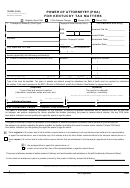

Power Of Attorney - Authorization For Certain Gift Transactions Page 2

ADVERTISEMENT

Power of Attorney, NY Statutory Gifts Rider

Effective 09/12/2010

(b) MODIFICATIONS:

Use this section if you wish to authorize gifts in amounts smaller than the gift tax exclusion amount, in

amounts in excess of the gift tax exclusion amount, gifts to other beneficiaries, or other gift

transactions.

Granting such authority to your agent gives your agent the authority to take actions which could

significantly reduce your property and/or change how your property is distributed at your death. If you

wish to authorize your agent to make gifts to himself or herself, you must separately grant that authority

in subdivision (c) below.

(

) I grant the following authority to my agent to make gifts pursuant to my

instructions, or otherwise for purposes which the agent reasonably deems to be in my

best interest:

(c) GRANT OF SPECIFIC AUTHORITY FOR AN AGENT TO MAKE GIFTS TO HIMSELF OR

HERSELF: (OPTIONAL)

If you wish to authorize your agent to make gifts or to himself or herself, you must grant that authority in

this section, indicating to which agent(s) the authorization is granted, and any limitations and

guidelines.

(

) I grant specific authority for the following agent(s) to make the following gifts to himself

or herself: ______________________________________

This authority must be exercised pursuant to my instructions, or otherwise for purposes which the agent

reasonably deems to be in my best interest.

(d) ACCEPTANCE BY THIRD PARTIES:

I agree to indemnify the third party for any claims that may arise against the third party because of

reliance on this Statutory Gifts Rider.

Page 2 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4