Sidbi Fixed Deposit Application Form Page 3

ADVERTISEMENT

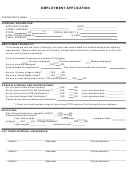

SIDBI FIXED DEPOSIT

TERMS AND CONDITIONS

ELIGIBLE DEPOSITORS: Individuals - Resident individuals, Minors through their Guardians are eligible. Non Resident Indians (NRI) are also eligible, subject to

compliance of certain conditions and furnishing of declaration.

Others : Hindu Undivided Family HUF (through Karta), Proprietary concern, Partnership firms, Companies, Body Corporate, Banks, Societies, Association of Persons (AOP),

Trusts, Charitable Trusts, Relief Funds & NGO’s, Public Sector undertakings, Central / State Govt Departments, P.F Trusts, Port Trusts , Mutual Funds, Welfare Funds,

Government University / Institutions, Private Educational Institution, Statutory bodies which are authorised to invest in such deposits.

Deposit Options : (1) Cumulative, (2) Non Cumulative.

Rate of interest : Interest shall be payable at the rate(s) indicated in Table annexed. Senior citizen (60 years of age or above) shall be paid additional interest of 0.50% over

and above the normal rate. The rate of interest prevailing on the date of realisation of the cheque / Demand Draft / RTGS / NEFT shall be applicable.

Interest Payment Option : In case of Non Cumulative option, the depositors can opt for Quarterly or Annual Interest Payment options. Interest payment option once

selected cannot be changed.

Minimum deposit of `.10,000 and in multiples of `.1,000 thereafter.

Minimum Deposit Amount :

Deposit Period : For all options minimum deposit period is 12 months and in the multiples of 1 month upto a maximum of 60 months.

Mode of Payment : Deposit may be made only by way of Cheque / Demand Draft / Pay Order / RTGS / NEFT in favour of ‘SMALL INDUSTRIES DEVELOPMENT BANK

OF INDIA’ marked 'Account Payee only’ and payable at the place of SIDBI branch where the Application form is submitted. Please note that Cash or Post dated cheques

will not be accepted.

Deposit by other than Individuals : All depositors other than individuals should submit a duly certified copy of Resolution / Letter from the competent authority of the

Organisation / Trust / Company etc., along with the application form, which expressly (i) states that the organisation/trust/company etc., is authorised to make deposit in

SIDBI Fixed Deposit, and (ii) specifies the names of persons authorised to sign all such documents as may be required by SIDBI for the purpose of making and redeeming

such deposits with SIDBI, appending thereto their specimen signatures attested by the banker / notary public / magistrate or such other competent authority.

Joint Deposits : Joint deposits are accepted only from individuals. Joint deposits may be made by a maximum of three individuals. After the submission of Application form,

request for addition of co-depositor or deletion of co-depositor (except in case of death of the depositor) will be considered only when the written request is signed by all the

depositors. All payment communication would be addressed to the First depositor. For any change in particulars like address or Bank details the request should be signed by

all the depositors in case of ‘Joint’ mode of deposit and by the ‘First’ depositor in all other mode of deposits. For the payment of principal amount along with interest at the

time of maturity the FD Receipt should be discharged by First depositor in case of ‘Sole’ and ‘Former or Survivor’ mode, jointly by all depositors in case of ‘Joint’ mode, by

either / anyone of the depositor in case of ‘Either or Survivor’ and ‘Anyone or Survivor’ mode of deposit.

Senior Citizen : In case of application from senior Citizen (Age 60 years and above), applicants are requested to furnish the proof of age viz. an attested copy of any one of

the following documents viz. Ration Card, Passport, Driving License, Voter Identification Card, PAN Card, Pension / Service Book, Birth Certificate, School Leaving

Certificate, LIC Policy etc. indicating the Date of Birth, as Depositor’s status as Senior Citizen. Interest benefits, applicable for Senior Citizen, can also be availed during the

currency of the FD, from the date of submission of Proof of Age, to the satisfaction of SIDBI. Such benefit would be effective from the date of submission of proof to SIDBI,

with prospective effect

Nomination : Nomination facility is available for single & joint deposits received from individuals. However, persons applying on behalf of minors and HUF’s or a Power of

Attorney Holder cannot nominate. The nomination may be cancelled or substituted at a later date by the depositors. The nomination will be governed by the SIDBI (Issue and

Management of Bonds) Regulations 1990 as amended by SIDBI (Issue and Management of Bonds) Amendment Regulations, 2001. Any request for cancellation / addition of

nominee after the submission of Application form should be signed by all the depositors irrespective of mode of holding.

