completed by the lender. Part two (2) is to be completed by the borrower.

2. A $150 non-refundable subordination processing fee is required.

3. Include a copy of the completed appraisal, Underwriting Transmitted Summary (form 1008), Uniform Residential Loan

Application (form 1003), and Preliminary Title Report dated within the last 45 days (The report must list complete

Mortgage/Deed of Trust information, including the lender’s names, loan amount, and recording information).

4. Send your completed Subordination Request Form along with the required documentation to DCU in one of the

following ways:

• Email your form to , or

• Fax your form to 866.774.5442, or

• Bring your form to any DCU branch office, or

• Mail your completed form to Digital Federal Credit Union, Attn: Mortgage Department,

220 Donald Lynch Boulevard, PO Box 9130, Marlborough, MA 01752

What you can expect

Once you’ve submitted your completed forms...

1. Allow a minimum of 30 business days for the SUBORDINATION AGREEMENT to be drawn up and sent out.

2. Upon receipt of your Home Equity Subordination Request, your Home Equity Line of Credit will be frozen through the

completion of the Subordination approval process.

3. SUBORDINATION AGREEMENTS will be sent by regular mail unless we are provided with a Federal Express Number.

Read the following carefully before proceeding with your request.

Subordination: Any member with an existing Home Equity Loan, who refinances their First Mortgage with either the Credit

Union or another institution and wishes to keep the Home Equity Loan open, needs to request that their Home Equity

Loan be subordinated to the new First Mortgage.

If the recording information (Book, Page, Document, or Instrument #) are not known, the Credit Union will leave them

blank on the SUBORDINATION AGREEMENT for the closing agent/ attorney to fill in prior to recording the new first mort-

gage and subordination agreement.

Provide all pages of property appraisal. The Appraisal cannot be more than 30 days old from the date of the subordina-

tion request.

In some cases due to Combined Loan to Value, the Credit Union will require that limits or balances on Home Equity Loans

be reduced for the subordination to be granted. Other LTV restrictions may apply (example: declining market value).

Due to privacy regulations, any request for copies of loan documents (notes, deeds of trust, etc.) must be accompanied

with a copy of a signed written authorization from the member whose documents are being requested.

The Credit Union uses its own SUBORDINATION AGREEMENT which is acceptable in most States.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2