Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

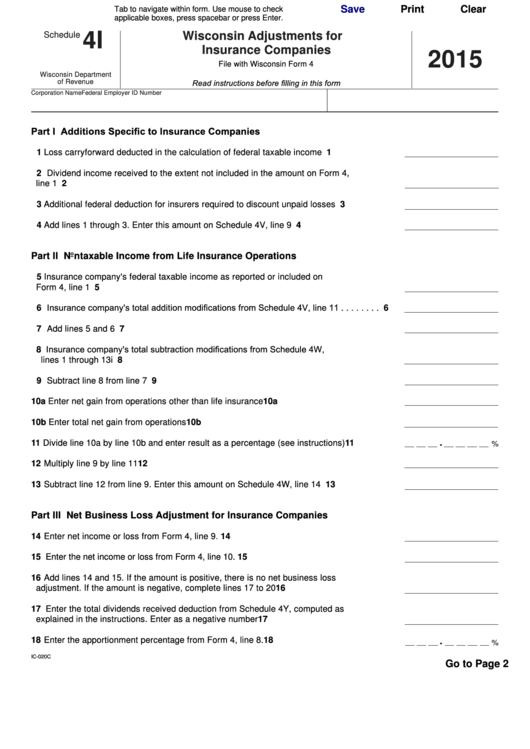

4I

Wisconsin Adjustments for

Schedule

Insurance Companies

2015

File with Wisconsin Form 4

Wisconsin Department

Read instructions before filling in this form

of Revenue

Corporation Name

Federal Employer ID Number

Part I Additions Specific to Insurance Companies

1

Loss carryforward deducted in the calculation of federal taxable income . . . . . . . . . . . 1

2

Dividend income received to the extent not included in the amount on Form 4,

line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3

Additional federal deduction for insurers required to discount unpaid losses . . . . . . . . 3

4

Add lines 1 through 3 . Enter this amount on Schedule 4V, line 9 . . . . . . . . . . . . . . . . . 4

Part II Nontaxable Income from Life Insurance Operations

5

Insurance company's federal taxable income as reported or included on

Form 4, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Insurance company's total addition modifications from Schedule 4V, line 11 . . . . . . . . 6

6

7

Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Insurance company's total subtraction modifications from Schedule 4W,

8

lines 1 through 13i . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9

Subtract line 8 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10a Enter net gain from operations other than life insurance . . . . . . . . . . . . . . . . . . . . . . . 10a

10b Enter total net gain from operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10b

.

11

Divide line 10a by line 10b and enter result as a percentage (see instructions) . . . . . . 11

%

12

Multiply line 9 by line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13

Subtract line 12 from line 9 . Enter this amount on Schedule 4W, line 14 . . . . . . . . . . . 13

Part III Net Business Loss Adjustment for Insurance Companies

14

Enter net income or loss from Form 4, line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15

Enter the net income or loss from Form 4, line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16

Add lines 14 and 15 . If the amount is positive, there is no net business loss

adjustment . If the amount is negative, complete lines 17 to 20 . . . . . . . . . . . . . . . . . . . 16

17

Enter the total dividends received deduction from Schedule 4Y, computed as

explained in the instructions . Enter as a negative number . . . . . . . . . . . . . . . . . . . . . . 17

18

Enter the apportionment percentage from Form 4, line 8 . . . . . . . . . . . . . . . . . . . . . . . . 18

.

%

IC-020C

Go to Page 2

1

1 2

2