Collection Information For Businesses Page 2

ADVERTISEMENT

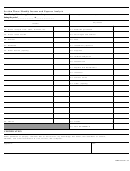

SECTION I, General Financial Information - Continued

11.

Real Estate: (Enter values, balance due, equity in asset, and monthly payment in item 19.)

Brief Description and Type of Ownership

Address (Include County and State)

a.

b.

c.

12. Life Insurance Policies Owned with Business as Beneficiary

Accumulative

Name Insured

Company

Policy Number

Type

Face Amount

Cash Value

$

$

12. Total (Enter in Item 18)

13. Additional Information Regarding Financial Condition (court proceedings, bankruptcies filed or anticipated, transfers of

assets for less than full value, changes in market conditions, etc.; including information regarding company participation

in trusts, estates, profit-sharing plans, etc.)

14.

Accounts/Notes Receivable (Include loans to stockholders, officers, partners, etc.)

Name

Address

Amount Due

Date Due

Status

$

14, Total (Enter in Item 17)

$

FORM TC803B 1/96

For additional information, you may access the Tax Commission's World Wide Home Page at:

If you need an accommodation under the Americans with Disabilities Act, contact the Tax Commission at (801) 297-3811 or Telecommunication Device for the

Deaf (801) 297-3819. Please allow three working days for a response.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4