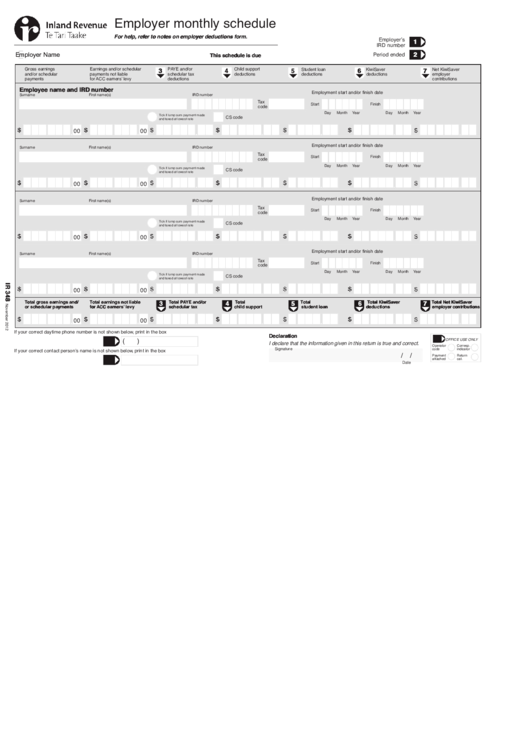

Employer monthly schedule

For help, refer to notes on employer deductions form.

Employer’s

1

IRD number

Period ended

This schedule is due

2

Employer Name

Gross earnings

Earnings and/or schedular

PAYE and/or

Child support

Student loan

KiwiSaver

Net KiwiSaver

3

4

5

6

7

and/or schedular

payments not liable

schedular tax

deductions

deductions

deductions

employer

payments

for ACC earners’ levy

deductions

contributions

Employee name and IRD number

Employment start and/or finish date

Surname

First name(s)

IRD number

Tax

Start

Finish

code

Day

Month

Year

Day

Month

Year

Tick if lump sum payment made

CS code

and taxed at lowest rate

00

00

Employment start and/or finish date

Surname

First name(s)

IRD number

Tax

Start

Finish

code

Day

Month

Year

Day

Month

Year

Tick if lump sum payment made

CS code

and taxed at lowest rate

00

00

Employment start and/or finish date

Surname

First name(s)

IRD number

Tax

Start

Finish

code

Day

Month

Year

Day

Month

Year

Tick if lump sum payment made

CS code

and taxed at lowest rate

00

00

Employment start and/or finish date

Surname

First name(s)

IRD number

Tax

Start

Finish

code

Day

Month

Year

Day

Month

Year

Tick if lump sum payment made

CS code

and taxed at lowest rate

00

00

Total gross earnings and/

Total earnings not liable

Total PAYE and/or

Total

Total

Total KiwiSaver

Total Net KiwiSaver

3

4

5

6

7

or schedular payments

for ACC earners’ levy

schedular tax

child support

student loan

deductions

employer contributions

00

00

If your correct daytime phone number is not shown below, print in the box

Declaration

(

)

OFFICE USE ONLY

I declare that the information given in this return is true and correct.

Operator

Corresp.

Signature

code

indicator

If your correct contact person’s name is not shown below, print in the box

/ /

Payment

Return

attached

cat.

Date

RESET form

1

1