8

which the debtor owned 5 percent or more of the voting or equity securities within six years immediately preceding

the commencement of this case.

If the debtor is a partnership, list the names, addresses, taxpayer-identification numbers, nature of the businesses,

and beginning and ending dates of all businesses in which the debtor was a partner or owned 5 percent or more of

the voting or equity securities, within six years immediately preceding the commencement of this case.

If the debtor is a corporation, list the names, addresses, taxpayer-identification numbers, nature of the businesses,

and beginning and ending dates of all businesses in which the debtor was a partner or owned 5 percent or more of

the voting or equity securities within six years immediately preceding the commencement of this case.

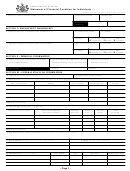

LAST FOUR DIGITS

OF SOCIAL-SECURITY

BEGINNING AND

NAME

OR OTHER INDIVIDUAL

ADDRESS

NATURE OF BUSINESS

ENDING DATES

TAXPAYER-I.D. NO.

(ITIN)/ COMPLETE EIN

______________________________________________________________________________________________________

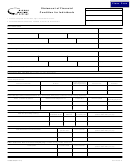

b. Identify any business listed in response to subdivision a., above, that is "single asset real estate" as

None

defined in 11 U.S.C. § 101.

NAME

ADDRESS

______________________________________________________________________________________________________

The following questions are to be completed by every debtor that is a corporation or partnership and by any individual

debtor who is or has been, within six years immediately preceding the commencement of this case, any of the following: an

officer, director, managing executive, or owner of more than 5 percent of the voting or equity securities of a corporation; a

partner, other than a limited partner, of a partnership, a sole proprietor, or self-employed in a trade, profession, or other activity,

either full- or part-time.

(An individual or joint debtor should complete this portion of the statement only if the debtor is or has been in

business, as defined above, within six years immediately preceding the commencement of this case. A debtor who has not been

in business within those six years should go directly to the signature page.)

_____________________________________________________________________________________________________

19. Books, records and financial statements

a. List all bookkeepers and accountants who within two years immediately preceding the filing of this

None

bankruptcy case kept or supervised the keeping of books of account and records of the debtor.

NAME AND ADDRESS

DATES SERVICES RENDERED

________________________________________________________________________________________________

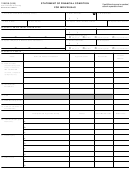

b. List all firms or individuals who within two years immediately preceding the filing of this bankruptcy

None

case have audited the books of account and records, or prepared a financial statement of the debtor.

NAME

ADDRESS

DATES SERVICES RENDERED

_____________________________________________________________________________________________________

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11