Power Of Attorney And

Download a blank fillable Power Of Attorney And in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Power Of Attorney And with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

REV-677 LE (08-12)

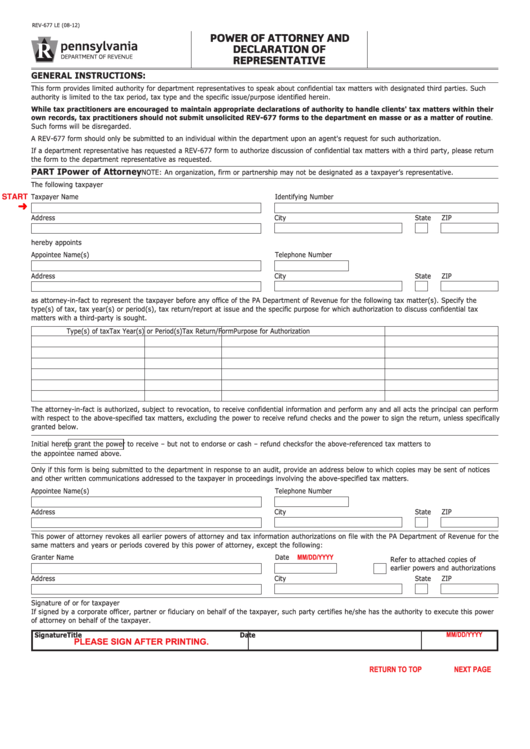

POWER OF ATTORNEY AND

DECLARATION OF

REPRESENTATIVE

GENERAL INSTRUCTIONS:

This form provides limited authority for department representatives to speak about confidential tax matters with designated third parties. Such

authority is limited to the tax period, tax type and the specific issue/purpose identified herein.

While tax practitioners are encouraged to maintain appropriate declarations of authority to handle clients' tax matters within their

own records, tax practitioners should not submit unsolicited REV-677 forms to the department en masse or as a matter of routine.

Such forms will be disregarded.

A REV-677 form should only be submitted to an individual within the department upon an agent's request for such authorization.

If a department representative has requested a REV-677 form to authorize discussion of confidential tax matters with a third party, please return

the form to the department representative as requested.

PART I

Power of Attorney

NOTE: An organization, firm or partnership may not be designated as a taxpayer’s representative.

The following taxpayer

START

Taxpayer Name

Identifying Number

Address

City

State

ZIP

hereby appoints

Appointee Name(s)

Telephone Number

Address

City

State

ZIP

as attorney-in-fact to represent the taxpayer before any office of the PA Department of Revenue for the following tax matter(s). Specify the

type(s) of tax, tax year(s) or period(s), tax return/report at issue and the specific purpose for which authorization to discuss confidential tax

matters with a third-party is sought.

Type(s) of tax

Tax Year(s) or Period(s)

Tax Return/Form

Purpose for Authorization

The attorney-in-fact is authorized, subject to revocation, to receive confidential information and perform any and all acts the principal can perform

with respect to the above-specified tax matters, excluding the power to receive refund checks and the power to sign the return, unless specifically

granted below.

Initial here

to grant the power to receive – but not to endorse or cash – refund checks for the above-referenced tax matters to

the appointee named above.

Only if this form is being submitted to the department in response to an audit, provide an address below to which copies may be sent of notices

and other written communications addressed to the taxpayer in proceedings involving the above-specified tax matters.

Appointee Name(s)

Telephone Number

Address

City

State

ZIP

This power of attorney revokes all earlier powers of attorney and tax information authorizations on file with the PA Department of Revenue for the

same matters and years or periods covered by this power of attorney, except the following:

MM/DD/YYYY

Granter Name

Date

Refer to attached copies of

earlier powers and authorizations

Address

City

State

ZIP

Signature of or for taxpayer

If signed by a corporate officer, partner or fiduciary on behalf of the taxpayer, such party certifies he/she has the authority to execute this power

of attorney on behalf of the taxpayer.

MM/DD/YYYY

Signature

Title

Date

PLEASE SIGN AFTER PRINTING.

PRINT FORM

Reset Entire Form

RETURN TO TOP

NEXT PAGE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2