Form W-9 - Request For Taxpayer Identification Number And Certification - 2007

ADVERTISEMENT

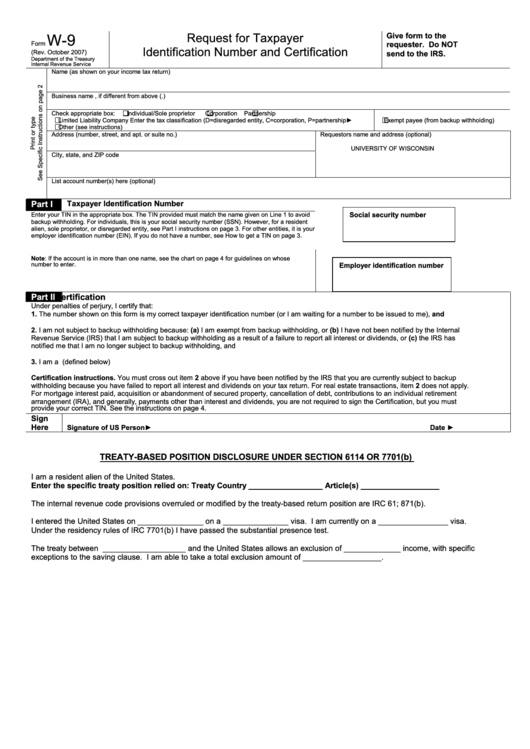

Give form to the

W-9

Request for Taxpayer

Form

requester. Do NOT

Identification Number and Certification

(Rev. October 2007)

send to the IRS.

Department of the Treasury

Internal Revenue Service

Name (as shown on your income tax return)

Business name , if different from above (.)

Check appropriate box:

Individual/Sole proprietor

Corporation

Partnership

Limited Liability Company Enter the tax classification (D=disregarded entity, C=corporation, P=partnership►

Exempt payee (from backup withholding)

Other (see instructions)

Address (number, street, and apt. or suite no.)

Requestors name and address (optional)

UNIVERSITY OF WISCONSIN

City, state, and ZIP code

List account number(s) here (optional)

Part I

Taxpayer Identification Number

Part II

Social security number

Enter your TIN in the appropriate box. The TIN provided must match the name given on Line 1 to avoid

backup withholding. For individuals, this is your social security number (SSN). However, for a resident

alien, sole proprietor, or disregarded entity, see Part I instructions on page 3. For other entities, it is your

employer identification number (EIN). If you do not have a number, see How to get a TIN on page 3.

Note: If the account is in more than one name, see the chart on page 4 for guidelines on whose

Employer identification number

number to enter.

Part II

Certification

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal

Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has

notified me that I am no longer subject to backup withholding, and

3. I am a U.S. citizen or other U.S. person (defined below)

Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup

withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply.

For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement

arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the Certification, but you must

provide your correct TIN. See the instructions on page 4.

Sign

Here

Signature of US Person►

Date ►

TREATY-BASED POSITION DISCLOSURE UNDER SECTION 6114 OR 7701(b)

I am a resident alien of the United States.

Enter the specific treaty position relied on: Treaty Country _________________ Article(s) __________________

The internal revenue code provisions overruled or modified by the treaty-based return position are IRC 61; 871(b).

I entered the United States on _______________ on a _______________ visa. I am currently on a ________________ visa.

Under the residency rules of IRC 7701(b) I have passed the substantial presence test.

The treaty between ___________________ and the United States allows an exclusion of _____________ income, with specific

exceptions to the saving clause. I am able to take a total exclusion amount of __________________.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1