State Grant And Special Programs

ADVERTISEMENT

14B40 – 12/13

TGSC 14

State Grant and Special Programs

Phone: 1-800-692-7392

Fax: 717-720-3786

P.O. Box 8157 Harrisburg, PA 17105-8157

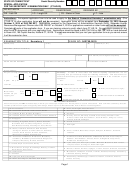

2014-15 REDUCED INCOME FORM

(DEPENDENT STUDENT)

(NOTE: Deadline for returning this form and 2013 tax documents to PHEAA is April 1, 2015.)

Student’s Social Security Number

________________________________________________

Print Student’s Name

OR

Student’s Account Number

2014-15

If your family’s 2014 income has been reduced, you should complete this form and return it to PHEAA, P.O. Box 8157, Harrisburg, PA 17105-8157 for

further consideration of your 2014-15 Pennsylvania State Grant application. If you have questions concerning this matter, please contact Agency staff

toll-free at 1-800-692-7392 (TTY: Dial 711 for hearing impaired). If you are unable to estimate the total income your family will receive from

January 1, 2014 until December 31, 2014, at this time, keep this form until you can provide an accurate estimate.

If there are other members of your family attending college during the 2014-15 academic year, and they have applied for Pennsylvania State Grant aid,

list their social security number(s) or account number(s) here.

____________________________________________

_________________________________________________

PHEAA requires a complete copy of your parent(s)’/stepparent’s 2013 U.S. INCOME TAX RETURN with all supporting forms, schedules and

Wage and Tax Statements (W-2 Forms).

Each W-2 Form must contain figures in Box 1 and either Box 16 or Box 18.

If your

parent(s)/stepparent have an interest in a corporation and/or partnership, you also need to submit copies of the most recent U.S.

Partnership and/or Corporation Tax Return(s), including the completed balance sheet(s) and K-1 schedule(s). If you do not submit ALL of

the requested 2013 tax documents, PHEAA will be unable to give further consideration to your request for reduced income processing.

Please review the sections below and indicate which explanation(s) applies to the reason(s) your family’s 2014 income will be reduced. If you check

boxes B, C, D, or E, you must complete Sections F and G.

A.

Death of Parent/Stepparent (death must have occurred ON OR AFTER January 1, 2013).

Date: _______________________ (Month/Day/Year)

Relationship to Student:

* If you checked “A” above, you must simply sign and return to PHEAA along with the requested tax information. You do not need to complete the

remainder of the form.

B.

Permanent and total (unable to work again) disability of parent, or stepparent (must have occurred ON OR AFTER January 1, 2013).

Date: _______________________ (Month/Day/Year)

Relationship to Student:

C.

Parent(s) and/or stepparent has retired; been unemployed for at least two full months or has experienced a change in employment status

which will result in an income reduction ON OR AFTER January 1, 2013.

Father/Stepparent/Parent 1’s Date: ______________

Mother/Stepparent/Parent 2’s Date: ___________

(Month/Day/Year)

(Month/Day/Year)

D.

Sources of untaxed income, as reportable on the Free Application for Federal Student Aid (FAFSA), has ceased or been reduced.

Date: _______________________ (Month/Day/Year)

E.

Other

Date: _______________________ (Month/Day/Year)

COMPLETION REQUIRED: YOU MUST PROVIDE AN EXPLANATION DETAILING ALL REASONS AND DATE(S) YOUR FAMILY’S 2014

F.

INCOME WILL BE REDUCED AND COMPLETE THE REST OF THE FORM. FAILURE TO PROPERLY COMPLETE THIS QUESTION WILL

RESULT IN THE FORM BEING RETURNED TO YOU.

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

_____________________________________________________________________________________________________________

PHEAA conducts its student loan servicing operations commercially as American

Education Services and for federally-owned loans as FedLoan Servicing.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

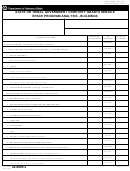

1

1 2

2 3

3 4

4