Instructions For 2015 Schedule 4i: Wisconsin Adjustments For Insurance Companies

ADVERTISEMENT

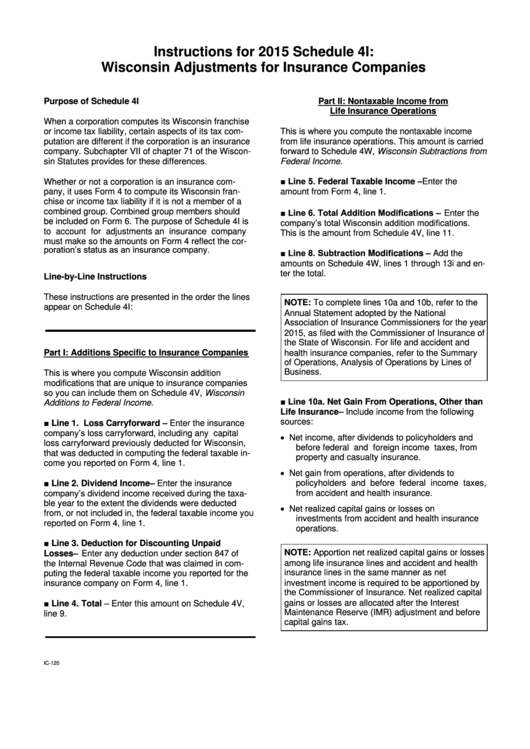

Instructions for 2015 Schedule 4I:

Wisconsin Adjustments for Insurance Companies

Purpose of Schedule 4I

Part II: Nontaxable Income from

Life Insurance Operations

When a corporation computes its Wisconsin franchise

or income tax liability, certain aspects of its tax com-

This is where you compute the nontaxable income

putation are different if the corporation is an insurance

from life insurance operations. This amount is carried

company. Subchapter VII of chapter 71 of the Wiscon-

forward to Schedule 4W, Wisconsin Subtractions from

sin Statutes provides for these differences.

Federal Income.

■ Line 5. Federal Taxable Income – Enter the

Whether or not a corporation is an insurance com-

pany, it uses Form 4 to compute its Wisconsin fran-

amount from Form 4, line 1.

chise or income tax liability if it is not a member of a

combined group. Combined group members should

■ Line 6. Total Addition Modifications – Enter the

be included on Form 6. The purpose of Schedule 4I is

company’s total Wisconsin addition modifications.

to account for adjustments an insurance company

This is the amount from Schedule 4V, line 11.

must make so the amounts on Form 4 reflect the cor-

poration’s status as an insurance company.

■ Line 8. Subtraction Modifications – Add the

amounts on Schedule 4W, lines 1 through 13i and en-

ter the total.

Line-by-Line Instructions

These instructions are presented in the order the lines

NOTE: To complete lines 10a and 10b, refer to the

appear on Schedule 4I:

Annual

Statement

adopted

by

the

National

Association of Insurance Commissioners for the year

2015, as filed with the Commissioner of Insurance of

the State of Wisconsin. For life and accident and

Part I: Additions Specific to Insurance Companies

health insurance companies, refer to the Summary

of Operations, Analysis of Operations by Lines of

Business.

This is where you compute Wisconsin addition

modifications that are unique to insurance companies

so you can include them on Schedule 4V, Wisconsin

■ Line 10a. Net Gain From Operations, Other than

Additions to Federal Income.

Life Insurance – Include income from the following

■ Line 1. Loss Carryforward – Enter the insurance

sources:

company’s loss carryforward, including any capital

Net income, after dividends to policyholders and

loss carryforward previously deducted for Wisconsin,

before federal and foreign income taxes, from

that was deducted in computing the federal taxable in-

property and casualty insurance.

come you reported on Form 4, line 1.

Net gain from operations, after dividends to

■ Line 2. Dividend Income – Enter the insurance

policyholders and before federal income taxes,

company’s dividend income received during the taxa-

from accident and health insurance.

ble year to the extent the dividends were deducted

Net

realized

capital

gains

or

losses

on

from, or not included in, the federal taxable income you

investments from accident and health insurance

reported on Form 4, line 1.

operations.

■ Line 3. Deduction for Discounting Unpaid

Losses – Enter any deduction under section 847 of

NOTE: Apportion net realized capital gains or losses

among life insurance lines and accident and health

the Internal Revenue Code that was claimed in com-

insurance lines in the same manner as net

puting the federal taxable income you reported for the

investment income is required to be apportioned by

insurance company on Form 4, line 1.

the Commissioner of Insurance. Net realized capital

■ Line 4. Total – Enter this amount on Schedule 4V,

gains or losses are allocated after the Interest

Maintenance Reserve (IMR) adjustment and before

line 9.

capital gains tax.

IC-120

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3