Form Vat-605 - Certificate For Deduction Of Tax At Source

ADVERTISEMENT

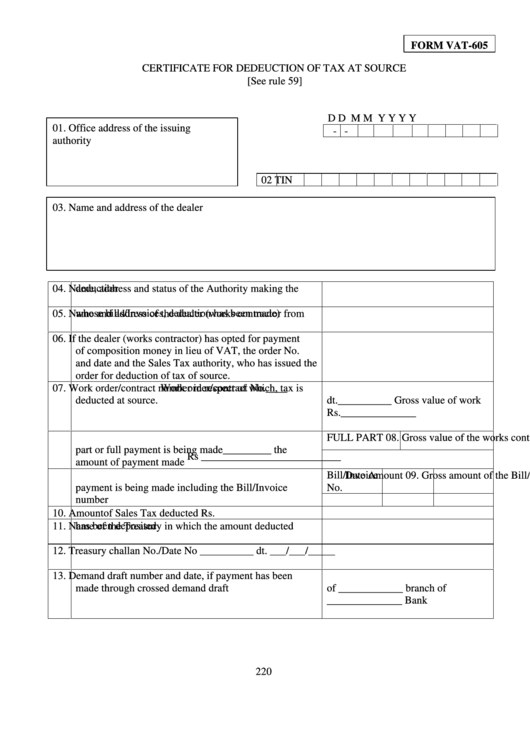

FORM VAT-605

CERTIFICATE FOR DEDEUCTION OF TAX AT SOURCE

[See rule 59]

D D

M M

Y Y Y Y

01. Office address of the issuing

-

-

authority

02 TIN

03. Name and address of the dealer

04. Name, address and status of the Authority making the

deduction

05. Name and address of the dealer (works contractor from

whose bills/Invoices, deduction has been made)

06. If the dealer (works contractor) has opted for payment

of composition money in lieu of VAT, the order No.

and date and the Sales Tax authority, who has issued the

order for deduction of tax of source.

07. Work order/contract number in respect of which, tax is

Work order/contract No.____

deducted at source.

dt.__________ Gross value of work

Rs.______________

08. Gross value of the works contract, in respect of which

FULL

PART

part or full payment is being made_________ the

Rs __________________________

amount of payment made

09. Gross amount of the Bill/Invoice in respectof which

Bill/Invoice

Date

Amount

payment is being made including the Bill/Invoice

No.

number

10. Amountof Sales Tax deducted

Rs.

11. Name of the Treasury in which the amount deducted

has been deposited

12. Treasury challan No./Date

No __________ dt. ___/___/_____

13. Demand draft number and date, if payment has been

D.D. No.______dt._____________

made through crossed demand draft

of ____________ branch of

______________ Bank

220

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3