Jedd Income Tax Form

ADVERTISEMENT

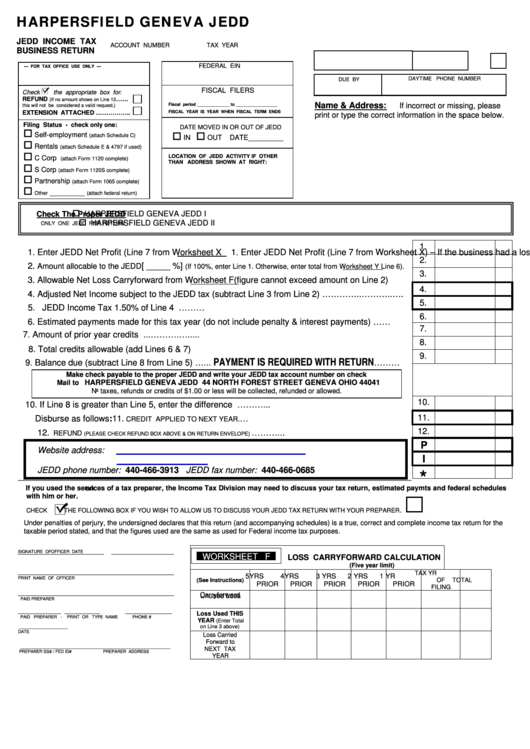

HARPERSFIELD GENEVA JEDD

JEDD INCOME TAX

ACCOUNT NUMBER

TAX YEAR

BUSINESS RETURN

FEDERAL EIN

--- FOR TAX OFFICE USE ONLY ---

DAYTIME PHONE NUMBER

DUE BY

FISCAL FILERS

Check

the appropriate box for

:

REFUND

……

(If no amount shows on Line 12

Name & Address:

Fiscal period ______________ to __________________

If incorrect or missing, please

this will not be considered a valid request.)

FISCAL YEAR IS YEAR WHEN FISCAL TERM ENDS

EXTENSION ATTACHED ……………..

print or type the correct information in the space below.

Filing Status - check only one:

DATE MOVED IN OR OUT OF JEDD

Self-employment

(attach Schedule C)

IN

OUT

DATE_________

Rentals

(attach Schedule E & 4797 if used)

LOCATION OF JEDD ACTIVITY IF OTHER

C Corp

(attach Form 1120 complete)

THAN ADDRESS SHOWN AT RIGHT:

S Corp

(attach Form 1120S complete)

Partnership

(attach Form 1065 complete)

_________

Other

(attach federal return)

HARPERSFIELD GENEVA JEDD I

Check The Proper JEDD

HARPERSFIELD GENEVA JEDD II

ONLY ONE JEDD PER RETURN

1.

1. Enter JEDD Net Profit (Line 7 from Worksheet X

1. Enter JEDD Net Profit (Line 7 from Worksheet X) – If the business had a loss, enter zero….......

2.

2.

[ _____ %]

Amount allocable to the JEDD

(If 100%, enter Line 1. Otherwise, enter total from Worksheet Y Line 6).

3.

3. Allowable Net Loss Carryforward from Worksheet F (figure cannot exceed amount on Line 2)....

4.

4. Adjusted Net Income subject to the JEDD tax (subtract Line 3 from Line 2) …………..………..….

5.

5. JEDD Income Tax 1.50% of Line 4 .................................................................................………....

6.

6. Estimated payments made for this tax year (do not include penalty & interest payments) …….....

7.

7. Amount of prior year credits ......................…….................................................................….….....

8.

8. Total credits allowable (add Lines 6 & 7) ........................................................................................

9.

PAYMENT IS REQUIRED WITH RETURN

9. Balance due (subtract Line 8 from Line 5) …...

………

Make check payable to the proper JEDD and write your JEDD tax account number on check

HARPERSFIELD GENEVA JEDD 44 NORTH FOREST STREET GENEVA OHIO 44041

Mail to

No taxes, refunds or credits of $1.00 or less will be collected, refunded or allowed.

10.

10. If Line 8 is greater than Line 5, enter the difference here.................................................………...

11.

Disburse as follows: 11.

................…....................................

CREDIT APPLIED TO NEXT YEAR.

12.

12.

…….......…...

REFUND

(PLEASE CHECK REFUND BOX ABOVE & ON RETURN ENVELOPE)

P

Website address:

I

JEDD phone number: 440-466-3913 JEDD fax number: 440-466-0685

*

_____________________________________________________________________________________________________

If you used the services of a tax preparer, the Income Tax Division may need to discuss your tax return, estimated paym

en

ts and federal schedules

with him or her.

.

CHECK

THE FOLLOWING BOX IF YOU WISH TO ALLOW US TO DISCUSS YOUR JEDD TAX RETURN WITH YOUR PREPARER

Under penalties of perjury, the undersigned declares that this return (and accompanying schedules) is a true, correct and complete income tax return for the

taxable period stated, and that the figures used are the same as used for Federal income tax purposes.

______________________

________________

WORKSHEET F

LOSS CARRYFORWARD CALCULATION

SIGNATURE OFOFFICER

DATE

(Five year limit)

________________________________________

TAX YR

5YRS

4YRS

3 YRS

2 YRS

1 YR

PRINT NAME OF OFFICER

OF

TOTAL

(See Instructions)

PRIOR

PRIOR

PRIOR

PRIOR

PRIOR

FILING

________________________________________

Unused Loss

PAID PREPARER

Carryforward

___________ _________

____________

Loss Used THIS

PAID PREPARER -

PRINT OR TYPE NAME

PHONE #

YEAR

(Enter Total

on Line 3 above)

_____________________

DATE

Loss Carried

Forward to

_________________________________________________________________

NEXT TAX

PREPARER SS# / FED ID#

PREPARER ADDRESS

YEAR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3