Last Will And Testament

ADVERTISEMENT

THE

L A S T W I L L A ND TE S TAM E NT

OF

Mary G. Smith

DECLARATION

I, Mary G. Smith, a resident of the state of Florida and county of Brevard County; and being of

sound mind and memory, do hereby make, publish and declare this to be my last will and testament,

thereby revoking and making null and void any and all other last will and testaments and/or codicils to last

will and testaments heretofore made by me. All references herein to “this Will” refer only to this last will

and testament.

FAMILY

At the time of executing this Will, I am married to Richard L. Smith. The names of my children are

listed below. Unless otherwise specifically indicated in this Will, any provision for my children includes the

below-named children, as well as any child of mine hereafter born or adopted.

Stephen A. Smith

Megan A. Smith

Christen L. Smith

DEBT

I direct that as soon as is practical after my death, the executor named pursuant to this Will review all

of my just debts and obligations, including last illness and funeral expenses, except for those secured long-

term debts that may be assumed by the beneficiary of such property, unless such assumption is prohibited by

law or on agreement by the beneficiary. The executor is further directed to pay any attorneys’ fees and any

other estate administrative expenses. The executor shall pay these just debts only after a creditor provides

timely and sufficient evidence to support its claim and in accordance with applicable state law.

I direct that any estate, inheritance, and succession taxes, including any interest and penalties

thereon, imposed by the federal government or any state, district, or territory, attributable to assets includible

in my estate, passing either under or outside of my Will, be apportioned among the persons interested in my

estate in accordance with applicable state and federal law. My executor is authorized and directed to seek

reimbursement from the beneficiaries of my estate of any taxes paid by my executor to the extent allowed by

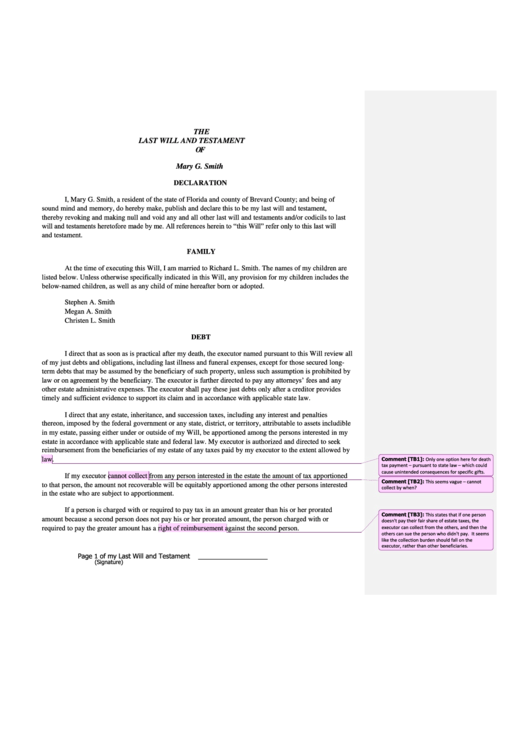

Comment [TB1]: Only one option here for death

law.

tax payment – pursuant to state law – which could

cause unintended consequences for specific gifts.

If my executor cannot collect from any person interested in the estate the amount of tax apportioned

Comment [TB2]: This seems vague – cannot

to that person, the amount not recoverable will be equitably apportioned among the other persons interested

collect by when?

in the estate who are subject to apportionment.

If a person is charged with or required to pay tax in an amount greater than his or her prorated

Comment [TB3]: This states that if one person

amount because a second person does not pay his or her prorated amount, the person charged with or

doesn't pay their fair share of estate taxes, the

executor can collect from the others, and then the

required to pay the greater amount has a right of reimbursement against the second person.

others can sue the person who didn't pay. It seems

like the collection burden should fall on the

executor, rather than other beneficiaries.

Page 1 of my Last Will and Testament

___________________

(Signature)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11