Sidbi Fixed Deposit Application Form Page 8

ADVERTISEMENT

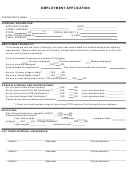

Know Your Customer Form (KYC)

IMPORTANT NOTES – PLEASE READ BEFORE FILLING UP THE FORM

1.

This Application Form is meant to enable a person to comply

requirements are mandatory for both the PoA issuer (i.e.

with the Client Identification Programme laid down under the

Investor) and the Attorney (i.e. the holder of PoA), both of

Prevention of Money Laundering Act, 2002 (PMLA) hereinafter

whom should be KYC compliant in their independent capacity.

referred to as Know Your Client (KYC) requirements. It is for use

6.

The KYC process requires investors to provide their Proof of

by INDIVIDUALS only. A separate form is provided for non-

identity (PAN card copy only) and Proof of Address (any valid

individual entities such as Hindu Undivided Family (HUF),

documents listed in section B of the KYC Application Form) to

Corporates, Trusts, Societies, etc.

comply with KYC requirements. SIDBI reserves the right to

2.

This form is not a Fixed Deposit Application Form, and is only

seek any additional information /documentation in terms of the

meant for providing information and documents required for

PMLA at any point of time.

KYC compliance.

Deposit may be made under the Fixed

7.

SIDBI will not be liable for any errors or omissions on the part of

Deposit Scheme only after completion of the KYC requirements.

the depositor in the KYC Application Form. Documents

3.

Joint Holders: Joint holders need to be individually KYC

received in support of KYC requirements will be verified by the

compliant before they can invest in the Fixed Deposit Scheme.

Agents appointed by SIDBI and thereafter scrutinized by SIDBI

e.g. in case of three joint holders, all holders need to fill up the

at the branch where the application is being made. The

KYC form and should be KYC compliant.

decision of SIDBI shall be final in the matter.

4.

Minors: In case of placement of deposits in respect of a Minor,

8.

SIDBI and its Directors, employees and agent(s) shall not be

the Guardian should be KYC compliant and accordingly fill up

liable in any manner for any claims arising whatsoever on

the KYC form. The Minor, upon attaining majority, should

account of rejection of any application due to non-compliance

immediately apply for KYC compliance in his/her own capacity

with the provisions of the PMLA or where SIDBI believes that

in order to be able to transact further in his/her own capacity.

transaction(s) by an applicant / investors is / are suspicious in

5.

Power of Attorney (PoA) Holder: Investors desirous of

nature within the purview of the PMLA.

investing through a PoA must note that the KYC compliance

GUIDELINES FOR FILLING UP THE KYC APPLICATION FORM

General

B.

Address Details

1.

The Application Form should be completed in BLOCK

1. Address for Communication: Please provide here the address

LETTERS.

where you wish to receive all communications sent. The address

2.

Please tick in the appropriate box wherever applicable.

you give here will supercede existing information in the

3.

Please fill the form in legible handwriting so as to avoid errors in

records. This address should match with the address in the

your

application

processing.

Please

do

not

overwrite.

‘Proof-of-Address’

submitted

as

supporting

document;

Corrections should be made by cancelling and re-writing, and

otherwise the KYC Application Form is liable to be rejected.

such corrections should be counter-signed by the applicant.

2.

Contact Details: Please provide your Telephone / Email contact

4.

Applications incomplete in any respect and / or not accompanied

details.

by required documents are liable to be rejected.

3. Proof of Address Documents : Please note that each of the two

5.

Applications complete in all respects and carrying necessary

addresses mentioned by you will need to be supported by a

documentary attachments should be submitted at the branch of

‘Proof-of-Address’ bearing your or your spouse’s / parent’s

SIDBI directly or its appointed agents.

(documents to establish relationship also to be submitted) name

6.

Submission of PAN card is compulsory.

as supporting documents. Please tick the box as applicable, for

7.

Proof of Identity and Proof of Address

the document provided by you. You may attach any one of the

• Original Documents + Self-attested photocopies (Originals will

following documents (Any document having an expiry date should

be returned over-the-counter after verification) OR

be valid on the date of submission):

• True Copies attested by a Notary Public / Gazetted Officer /

Latest* Telephone Bill • Latest* Electricity Bill • Passport • Driving

Manager of a Scheduled Commercial Bank or Multinational

License • Latest* Bank Passbook • Latest* Bank Account

Foreign Banks (Name, Designation and Seal should be

Statement • Voter Identity Card • Ration Card • Latest* Demat

affixed on the copy). Unattested photocopies of an original

Account Statement • Registered Lease / Sale Agreement of

document are not acceptable.

residence • Proof of Address issued by Bank Managers of

• If the above documents including attestation / certifications are

Scheduled Commercial Banks / Multinational Foreign Banks /

in regional language or foreign language then the same has

Gazetted Officer/ Notary Public / Elected Representatives to the

to be translated into English for submission.

Legislative Assembly / Parliament / Document issued by any

A.

Identity Details

Government or Statutory Authority

1.

Name : Please state your name as Title (Mr / Mrs / Ms / Dr etc.),

* These documents should not be more than three months old as on

First, Middle and Last Name in the space provided. This should

the date of submission of this form.

match with the name as mentioned in the PAN card failing which

4. Permanent Address / Overseas Address: If you are a Resident

the application is liable to be rejected. If the PAN card has a

Indian, and your Permanent address is different from the one

name by which the applicant has been known differently in the

mentioned in the Address for Correspondence, please state it

past, than the one provided in this application form, then

here. If you are a Non-Resident Indian or a Person of Indian

requisite proof should be provided e.g. marriage certificate, or

Origin, it is mandatory for you to state your Overseas Address

gazetted copy of name change.

here.

2.

Date of Birth: Please ensure that this matches with the Date of

C. Other details

Birth as indicated in the PAN card.

1. Gross Annual Income details: Please tick the applicable box

3.

Nationality: Foreign Nationals are not allowed to apply, unless

indicating your Gross Annual Income (including both taxable and

they are Non-Resident Indians (NRIs) or Persons of Indian

tax-free incomes).

Origin (PIO).

2. Occupation details: Please indicate your current occupation by

4.

Status : Please tick your current residential status.

ticking the one most applicable to you. You are required to fill up

5.

PAN : PAN is mandatory to be KYC compliant

the next section, if it additionally applies to you. After you have

6.

Please affix and sign across the most recent colour photograph.

completed filling up the KYC Application Form, please submit the

same along with the entire set of supporting documents.

Other important notes, after the KYC Acknowledgement is

issued to you : Signature on the Fixed Deposit Application Form

should match with that on this KYC Application Form. Any changes

in an Applicant’s details after submission of this form such as Name,

Address, Status, Income bracket, Occupation or Signature, etc.

should be registered Original / Attested copies of documents

supporting the change will be required to be submitted together with

the KYC

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8