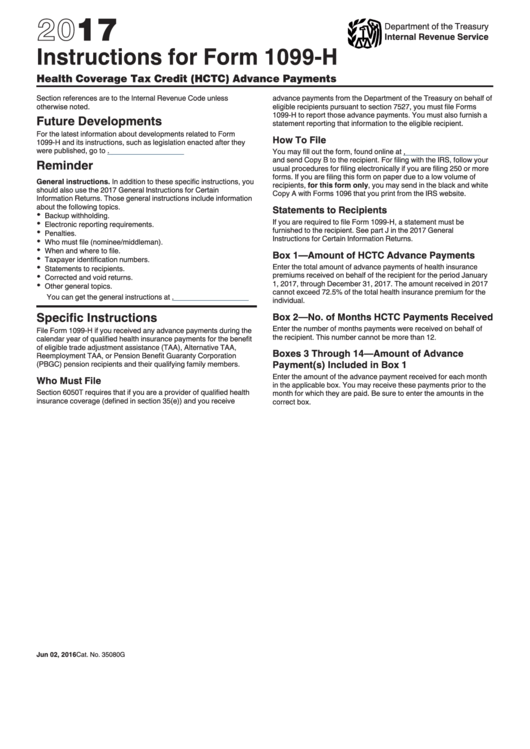

Instructions For Form 1099-H - 2017

ADVERTISEMENT

2018

Department of the Treasury

Internal Revenue Service

Instructions for Form 1099-H

Health Coverage Tax Credit (HCTC) Advance Payments

Section references are to the Internal Revenue Code

wi.hctc.stakehldr.en@irs.gov. Unless you notify the HCTC

unless otherwise noted.

Program of your intent to file information returns and

furnish statements, you will be considered to have elected

Future Developments

to have the HCTC Program file Form 1099-H and furnish

statements to recipients in satisfying section 6050T filing

For the latest information about developments related to

and furnishing requirements.

Form 1099-H and its instructions, such as legislation

enacted after they were published, go to

IRS.gov/

How To File

Form1099H.

For filing with the IRS, see part E in the 2018 General

Reminder

Instructions for Certain Information Returns and Pub.

1220.

General instructions. In addition to these specific

instructions, you should also use the 2018

General

Statements to Recipients

Instructions for Certain Information

Returns. Those

If you are required to file Form 1099-H, a statement must

general instructions include information about the

be furnished to the recipient. The HCTC Program will

following topics.

furnish a copy of Form 1099-H or an acceptable substitute

Backup withholding.

statement to each recipient on your behalf, unless you

Electronic reporting requirements.

elect to file Form 1099-H and furnish the copy or

Penalties.

substitute statement yourself. If you make this election,

Who must file (nominee/middleman).

you may fill out the form, found online at

IRS.gov/

When and where to file.

Form1099H, and send Copy B to the recipient. See part J

Taxpayer identification numbers (TINs).

in the 2018 General Instructions for Certain Information

Statements to recipients.

Returns.

Corrected and void returns.

Other general topics.

Truncating recipient‘s TIN on recipient statements.

Pursuant to Treasury Regulations section 301.6109-4, all

You can get the general instructions from

General

filers of this form may truncate a recipient’s TIN (social

Instructions for Certain Information Returns

at

IRS.gov/

security number (SSN), individual taxpayer identification

1099generalinstructions

or go to IRS.gov/Form1099H.

number (ITIN), or adoption taxpayer identification number

Specific Instructions

(ATIN)) on recipient statements. Truncation is not allowed

on any documents the filer files with the IRS. A filer’s TIN

File Form 1099-H if you received any advance payments

may not be truncated on any form. See part J in the 2018

during the calendar year of qualified health insurance

General Instructions for Certain Information Returns.

payments for the benefit of recipients of eligible trade

Expired ITINs may continue to be used for

adjustment assistance (TAA), Alternative TAA (ATAA),

information return purposes regardless of whether

!

Reemployment TAA (RTAA); or Pension Benefit Guaranty

they have expired for individual income tax return

Corporation (PBGC) payees, and their qualifying family

CAUTION

filing purposes. See part J in the 2018 General

members. These individuals are referred to in these

Instructions for Certain Information Returns.

instructions as recipients.

Waiver of penalties. Section 6724(a) authorizes the IRS

Who Must File

to waive any penalties under sections 6721 and 6722 for

Section 6050T requires providers of qualified health

failure to comply with the reporting requirements of

insurance coverage (defined in section 35(e)) that receive

section 6050T if such failures resulted from reasonable

advance payments of the HCTC from the Department of

cause and not willful neglect. The HCTC Program will

the Treasury on behalf of eligible recipients pursuant to

furnish a copy of Form 1099-H or an acceptable substitute

section 7527 to file Forms 1099-H to report those advance

statement to each recipient on your behalf, unless you

payments and to furnish a statement reporting that

elect to file Form 1099-H and furnish the copy or

information to the recipient.

substitute statement yourself. The IRS will not assert the

However, Notice 2004-47, 2004-29 I.R.B. 48, available

penalties imposed by sections 6721 and 6722 for

at IRS.gov/irb/2004-29_IRB, provides that the IRS HCTC

information returns and statements required to be filed

Program (formerly the IRS HCTC Transaction Center), as

and furnished under section 6050T against you if you

an administrator of the HCTC, will file the required returns

allow the HCTC Program to file and furnish Forms

and furnish statements to the recipients unless you elect

1099-H. If you elect not to allow the HCTC Program to file

to file and furnish information returns and statements on

and furnish Forms 1099-H, the general rules for seeking a

your own. Contact the HCTC Program for this purpose by

penalty waiver under section 6724(a) apply. See

emailing the HCTC Program at

Oct 20, 2017

Cat. No. 35080G

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2