EFO00104p2

11-28-12

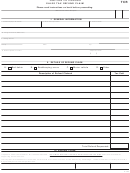

Idaho State Tax Commission

POWER OF ATTORNEY

GENERAL INFORMATION

PURPOSE OF FORM

A Power of Attorney (POA) is a legal document authorizing someone to act as your representative. You, the taxpayer,

must complete, sign, and return this form if you wish to grant power of attorney to an accountant, tax return preparer,

attorney, family member or anyone else to act on your behalf with the Idaho Tax Commission. This form can be used for

any matter affecting a tax administered by the Tax Commission, including audit and collection matters. It doesn’t apply to

matters before other state or federal agencies, including the IRS. This form is effective on the date signed and will remain

in effect until the expiration date, if specifically designated, or until you revoke it, whichever is earlier.

SUBMITTING A POA

You can appoint, change, or add representative(s) at any time by submitting a POA. If you previously filed a POA with the

Tax Commission, submitting another POA with the same tax matters and tax periods will automatically replace and revoke

all previous POAs on file. If you want to add a representative, but not replace or revoke the previous POA(s), check the

box in Section 5 and attach a copy of all POAs that are to remain in effect.

REVOKING OR WITHDRAWING A POA

You may revoke a POA or the representative may withdraw at any time by submitting a copy of the previously executed

POA with “REVOKE” written across the top of the form with your signature and date. You can also submit a written

statement specifying your intention to revoke a POA or withdraw as the representative. You must sign and date the

statement and include the name, address, and SSN/EIN of the taxpayer and the name and address of the representatives

whose authority is being revoked or withdrawn.

EXPIRATION

A Tax Commission POA is valid:

•

For any prior tax period or tax year designated by the taxpayer and can be used to designate representation for

tax periods or tax years that end up to three years from the end of the current calendar year.

•

Until it expires on a date designated on the POA. (See Section 5)

•

Until revoked by the taxpayer or withdrawn by the representative

•

Until the taxpayer becomes incapacitated and unable to make his own decisions

•

Until the taxpayer’s death

WHO MUST SIGN

•

Individuals: The parties identified in Section 1 must sign.

•

Corporation or Association: An officer having authority to bind the corporation or association must sign.

•

Partnership or LLC: A partner or member who is authorized to act in the name of the partnership or LLC must

sign.

•

Estate, Trust, or Fiduciary: The personal representative must sign.

FILING THIS FORM

If you are working with a specific section and/or employee of the Tax Commission, mail or fax the completed POA to that

section and/or employee.

Otherwise, mail or fax the completed form to:

Idaho Tax Commission

Accounts Registration Department

PO Box 36

Boise ID 83722-0410

Fax: (208) 334-5364

TAXPAYER SERVICES: General tax information

Local ………………………..…. (208) 334-7660

Toll free…………………….....

(800) 972-7660

Hearing impaired……………... (800) 377-3529

Web site………………………… tax.idaho.gov

1

1 2

2