Go to Application

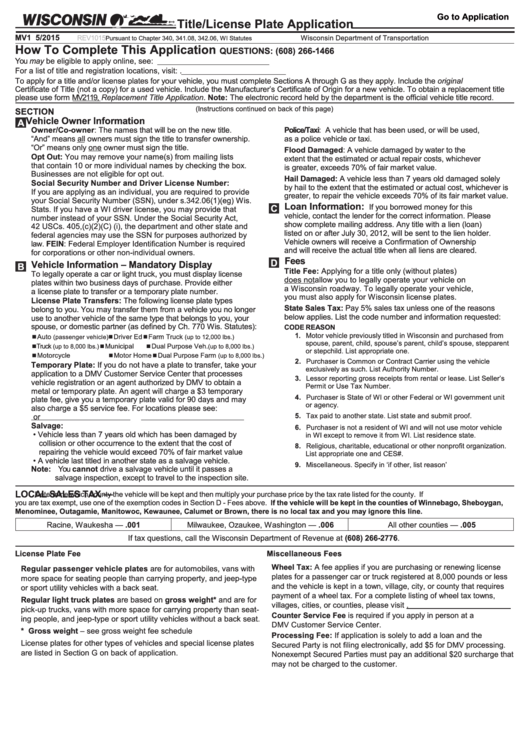

Title/License Plate Application

MV1

5/2015

REV1015

Wisconsin Department of Transportation

Pursuant to Chapter 340, 341.08, 342.06, WI Statutes

How To Complete This Application

QUESTIONS: (608) 266-1466

You may be eligible to apply online, see: wisconsindmv.gov/emvpublic

For a list of title and registration locations, visit: wisconsindmv.gov/partners.

To apply for a title and/or license plates for your vehicle, you must complete Sections A through G as they apply. Include the original

Certificate of Title (not a copy) for a used vehicle. Include the Manufacturer’s Certificate of Origin for a new vehicle. To obtain a replacement title

please use form MV2119, Replacement Title Application. Note: The electronic record held by the department is the official vehicle title record.

(Instructions continued on back of this page)

SECTION

Vehicle Owner Information

A

Owner/Co-owner: The names that will be on the new title.

Police/Taxi: A vehicle that has been used, or will be used,

“And” means all owners must sign the title to transfer ownership.

as a police vehicle or taxi.

“Or” means only one owner must sign the title.

Flood Damaged: A vehicle damaged by water to the

Opt Out: You may remove your name(s) from mailing lists

extent that the estimated or actual repair costs, whichever

that contain 10 or more individual names by checking the box.

is greater, exceeds 70% of fair market value.

Businesses are not eligible for opt out.

Hail Damaged: A vehicle less than 7 years old damaged solely

Social Security Number and Driver License Number:

by hail to the extent that the estimated or actual cost, whichever is

If you are applying as an individual, you are required to provide

greater, to repair the vehicle exceeds 70% of its fair market value.

your Social Security Number (SSN), under s.342.06(1)(eg) Wis.

Loan Information:

C

If you borrowed money for this

Stats. If you have a WI driver license, you may provide that

vehicle, contact the lender for the correct information. Please

number instead of your SSN. Under the Social Security Act,

show complete mailing address. Any title with a lien (loan)

42 USCs. 405,(c)(2)(C) (i), the department and other state and

listed on or after July 30, 2012, will be sent to the lien holder.

federal agencies may use the SSN for purposes authorized by

Vehicle owners will receive a Confirmation of Ownership

law. FEIN: Federal Employer Identification Number is required

and will receive the actual title when all liens are cleared.

for corporations or other non-individual owners.

Fees

D

Vehicle Information – Mandatory Display

B

Title Fee: Applying for a title only (without plates)

To legally operate a car or light truck, you must display license

does not allow you to legally operate your vehicle on

plates within two business days of purchase. Provide either

a Wisconsin roadway. To legally operate your vehicle,

a license plate to transfer or a temporary plate number.

you must also apply for Wisconsin license plates.

