State Grant And Special Programs Page 3

ADVERTISEMENT

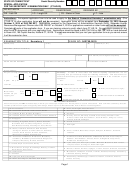

State Grant and Special Programs

Phone: 1-800-692-7392

Fax: 717-720-3786

P.O. Box 8157 Harrisburg, PA 17105-8157

Frequently Asked Questions

BEFORE RETURNING THE REDUCED INCOME FORM PLEASE READ THIS FAQ AND ALL OF THE INSTRUCTIONS ON

THE FORM. IF YOU FAIL TO PROVIDE ALL OF THE INFORMATION THE FORM WILL BE RETURNED. THE AGENCY WILL

ALSO TAKE THE NECESSARY STEPS TO PREVENT ANY FURTHER PROCESSING OF YOUR STATE GRANT

APPLICATION AND COULD RESULT IN DELAYING FUNDS THAT YOU MAY BE ELIGIBLE TO RECEIVE FROM BEING

DISBURSED TO YOUR SCHOOL.

What if I cannot provide a copy of my parent(s)’/stepparent’s taxes at this time?

You should keep the enclosed form and return it once a complete copy of your parent(s)’/stepparent’s 2013 U.S. Income Tax

Return is available. This includes all supporting forms, schedules and 2013 W-2 Forms. If your parent(s)/stepparent have an

interest in a corporation and/or partnership, you also need to submit copies of the most recent U.S. Partnership and/or Corporate

Tax Return(s), including the completed balance sheet(s) and K-1 schedule(s). You must also provide copies of all 1099 Forms

received for all family members who received Social Security during 2013 or if your family had received a pension distribution

(Form 1040, line 16A or Form 1040A, line 12A) or an IRA distribution (Form 1040, line 15A or Form 1040A, line 11A). The Agency

will not process the Special Consideration form until all the tax information is received.

What if my parent(s)/stepparent have filed an extension and will not have their taxes completed until after the term starts? Will the

Agency still be able to extend special consideration for a term that has already started or has been completed?

Yes. As long as the information is received prior to April 1, 2015 the Agency will be able to extend special consideration to your

application for the entire academic year, as long as you meet all the requirements.

What if a parent/stepparent is self-employed and is experiencing a reduction in income?

If the only reason for the reduction is due to self-employed earnings decreasing then unless the business has closed, this is not an

acceptable reason at this time since self-employment earnings can be subject to significant fluctuation throughout the year. If your

parent(s)/stepparent is self-employed and is no longer employed due to economic conditions or a natural disaster, please submit a

copy of their final Partnership and/or Corporate return(s). If they did not file Corporate or Partnership returns, please provide

documentation to verify that their business is no longer in operation. You should complete this form and mail it back to us along

with a completed copy of the 2013 and 2014 U.S. Income Tax returns once available but no later than April 1, 2015. As long as

this information is received prior to April 1, 2015, PHEAA will give further review to your 2014-15 State Grant application.

What if my parent(s)/stepparent will have a decrease in overtime earnings, regular earnings, and/or bonuses?

You must submit a signed statement from your parent’s/stepparent’s employer verifying the following data: (a) the date the

overtime, regular earnings, and/or bonuses ceased or were reduced (b) the total amount of gross overtime, regular earnings,

and/or bonuses received during 2013 and (c) the total gross overtime wages, regular earnings, and/or bonuses to be received

during the 2014 tax year.

What if my parent was not permanently laid off?

When a parent has seasonal employment, is a union laborer, works at a school, is employed on a temporary basis, etc. and they

are only temporarily unemployed your family should not complete the reduced income form until after October 1, 2014 or until your

family is able to provide an estimate that includes all income that may be received from their employer from January 1, 2014 until

December 31, 2014.

What if my parent is disabled after January 1, 2013?

Your parent must be totally and permanently disabled (unable to ever work again in any capacity). If they are only on temporary

disability the Agency will consider them as unemployed and not disabled. You must provide a letter from your parent’s physician

explaining the prognosis as it relates to them ever being employed in any capacity in the future and the date they became disabled.

If the letter does not clearly state that your parent will not be able to be employed again in any capacity the Agency will be unable

to grant recent disability consideration. However, the Agency may be able to process your application based on an approved

reduction in your parent(s)’ 2014 income.

What if the income reduction occurred after October 31, 2014?

You should complete this form and mail it back to us along with completed copies of the 2013 and 2014 U.S. Income Tax returns

once available but no later than April 1, 2015. As long as this information is received prior to April 1, 2015, PHEAA will give further

review to your 2014-15 State Grant application.

I have already supplied my school with this information. Do I need to submit this information to both State Grant and Special

Programs and the school?

Yes. The schools and State Grant and Special Programs have different policies for what is acceptable and both process the

information accordingly.

PHEAA conducts its student loan servicing operations commercially as American

Education Services and for federally-owned loans as FedLoan Servicing.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4