Biaw Health Insurance Trust Employer Participation Agreement Page 2

ADVERTISEMENT

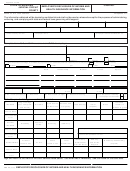

3. Employee Participation Requirements

A. Total number of employees on payroll, regardless of hours worked.................................................................................................................................. ___________

(Do not include COBRA participants.)

B. Employees not eligible for coverage on this plan:

1. Employees working fewer than the minimum hours as indicated in Section 2A...................... ___________

2. Employees who are not eligible by class as indicated in Section 2B......................................... ___________

3. Employees who have not completed the probationary period indicated in Section 2C............ ___________

(For new groups only, enter zero (0) if you selected “future” employees in Section 2E.)

4. Employees paid via IRS form 1099, or temporary, seasonal or substitute employees................___________

Subtotal B: ___________

C. Please indicate the number of employees waiving coverage for each of the following approved reasons:

1. Employees covered by Medicare as primary............................................................................. ___________

2. Employees covered by Military coverage (TriCare/Champus)................................................... ___________

3. Employees covered by other group coverage (e.g., spousal coverage, union, etc.)................... ___________

4. Employees covered by Tribal coverage..................................................................................... ___________

5. Employees waiving due to Christian Scientist beliefs............................................................... ___________

Subtotal C: ___________

Total eligible employees (A- Subtotal B - Subtotal C):

___________

D. Total number of enrolled employees...............................................................................................................................................................................

___________

E. Employees covered by your group under the Federal provisions of COBRA......................................................................................................................

___________

4. Federal Mandates: FMLA/TEFRA/DEFRA/COBRA/OBRA

(Family and Medical Leave Act/Tax Equity and Fiscal Responsibility Act of 1982/Consolidated Omnibus Budget Reconciliation Act

of 1985/Omnibus Budget Reconciliation Act of 1989 & 1993)

Yes

No

Did your company employ 50 or more full-time and/or part-time employees during each of 20 calendar weeks in the current or

preceding calendar year (January - December), and is it subject to FMLA? (If yes, you are required by federal law to comply with

FMLA provisions.)

All Trust Companies are subject to TEFRA/DEFRA, COBRA and OBRA laws.

5. Prior Coverage Information for New Groups

If your group is renewing coverage, please check here and skip to Section 6. (For renewing groups, the carrier has your group’s prior coverage information on fi le.

If your group is enrolling in the BIAW Trust for the fi rst time, please check here and complete this section in its entirety.

Yes No

Does your group have current group medical coverage?

If Yes, complete the following information:

Name of prior medical carrier: _____________________________

Date coverage began: _______________________

Date coverage canceled: _______________________

Yes No

Does your group have current group dental coverage?

If Yes, complete the following information:

Name of prior dental carrier: _______________________________

Date coverage began: _______________________

Date coverage canceled: _______________________

The probationary period for your prior carrier was: __________________

To receive credit for dental waiting periods, please attach a copy of the last billing statement from your prior carrier. Indicate the number of months (next to his or her name) that each

employee has been continuously covered (if over 6 months, show as 6+).

6. Employer Contribution

The employer will pay the following percentages of the monthly rate. The employer must pay a minimum 75% of total employee cost.

Employer Contribution

Medical Plan %

Dental Plan %

%

%

Employer pays for Employee:

%

%

Employer pays for Dependents:

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4