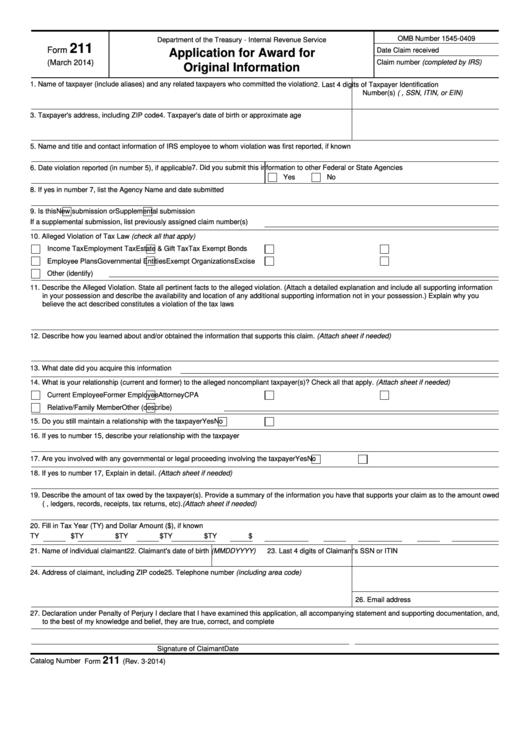

OMB Number 1545-0409

Department of the Treasury - Internal Revenue Service

211

Form

Date Claim received

Application for Award for

(March 2014)

Claim number (completed by IRS)

Original Information

1. Name of taxpayer (include aliases) and any related taxpayers who committed the violation

2. Last 4 digits of Taxpayer Identification

Number(s) (e.g., SSN, ITIN, or EIN)

3. Taxpayer's address, including ZIP code

4. Taxpayer's date of birth or approximate age

5. Name and title and contact information of IRS employee to whom violation was first reported, if known

6. Date violation reported (in number 5), if applicable

7. Did you submit this information to other Federal or State Agencies

Yes

No

8. If yes in number 7, list the Agency Name and date submitted

9. Is this

New submission or

Supplemental submission

If a supplemental submission, list previously assigned claim number(s)

10. Alleged Violation of Tax Law (check all that apply)

Income Tax

Employment Tax

Estate & Gift Tax

Tax Exempt Bonds

Employee Plans

Governmental Entities

Exempt Organizations

Excise

Other (identify)

11. Describe the Alleged Violation. State all pertinent facts to the alleged violation. (Attach a detailed explanation and include all supporting information

in your possession and describe the availability and location of any additional supporting information not in your possession.) Explain why you

believe the act described constitutes a violation of the tax laws

12. Describe how you learned about and/or obtained the information that supports this claim. (Attach sheet if needed)

13. What date did you acquire this information

14. What is your relationship (current and former) to the alleged noncompliant taxpayer(s)? Check all that apply. (Attach sheet if needed)

Current Employee

Former Employee

Attorney

CPA

Relative/Family Member

Other (describe)

15. Do you still maintain a relationship with the taxpayer

Yes

No

16. If yes to number 15, describe your relationship with the taxpayer

17. Are you involved with any governmental or legal proceeding involving the taxpayer

Yes

No

18. If yes to number 17, Explain in detail. (Attach sheet if needed)

19. Describe the amount of tax owed by the taxpayer(s). Provide a summary of the information you have that supports your claim as to the amount owed

(i.e. books, ledgers, records, receipts, tax returns, etc). (Attach sheet if needed)

20. Fill in Tax Year (TY) and Dollar Amount ($), if known

TY

$

TY

$

TY

$

TY

$

TY

$

21. Name of individual claimant

22. Claimant's date of birth (MMDDYYYY)

23. Last 4 digits of Claimant's SSN or ITIN

24. Address of claimant, including ZIP code

25. Telephone number (including area code)

26. Email address

27. Declaration under Penalty of Perjury I declare that I have examined this application, all accompanying statement and supporting documentation, and,

to the best of my knowledge and belief, they are true, correct, and complete

Signature of Claimant

Date

211

Catalog Number 16571S

Form

(Rev. 3-2014)

1

1 2

2