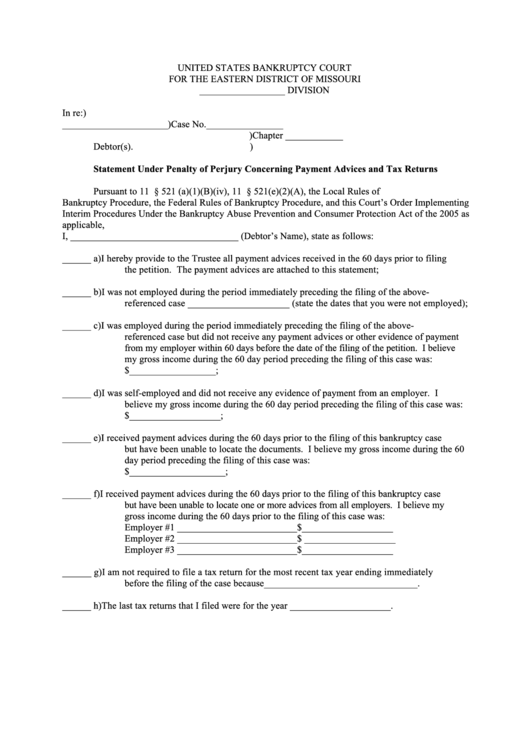

Statement Under Penalty Of Perjury Concerning Payment Advices And Tax Returns Form

ADVERTISEMENT

UNITED STATES BANKRUPTCY COURT

FOR THE EASTERN DISTRICT OF MISSOURI

__________________ DIVISION

In re:

)

______________________

)

Case No.________________

)

Chapter ____________

Debtor(s).

)

Statement Under Penalty of Perjury Concerning Payment Advices and Tax Returns

Pursuant to 11 U.S.C. § 521 (a)(1)(B)(iv), 11 U.S.C. § 521(e)(2)(A), the Local Rules of

Bankruptcy Procedure, the Federal Rules of Bankruptcy Procedure, and this Court’s Order Implementing

Interim Procedures Under the Bankruptcy Abuse Prevention and Consumer Protection Act of the 2005 as

applicable,

I, ___________________________________ (Debtor’s Name), state as follows:

______ a)

I hereby provide to the Trustee all payment advices received in the 60 days prior to filing

the petition. The payment advices are attached to this statement;

______ b)

I was not employed during the period immediately preceding the filing of the above-

referenced case _____________________ (state the dates that you were not employed);

______ c)

I was employed during the period immediately preceding the filing of the above-

referenced case but did not receive any payment advices or other evidence of payment

from my employer within 60 days before the date of the filing of the petition. I believe

my gross income during the 60 day period preceding the filing of this case was:

$__________________;

______ d)

I was self-employed and did not receive any evidence of payment from an employer. I

believe my gross income during the 60 day period preceding the filing of this case was:

$___________________;

______ e)

I received payment advices during the 60 days prior to the filing of this bankruptcy case

but have been unable to locate the documents. I believe my gross income during the 60

day period preceding the filing of this case was:

$____________________;

______ f)

I received payment advices during the 60 days prior to the filing of this bankruptcy case

but have been unable to locate one or more advices from all employers. I believe my

gross income during the 60 days prior to the filing of this case was:

Employer #1 _________________________

$___________________

Employer #2 _________________________

$ ___________________

Employer #3 _________________________

$___________________

______ g)

I am not required to file a tax return for the most recent tax year ending immediately

before the filing of the case because________________________________.

______ h)

The last tax returns that I filed were for the year _____________________.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2