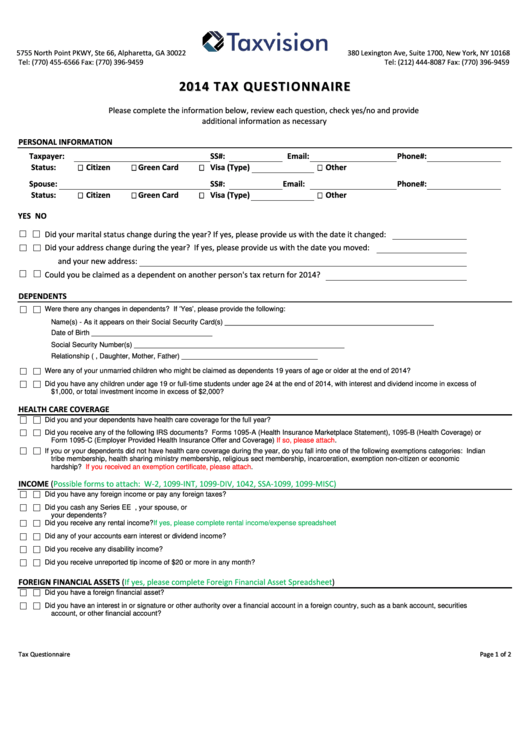

5755 North Point PKWY, Ste 66, Alpharetta, GA 30022

380 Lexington Ave, Suite 1700, New York, NY 10168

Tel: (770) 455-6566 Fax: (770) 396-9459

Tel: (212) 444-8087 Fax: (770) 396-9459

2

0

1

4

T

A

X

Q

U

E

S

T

I

O

N

N

A

I

R

E

2

0

1

4

T

A

X

Q

U

E

S

T

I

O

N

N

A

I

R

E

Please complete the information below, review each question, check yes/no and provide

additional information as necessary

PERSONAL INFORMATION

Taxpayer:

SS#:

Email:

Phone#:

U.S. Status:

Citizen

Green Card

Visa (Type)

Other

Spouse:

SS#:

Email:

Phone#:

U.S. Status:

Citizen

Green Card

Visa (Type)

Other

YES NO

Did your marital status change during the year? If yes, please provide us with the date it changed:

Did your address change during the year? If yes, please provide us with the date you moved:

and your new address:

Could you be claimed as a dependent on another person's tax return for 2014?

DEPENDENTS

Were there any changes in dependents? If ‘Yes’, please provide the following:

Name(s) - As it appears on their Social Security Card(s) ______________________________________________________

Date of Birth _______________________________

Social Security Number(s) ______________________________________________________

Relationship (i.e. Son, Daughter, Mother, Father) ___________________________________

Were any of your unmarried children who might be claimed as dependents 19 years of age or older at the end of 2014?

Did you have any children under age 19 or full-time students under age 24 at the end of 2014, with interest and dividend income in excess of

$1,000, or total investment income in excess of $2,000?

HEALTH CARE COVERAGE

Did you and your dependents have health care coverage for the full year?

Did you receive any of the following IRS documents? Forms 1095-A (Health Insurance Marketplace Statement), 1095-B (Health Coverage) or

Form 1095-C (Employer Provided Health Insurance Offer and Coverage)

If so, please

attach.

If you or your dependents did not have health care coverage during the year, do you fall into one of the following exemptions categories: Indian

tribe membership, health sharing ministry membership, religious sect membership, incarceration, exemption non-citizen or economic

hardship?

If you received an exemption certificate, please

attach.

INCOME

(Possible forms to attach: W-2, 1099-INT, 1099-DIV, 1042, SSA-1099, 1099-MISC)

Did you have any foreign income or pay any foreign taxes?

Did you cash any Series EE U.S. savings bonds issued after 1989 and pay qualified higher education expenses for yourself, your spouse, or

your dependents?

Did you receive any rental income?

If yes, please complete rental income/expense spreadsheet

Did any of your accounts earn interest or dividend income?

Did you receive any disability income?

Did you receive unreported tip income of $20 or more in any month?

FOREIGN FINANCIAL ASSETS

(If yes, please complete Foreign Financial Asset

Spreadsheet)

Did you have a foreign financial asset?

Did you have an interest in or signature or other authority over a financial account in a foreign country, such as a bank account, securities

account, or other financial account?

T

T

a

a

x

x

Q

Q

u

u

e

e

s

s

t

t

i

i

o

o

n

n

n

n

a

a

i

i

r

r

e

e

P

P

a

a

g

g

e

e

1

1

o

o

f

f

2

2

1

1 2

2