Flexible Farm Lease Agreements

ADVERTISEMENT

Ag Decision Maker

Flexible Farm

Lease Agreements

File C2-21

F

luctuating markets and uncertain yields make

are shared between tenant and owner, in the same

it difficult to arrive at a fair cash rental rate in

proportion as the gross revenue. In this respect, it is

advance of each crop year. To address this

similar to a crop share lease.

problem, some owners and tenants use flexible lease

Most of the flexible leases in Iowa specify that the rent

agreements in which the rent is not determined until

will be equal to anywhere from 25 to 40 percent of the

after the crop is harvested. The final rental rate is based

gross crop value or gross crop revenue. Table 1 below

on actual prices and/or yields attained each year. A

shows average cash rents in Iowa as a percent of the

recent survey showed that flexible leases accounted for

gross crop value and revenue for the past 10 years.

nearly 12 percent of all cash leases in Iowa.

Gross crop value is the state average yield times the

Flexible leases have the following advantages:

state average price from October through December.

Gross crop revenue includes gross crop value plus all

• The actual rent paid adjusts automatically as

USDA commodity program payments and crop insur-

yields or prices fluctuate.

ance indemnity payments. In recent years, only direct

• Risks are shared between the owner and the

payments of about $20 to $25 per acre have been

tenant, as are profit opportunities.

included in the calculation of USDA payments.

• Owners are paid in cash – they do not have

to be involved in decisions about crop inputs

Example 1

Corn

–

or grain marketing.

• Cash rent will be equal to 25 percent of the gross

Option A: Share of Gross Revenue

crop revenue.

The most common type of flexible lease calls for the

• The actual yield of corn is 160 bushels per acre,

owner to receive cash rent equal to a specified share of

and the actual price is $4 per bushel.

the gross revenue of the crop. The value of the crop is

• The gross income is equal to (160 x $4) = $640.

• The cash rent is equal to (25% x $640), or $160

determined by multiplying the actual harvested yield

per acre.

by the market price available, usually at harvest time.

Under this type of lease both price and yield risks

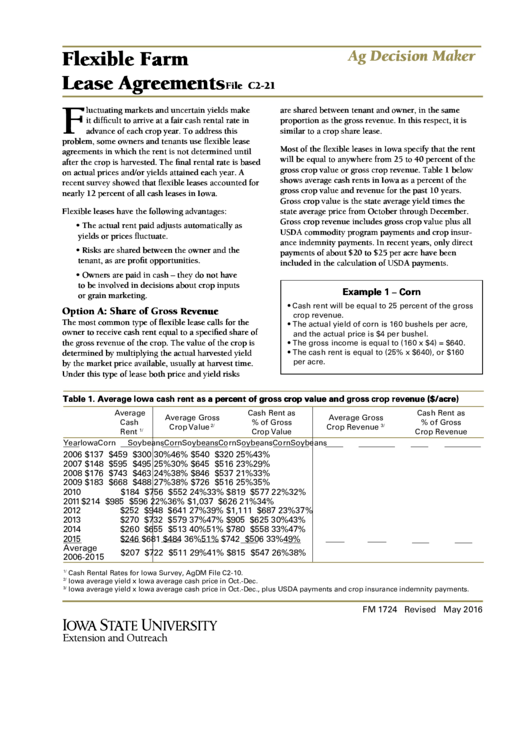

Table 1. Average Iowa cash rent as a percent of gross crop value and gross crop revenue ($/acre)

Average

Cash Rent as

Cash Rent as

Average Gross

Average Gross

Cash

% of Gross

% of Gross

Crop Value

Crop Revenue

2/

3/

Rent

Crop Value

Crop Revenue

1/

Year

Iowa

Corn

Soybeans

Corn

Soybeans

Corn

Soybeans

Corn

Soybeans

2006

$137

$459

$300

30%

46%

$540

$320

25%

43%

2007

$148

$595

$495

25%

30%

$645

$516

23%

29%

2008

$176

$743

$463

24%

38%

$846

$537

21%

33%

2009

$183

$668

$488

27%

38%

$726

$516

25%

35%

2010

$184

$756

$552

24%

33%

$819

$577

22%

32%

2011

$214

$985

$596

22%

36%

$1,037

$626

21%

34%

2012

$252

$948

$641

27%

39%

$1,111

$687

23%

37%

2013

$270

$732

$579

37%

47%

$905

$625

30%

43%

2014

$260

$655

$513

40%

51%

$780

$558

33%

47%

2015

$246

$681

$484

36%

51%

$742

$506

33%

49%

Average

$207

$722

$511

29%

41%

$815

$547

26%

38%

2006-2015

Cash Rental Rates for Iowa Survey, AgDM File C2-10.

1/

Iowa average yield x Iowa average cash price in Oct.-Dec.

2/

Iowa average yield x Iowa average cash price in Oct.-Dec., plus USDA payments and crop insurance indemnity payments.

3/

FM 1724 Revised May 2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4