License Plate Transfers: The following license plate types

State Sales Tax: Pay 5% sales tax unless one of the reasons

belong to you. You may transfer them from a vehicle you no longer

below applies. List the code number and information requested:

use to another vehicle of the same type that belongs to you, your

spouse, or domestic partner (as defined by Ch. 770 Wis. Statutes):

CODE REASON

1. Motor vehicle previously titled in Wisconsin and purchased from

Auto

Driver Ed

Farm Truck

(passenger vehicle)

(up to 12,000 lbs.)

spouse, parent, child, spouse’s parent, child’s spouse, stepparent

Truck

Municipal

Dual Purpose Veh.

(up to 8,000 lbs.)

(up to 8,000 lbs.)

or stepchild. List appropriate one.

Motorcycle

Motor Home

Dual Purpose Farm

(up to 8,000 lbs.)

2. Purchaser is Common or Contract Carrier using the vehicle

Temporary Plate: If you do not have a plate to transfer, take your

exclusively as such. List Authority Number.

application to a DMV Customer Service Center that processes

3. Lessor reporting gross receipts from rental or lease. List Seller’s

vehicle registration or an agent authorized by DMV to obtain a

Permit or Use Tax Number.

metal or temporary plate. An agent will charge a $3 temporary

4. Purchaser is State of WI or other Federal or WI government unit

plate fee, give you a temporary plate valid for 90 days and may

or agency.

also charge a $5 service fee. For locations please see:

5. Tax paid to another state. List state and submit proof.

wisconsindmv.gov/centers or wisconsindmv.gov/partners

Salvage:

6. Purchaser is not a resident of WI and will not use motor vehicle

• Vehicle less than 7 years old which has been damaged by

in WI except to remove it from WI. List residence state.

collision or other occurrence to the extent that the cost of

8. Religious, charitable, educational or other nonprofit organization.

repairing the vehicle would exceed 70% of fair market value

List appropriate one and CES#.

• A vehicle last titled in another state as a salvage vehicle.

9. Miscellaneous. Specify in ‘if other, list reason’

Note: You cannot drive a salvage vehicle until it passes a

salvage inspection, except to travel to the inspection site.

LOCAL SALES TAX —

Determine which county the vehicle will be kept and then multiply your purchase price by the tax rate listed for the county. If

you are tax exempt, use one of the exemption codes in Section D - Fees above. If the vehicle will be kept in the counties of Winnebago, Sheboygan,

Menominee, Outagamie, Manitowoc, Kewaunee, Calumet or Brown, there is no local tax and you may ignore this line.

Racine, Waukesha — .001

Milwaukee, Ozaukee, Washington — .006

All other counties — .005

If tax questions, call the Wisconsin Department of Revenue at (608) 266-2776.

License Plate Fee

Miscellaneous Fees

Wheel Tax: A fee applies if you are purchasing or renewing license

Regular passenger vehicle plates are for automobiles, vans with

plates for a passenger car or truck registered at 8,000 pounds or less

more space for seating people than carrying property, and jeep-type

and the vehicle is kept in a town, village, city, or county that requires

or sport utility vehicles with a back seat.

payment of a wheel tax. For a complete listing of wheel tax towns,

Regular light truck plates are based on gross weight* and are for

villages, cities, or counties, please visit wisconsindmv.gov/wheeltax.

pick-up trucks, vans with more space for carrying property than seat-

Counter Service Fee is required if you apply in person at a

ing people, and jeep-type or sport utility vehicles without a back seat.

DMV Customer Service Center.

* Gross weight – see gross weight fee schedule

Processing Fee: If application is solely to add a loan and the

License plates for other types of vehicles and special license plates

Secured Party is not filing electronically, add $5 for DMV processing.

are listed in Section G on back of application.

Nonexempt Secured Parties must pay an additional $20 surcharge that

may not be charged to the customer.

1

1 2

2 3

3 4

4