Instructions For Completing International Fuel Tax Agreement (Ifta) Quarterly Tax Return - 2013

ADVERTISEMENT

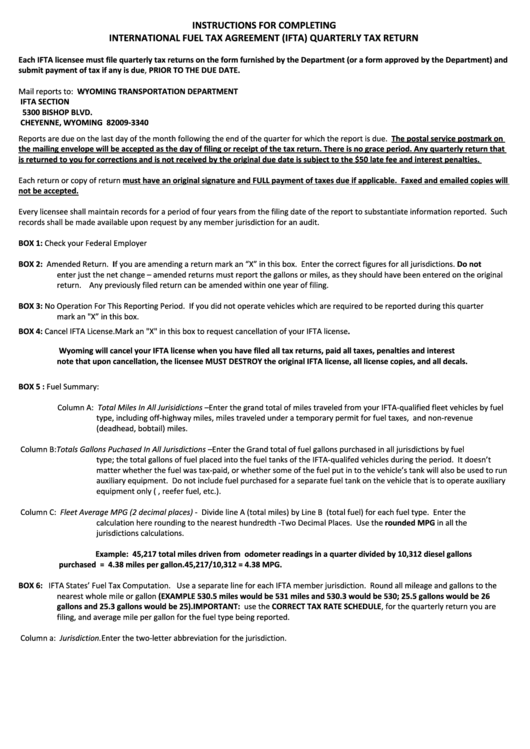

INSTRUCTIONS FOR COMPLETING

INTERNATIONAL FUEL TAX AGREEMENT (IFTA) QUARTERLY TAX RETURN

Each IFTA licensee must file quarterly tax returns on the form furnished by the Department (or a form approved by the Department) and

submit payment of tax if any is due, PRIOR TO THE DUE DATE.

Mail reports to:

WYOMING TRANSPORTATION DEPARTMENT

IFTA SECTION

5300 BISHOP BLVD.

CHEYENNE, WYOMING 82009-3340

Reports are due on the last day of the month following the end of the quarter for which the report is due. The postal service postmark on

the mailing envelope will be accepted as the day of filing or receipt of the tax return. There is no grace period. Any quarterly return that

is returned to you for corrections and is not received by the original due date is subject to the $50 late fee and interest penalties.

Each return or copy of return must have an original signature and FULL payment of taxes due if applicable. Faxed and emailed copies will

not be accepted.

Every licensee shall maintain records for a period of four years from the filing date of the report to substantiate information reported. Such

records shall be made available upon request by any member jurisdiction for an audit.

BOX 1:

Check your Federal Employer I.D. Number and the name and address of the company for accuracy.

BOX 2:

Amended Return. If you are amending a return mark an “X” in this box. Enter the correct figures for all jurisdictions. Do not

enter just the net change – amended returns must report the gallons or miles, as they should have been entered on the original

return. Any previously filed return can be amended within one year of filing.

BOX 3:

No Operation For This Reporting Period. If you did not operate vehicles which are required to be reported during this quarter

mark an "X” in this box.

BOX 4:

Cancel IFTA License. Mark an "X" in this box to request cancellation of your IFTA license.

Wyoming will cancel your IFTA license when you have filed all tax returns, paid all taxes, penalties and interest due. Please

note that upon cancellation, the licensee MUST DESTROY the original IFTA license, all license copies, and all decals.

BOX 5 :

Fuel Summary:

Column A: Total Miles In All Jurisidictions – Enter the grand total of miles traveled from your IFTA-qualified fleet vehicles by fuel

type, including off-highway miles, miles traveled under a temporary permit for fuel taxes, and non-revenue

(deadhead, bobtail) miles.

Column B: Totals Gallons Puchased In All Jurisdictions – Enter the Grand total of fuel gallons purchased in all jurisdictions by fuel

type; the total gallons of fuel placed into the fuel tanks of the IFTA-qualifed vehicles during the period. It doesn’t

matter whether the fuel was tax-paid, or whether some of the fuel put in to the vehicle’s tank will also be used to run

auxiliary equipment. Do not include fuel purchased for a separate fuel tank on the vehicle that is to operate auxiliary

equipment only (i.e., reefer fuel, etc.).

Column C: Fleet Average MPG (2 decimal places) - Divide line A (total miles) by Line B (total fuel) for each fuel type. Enter the

calculation here rounding to the nearest hundredth - Two Decimal Places. Use the rounded MPG in all the

jurisdictions calculations.

Example: 45,217 total miles driven from odometer readings in a quarter divided by 10,312 diesel gallons

purchased = 4.38 miles per gallon. 45,217/10,312 = 4.38 MPG.

BOX 6:

IFTA States’ Fuel Tax Computation. Use a separate line for each IFTA member jurisdiction. Round all mileage and gallons to the

nearest whole mile or gallon (EXAMPLE 530.5 miles would be 531 miles and 530.3 would be 530; 25.5 gallons would be 26

gallons and 25.3 gallons would be 25). IMPORTANT: use the CORRECT TAX RATE SCHEDULE, for the quarterly return you are

filing, and average mile per gallon for the fuel type being reported.

Column a:

Jurisdiction. Enter the two-letter abbreviation for the jurisdiction.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3