Form Nj-1040-Es - Estimated Tax Worksheet For Individuals - 2016

ADVERTISEMENT

-ES

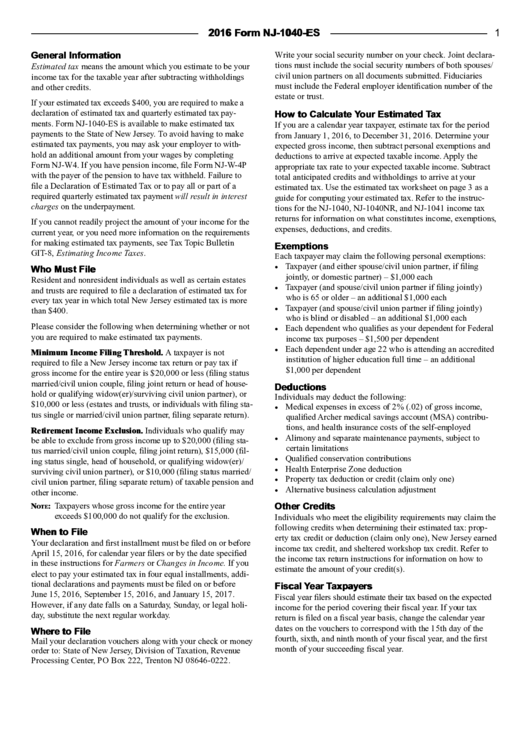

2016 Form NJ-1040-ES

1

General Information

Write your social security number on your check. Joint declara-

tions must include the social security numbers of both spouses/

Estimated tax means the amount which you estimate to be your

civil union partners on all documents submitted. Fiduciaries

income tax for the taxable year after subtracting withholdings

must include the Federal employer identification number of the

and other credits.

estate or trust.

If your estimated tax exceeds $400, you are required to make a

declaration of estimated tax and quarterly estimated tax pay-

How to Calculate Your Estimated Tax

ments. Form NJ-1040-ES is available to make estimated tax

If you are a calendar year taxpayer, estimate tax for the period

payments to the State of New Jersey. To avoid having to make

from January 1, 2016, to December 31, 2016. Determine your

estimated tax payments, you may ask your employer to with-

expected gross income, then subtract personal exemptions and

hold an additional amount from your wages by completing

deductions to arrive at expected taxable income. Apply the

Form NJ-W4. If you have pension income, file Form NJ-W-4P

appropri ate tax rate to your expected taxable income. Subtract

with the payer of the pension to have tax withheld. Failure to

total anticipated credits and withholdings to arrive at your

file a Declaration of Estimated Tax or to pay all or part of a

estimated tax. Use the estimated tax worksheet on page 3 as a

required quarterly estimated tax payment will result in interest

guide for comput ing your estimated tax. Refer to the instruc-

charges on the underpayment.

tions for the NJ-1040, NJ-1040NR, and NJ-1041 income tax

returns for information on what constitutes income, exemptions,

If you cannot readily project the amount of your income for the

expenses, deductions, and credits.

current year, or you need more information on the requirements

for making estimated tax payments, see Tax Topic Bulletin

Exemptions

GIT-8, Estimating Income Taxes.

ach taxpayer may claim the following personal exemptions:

E

Taxpayer (and either spouse/civil union partner, if filing

•

Who Must File

jointly, or domestic partner) – $1,000 each

Resident and nonresident individuals as well as certain estates

Taxpayer (and spouse/civil union partner if filing jointly)

•

and trusts are required to file a declaration of estimated tax for

who is 65 or older – an additional $1,000 each

every tax year in which total New Jersey estimated tax is more

Taxpayer (and spouse/civil union partner if filing jointly)

•

than $400.

who is blind or disabled – an additional $1,000 each

Please consider the following when determining whether or not

Each dependent who qualifies as your dependent for Federal

•

you are required to make estimated tax payments.

income tax purposes – $1,500 per dependent

Each dependent under age 22 who is attending an accredited

•

Minimum Income Filing Threshold. A taxpayer is not

institution of higher education full time – an additional

required to file a New Jersey income tax return or pay tax if

$1,000 per dependent

gross income for the entire year is $20,000 or less (filing status

married/civil union couple, filing joint return or head of house-

Deductions

hold or qualifying widow(er)/surviving civil union partner), or

Individuals may deduct the following:

$10,000 or less (estates and trusts, or individ uals with filing sta-

Medical expenses in excess of 2% (.02) of gross income,

•

tus single or married/civil union partner, filing separate return).

qualified Archer medical savings account (MSA) contribu-

tions, and health insurance costs of the self-employed

Retirement Income Exclusion. Individuals who qualify may

Alimony and separate maintenance payments, subject to

•

be able to exclude from gross income up to $20,000 (filing sta-

certain limitations

tus married/civil union couple, filing joint return), $15,000 (fil-

Qualified conservation contributions

•

ing status single, head of household, or qualifying widow(er)/

Health Enterprise Zone deduction

•

surviving civil union partner), or $10,000 (filing status married/

Property tax deduction or credit (claim only one)

•

civil union partner, filing separate return) of taxable pension and

Alternative business calculation adjustment

•

other income.

Taxpayers whose gross income for the entire year

Other Credits

N

:

ote

exceeds $100,000 do not qualify for the exclusion.

Individuals who meet the eligibility requirements may claim the

following credits when determining their estimated tax: prop-

When to File

erty tax credit or deduction (claim only one), New Jersey earned

Your declaration and first installment must be filed on or before

income tax credit, and sheltered workshop tax credit. Refer to

April 15, 2016, for calendar year filers or by the date specified

the income tax return instructions for information on how to

in these instructions for Farmers or Changes in Income. If you

estimate the amount of your credit(s).

elect to pay your estimated tax in four equal installments, addi-

tional declarations and payments must be filed on or before

Fiscal Year Taxpayers

June 15, 2016, September 15, 2016, and January 15, 2017.

Fiscal year filers should estimate their tax based on the expected

How ever, if any date falls on a Saturday, Sunday, or legal holi-

income for the period covering their fiscal year. If your tax

day, substitute the next regular workday.

return is filed on a fiscal year basis, change the calendar year

dates on the vouchers to correspond with the 15th day of the

Where to File

fourth, sixth, and ninth month of your fiscal year, and the first

Mail your declaration vouchers along with your check or money

month of your succeeding fiscal year.

order to: State of New Jersey, Division of Taxation, Revenue

Processing Center, PO Box 222, Trenton NJ 08646-0222.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4