Tso Cai Txhaj Tshuaj Tiv Thaiv Kab Mob Tetanus-Diphtheria-Acellular Pertussis

ADVERTISEMENT

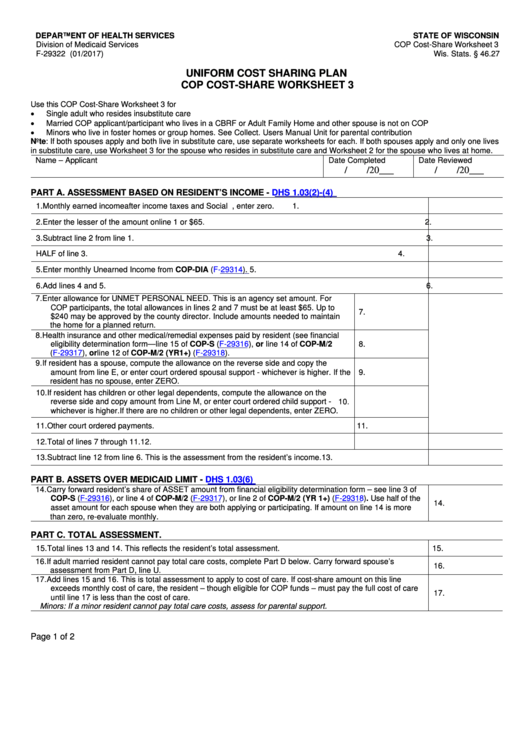

DEPARTMENT OF HEALTH SERVICES

STATE OF WISCONSIN

Division of Medicaid Services

COP Cost-Share Worksheet 3

F-29322 (01/2017)

Wis. Stats. § 46.27

UNIFORM COST SHARING PLAN

COP COST-SHARE WORKSHEET 3

Use this COP Cost-Share Worksheet 3 for

•

Single adult who resides in substitute care

•

Married COP applicant/participant who lives in a CBRF or Adult Family Home and other spouse is not on COP

•

Minors who live in foster homes or group homes. See Collect. Users Manual Unit for parental contribution

Note: If both spouses apply and both live in substitute care, use separate worksheets for each. If both spouses apply and only one lives

in substitute care, use Worksheet 3 for the spouse who resides in substitute care and Worksheet 2 for the spouse who lives at home.

Name – Applicant

Date Completed

Date Reviewed

/

/20___

/

/20___

PART A. ASSESSMENT BASED ON RESIDENT’S INCOME -

DHS 1.03(2)-(4)

1. Monthly earned income after income taxes and Social Security. If resident is a minor in school, enter zero.

1.

2. Enter the lesser of the amount on line 1 or $65.

2.

3. Subtract line 2 from line 1.

3.

4. Enter HALF of line 3.

4.

5. Enter monthly Unearned Income from COP-DIA (F-29314).

5.

6. Add lines 4 and 5.

6.

7. Enter allowance for UNMET PERSONAL NEED. This is an agency set amount. For

COP participants, the total allowances in lines 2 and 7 must be at least $65. Up to

7.

$240 may be approved by the county director. Include amounts needed to maintain

the home for a planned return.

8. Health insurance and other medical/remedial expenses paid by resident (see financial

eligibility determination form—line 15 of COP-S (F-29316), or line 14 of COP-M/2

8.

(F-29317), or line 12 of COP-M/2 (YR1+) (F-29318).

9. If resident has a spouse, compute the allowance on the reverse side and copy the

amount from line E, or enter court ordered spousal support - whichever is higher. If the

9.

resident has no spouse, enter ZERO.

10. If resident has children or other legal dependents, compute the allowance on the

reverse side and copy amount from Line M, or enter court ordered child support -

10.

whichever is higher. If there are no children or other legal dependents, enter ZERO.

11. Other court ordered payments.

11.

12. Total of lines 7 through 11.

12.

13. Subtract line 12 from line 6. This is the assessment from the resident’s income.

13.

PART B. ASSETS OVER MEDICAID LIMIT -

DHS 1.03(6)

14. Carry forward resident’s share of ASSET amount from financial eligibility determination form – see line 3 of

COP-S (F-29316), or line 4 of COP-M/2 (F-29317), or line 2 of COP-M/2 (YR 1+) (F-29318). Use half of the

14.

asset amount for each spouse when they are both applying or participating. If amount on line 14 is more

than zero, re-evaluate monthly.

PART C. TOTAL ASSESSMENT.

15. Total lines 13 and 14. This reflects the resident’s total assessment.

15.

16. If adult married resident cannot pay total care costs, complete Part D below. Carry forward spouse’s

16.

assessment from Part D, line U.

17. Add lines 15 and 16. This is total assessment to apply to cost of care. If cost-share amount on this line

exceeds monthly cost of care, the resident – though eligible for COP funds – must pay the full cost of care

17.

until line 17 is less than the cost of care.

Minors: If a minor resident cannot pay total care costs, assess for parental support.

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2