Succession : In the event of the demise of the sole or all joint depositors, the fixed deposit amount together with interest thereon, will be paid to the nominee as stated in

the Application. In case nomination has not been provided, SIDBI will recognise the title of such person(s) to the deposit who would produce the requisite legal

representation to the satisfaction of SIDBI. Before receiving such payment, such person(s) will surrender to SIDBI the post dated Interest Warrants, if any, relating to the

deposit, remaining unencashed and the relevant Deposit Receipt. In the event of the demise of one of the Joint Depositors, SIDBI will recognise the title of the remaining

Depositor(s) for receiving payment relating to the Deposits as given in the deposit Application.

Charitable Trusts: Along with the duly filled-in Application form, all Charitable Trusts are required to enclose an attested copy of (a) Certificate of Registration with the

Charity Commisioner or such competent authority and/or (b) Certificate issued by Income Tax authorities that the Trust is registered under Section 12A of Income Tax Act,

1961.

Interest Payment : Interest will accrue from the Date of realisation of cheque / DD in SIDBI’s account. Interest option once opted cannot be changed during the tenor of the

Fixed Deposit. In case, the duly discharged FD Receipt, is not submitted for renewal / maturity payment, within 14 days from the date of maturity, then simple interest at

savings bank rate / rate stipulated by SIDBI / RBI, shall be paid.

Calculation of interest : Interest in respect of all the cases would be computed on the basis of ‘Actual / Actual (Financial Year)’. The interest on deposit will cease on the

date of maturity except in case of Automatic Renewal / Renewal within 14 days from the date of maturity, at the then prevailing rate of interest. In case, Februray contains 29

days in the Financial Year, then the denominator shall contain 366 days, irrespective of whether the deposit has matured / placed after / prior to February.

Interest Calculation on Cumulative Deposit : Interest will be compounded after every 3 months from the date of realisation of the cheque / DD/RTGS/NEFT. In case the

accrued interest attracts deduction of tax at source as per the extant provisions of Income Tax Act, 1961, the compounding will be done on interest net of tax and relevant

TDS certificate will be sent to the depositor, as per Income Tax guidelines.

Interest Calculation on Non Cumulative Deposit : In case of Quarterly interest payment option, the first interest will be calculated from the Date of realisation of the cheque

/ Demand Draft / Pay Order till the end of 3 calendar months on a Quarterly basis. In case of Annual interest payment option the interest will be calculated from the Date of

realisation of the cheque / Demand Draft / Pay Order, which shall be compounded on quarterly basis, till the end of 12 calendar months and interest would be paid on Annual

basis.

Interest Payment : Interest on Cumulative deposit, compounded Quarterly (net of TDS) will be paid along with the maturity proceeds.

Under Quarterly / Annual Interest payment Options, Interest, net of TDS, would be credited on the due dates, preferably by ECS to the bank account of the First depositor. In

the absence of Bank account details, cheque / warrants will be issued in the first depositor’s name at his / her sole risk and responsibility for any fraudulent encashment.

ECS Facility : Electronic Clearing Facility is presently available at all core banking branches. Depositors who wish to receive the payment by way of ECS facility at the

aforementioned centres may indicate the same in the Application form at the appropriate space and also attach a self attested photocopy / cancelled leaf of the personalised

Bank cheque leaf or relevant proof to the satisfaction of SIDBI, along with the Application form.

Tax Deduction : Tax will be deducted at source on the interest payable on the deposit as per the prevalent provisions under the Income Tax Act, 1961. As per the present

provisions under Section 194A of the Income Tax Act, 1961, interest upto `.5,000 in a financial year is exempt from deduction of tax at source. No tax will be deducted if

declaration under Section 197 of Income Tax Act, 1961 in Form 15G by Individuals with Annual interest income upto Rs.1 lakh, or in Form 15H by Senior Citizens

(irrespective of amount of Annual interest income), or certificate in Form 15AA by the Assessing Officer, as applicable, is submitted by the First depositor at the beginning of

every financial year one month before the first date of interest payment / compounding in the financial year. Please note that these rules under the Income Tax Act, 1961 are

subject to change from time to time. Income Tax once deducted would not be refunded by SIDBI under any circumstances.

Tax Benefits : SIDBI Fixed Deposit is an eligible investment option for religious and charitable trusts under Section 11(5) of the Income Tax Act, 1961.

Repayment : The Deposit will automatically expire on maturity. For repayment, the original Deposit Receipt, duly discharged on a revenue stamp of requisite value by all the

depositor(s), should be submitted to SIDBI at least 2 weeks prior to the date of maturity to any of the Offices of SIDBI. Repayment will be made, preferably, through ECS or

by a “Account Payee” Cheque / DD or as the case may be. If the due date of maturity payment falls on a day which is not a business day, then payment of redemption

amount will be made on the next business day, interest for the interveining period shall be also paid. If the maturity payment is delayed beyond 14 days, for whatsoever

reasons, then simple interest at Savings Bank rate / rate specified by RBI or SIDBI shall accrue from the date of maturity till payment. Applicable TDS shall be deducted on

post maturity interest accruals.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8